Bitcoin recovery here? Key Factors That Could Help BTC Grow Again

- STH-SOPR and another indicator showed that Bitcoin was getting closer.

- An increase in the stock-to-flow ratio supported potential price increases.

History may not repeat itself in the cryptocurrency market, but patterns often rhyme. This is why the price of Bitcoin (BTC) could be preparing for a significant move following a correction.

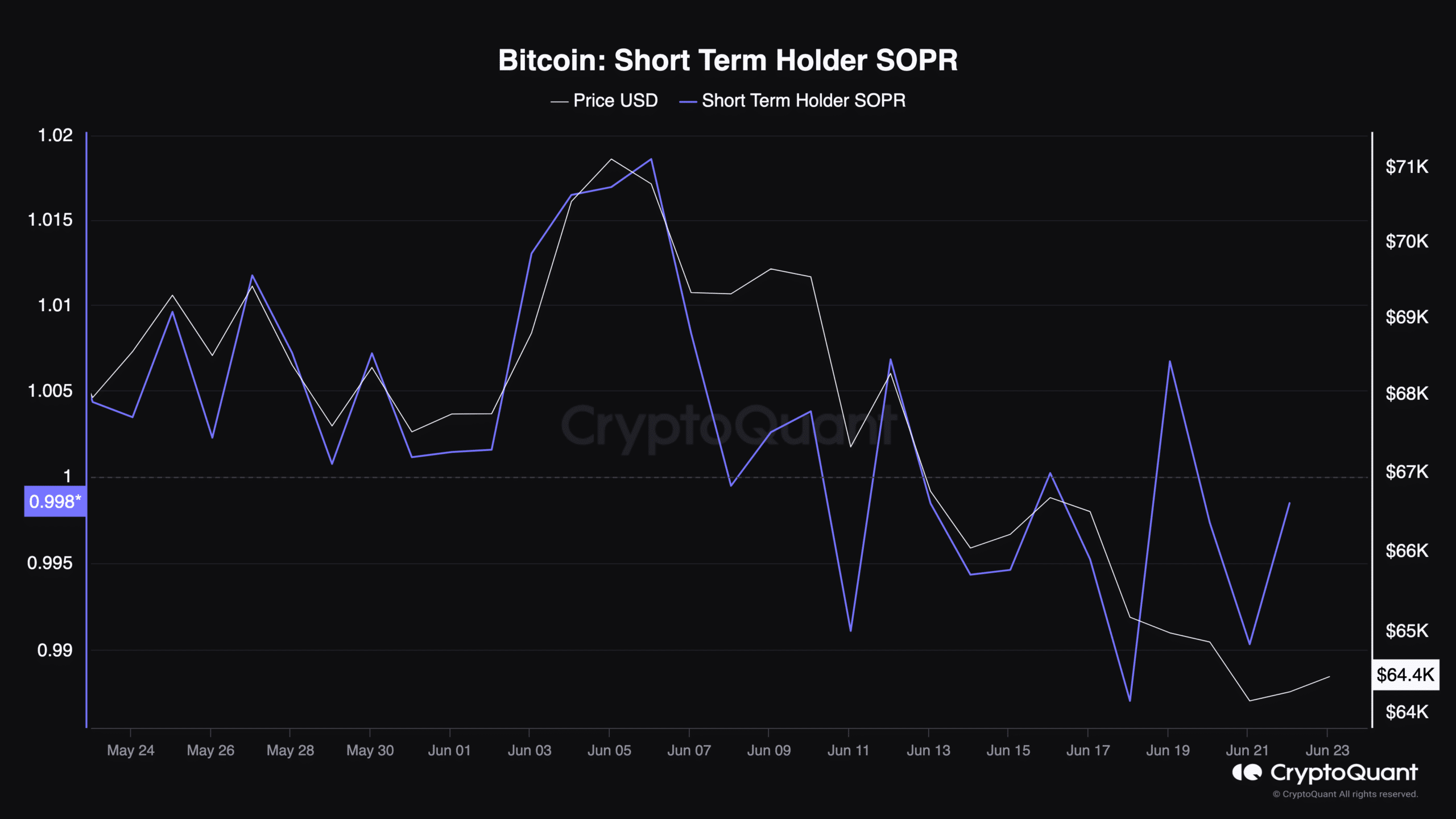

STH-SOPR is one of the reasons for this prediction. STH stands