$22.6bn takeover bid avalanche puts Spanish stock market on target: ‘It’s a perfect storm’ | Companies

This is the year of takeovers. Despite everything, the Spanish stock market has been in a frenzy for weeks that few remember. Almost every week, a fund or a new company announces its intention to buy a Spanish company listed on the stock exchange. Plans that steal the covers of the press for days and are discussed in influential circles of the financial world in Madrid. They made it work…

To continue reading this article about Cinco Días, you need a Premium Subscription to EL PAÍS.

This is the year of takeovers. Despite everything, the Spanish stock market has been in a frenzy for weeks that few remember. Almost every week, a fund or a new company announces its intention to buy a Spanish company listed on the stock exchange. Plans that steal the covers of the press for a few days and are discussed in influential circles of the Madrid financial world. They have kept investment banks, law firms, large investment structures and regulators working at full capacity. Almost as quickly, they are being overtaken by a new offer from the most unexpected place.

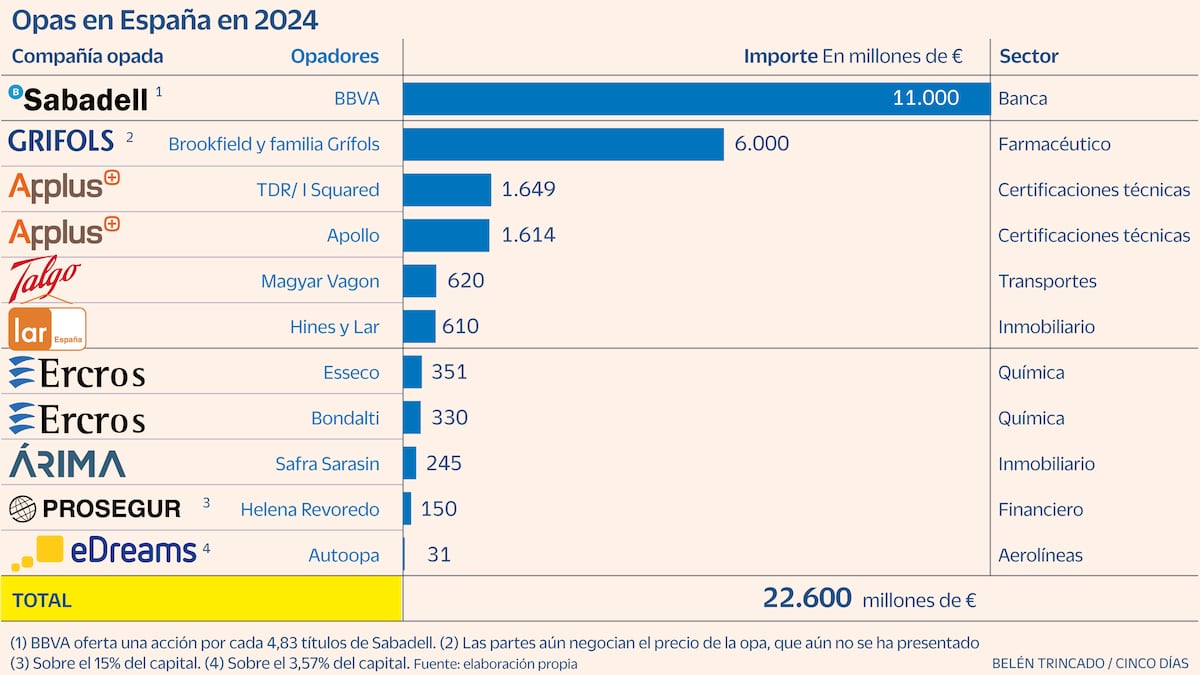

In numbers, this means 11 offers in the pipeline in 2024, totaling $22.6 billion, in contrast to the almost flat encephalogram in 2023. Between January and May last year, the Spanish market did not receive a single takeover offer, and only at the end of this term three were received (offers from the Apollo fund for Applus, Antin for OPDE and the FCC for the company itself). The wages in 2024 could be even higher if the wages of the Emirati electricity company Taqa and Criteria, the financial arm of La Caixa, for Naturgy, or Atitlan – the company owned by Juan Roig’s son-in-law, Roberto Centeno – for OHLA, are not disappointed.

Moreover, the takeover bids that are pending are of very different types. There are hostile bids, such as BBVA’s bid for Banco Sabadell, which also represent a major concentration operation that will transform a sector, in this case the banking sector. The battle that is looming in the railway sector over Talgo also has an industrial profile: between the bid of the Hungarian Magyar Vagon and that of the Czech Škoda. On the other hand, there are takeover bids with a more financial purpose, led by all-powerful venture capital funds, such as the war for Applus or the acquisition of Árima SOCIMI by Safra Sarasin. Others, such as the deal that the Brookfield fund is pursuing with the Grifols family for the Catalan pharmaceutical company, are more like a financial rescue operation.

“It’s a perfect storm,” explains one investment banker. To find the reasons for this movement, we must broaden our focus. The sources interviewed note that the interest in Spanish companies goes beyond the stock market and also affects companies not listed on the stock exchange – all that is known in the jargon as mergers and acquisitions (or M&A, by its English acronym). This year, outside the stock market, the Liberty Media group also bought Dorna Sports, the owner of the Moto GP competition, for more than $4 billion, the EQT fund acquired the European University of Madrid for 2.2 billion and the car company Cinven did the same with Idealista for 2.9 billion.

“We saw a strong recovery in M&A activity in the first half of the year, coinciding with a shift to a more favourable macroeconomic cycle, which bolstered the confidence of CEOs and business managers. private equity. Consequently, we have witnessed a large number of major strategic operations, as well as public to private (from public to private, transition from listed to unlisted) under the management of investment funds private equity— Goldman Sachs sources say.

The key is the increased confidence in economic progress on the part of the top managers of large companies. This is forcing them to seek riskier proposals, such as hostile takeovers or competing bids. These types of moves have the least guarantee of success and therefore require the most courage from the managers who lead them. “Until now, the key issue in the Spanish market has been the existence of controlling shareholders who have supported and facilitated takeover processes, but in this wave of proposals we see that many of them are aimed directly at free swimminglike BBVA-Sabadell. Since Endesa and the subsequent development of the takeover rules, there have only been two competitors on the Spanish market (Realia and Abertis), and neither of them has reached the envelope process (the regulation puts an end to takeover wars, in which each competitor sends its final offer to the CNMV in a sealed envelope). Now we have an offer from Applus, an offer from Ercros is in the works, and there are rumors about the possibility of a competing offer being submitted to Talgo. This is something unusual in the last 18 years, and it came as a surprise,” describes Esteban Arza, M&A partner at Linklaters.

The second ingredient of this perfect cocktail in the Spanish stock market is the valuation of its companies. It is true that Ibex 35 has had two good years. In 2023 it rose by 23%, and in 2024 it rose by 9%, until it traded above 11,000 points, and within a year it reached the highs of 2015. However, its relative valuation still keeps it far from the European level. competitors, but especially from the Americans.

“The Spanish market has very good companies, leaders in their sectors and with growth potential. Many of these companies are undervalued on the stock market due to valuation differences between private and public investors, which leads to takeover bids, also favoured by an active financial market,” comments Luis Choya, head of M&A at Iberia. Among other reasons, this makes Spanish companies leaders in many sectors, and their management teams are well regarded abroad and have growth prospects. The growing role of shareholder activism is also driving many transactions, such as Grifols.

The avalanche of takeover bids has the opposite effect: the promotion of companies on the stock market is not followed by the same pace of stock market debuts. This year was supposed to be the year of IPOs, helped by the good performance of the main indices in 2023, but in the end the takeover bids ate the toast. Here comes the background current predicted by the investment banker, present in many of both types of operations, according to which private capital (which is not listed on the stock market) will gradually replace public capital (which is) in medium-sized companies. markets will be limited to large corporations only. If this trend continues, at some point the takeover bids will stop coming, because they will not be put up for sale. More and more voices in the market are calling on public administrations, and more precisely the National Securities Market Commission (CNMV), to relax the rules on public offerings, and Brussels is also working on new rules in this regard.

The key question now is whether this trend will continue in the second half of the year or whether the craze for takeover bids will end. “The Spanish M&A market has generally picked up in the last few months and we are optimistic about a busy second half of the year. Energy, infrastructure and telecoms are sectors that remain very active. Spain has large companies in various sectors and good performance will attract investment appetite,” concludes Bosco de Checa, partner in commercial and capital markets at A&O Shearman.

Goldman Sachs, Morgan Stanley and JP Morgan Lead M&A Market

In the first half of the high activity in the mergers and acquisitions (M&A, in the jargon), three American banks took the lead in terms of activity in the sector. According to consultancy Dealogic, they are Goldman Sachs with 18.5 billion, followed by Morgan Stanley (16.5 billion) and JP Morgan (12.4 billion). On the other hand, according to the classification of fees charged in this segment, JP Morgan leads with about 37 million, followed by Goldman Sachs (26 million) and Bank of America (16 million).

“In Spain, we have seen a clear recovery in M&A activity, with a wide range of deals in the first half of the year. From strategic cross-border deals such as Liberty Media-Dorna and Acerinox-Haynes, to hostile bids such as BBVA-Sabadell, through minority buyouts by Telefonica in Germany and Iberdrola in Avangrid, or deals with public to private “with a variety of competitive offers in the case of Applus,” says Olaf Diaz-Pintado, partner and CEO of Goldman Sachs in Spain.

Keep up to date with all the information Five days V Facebook, X And LinkedInor in our newsletter Five-day program

Newsletters

Subscribe to receive exclusive economic information and financial news that are most relevant to you.

Register!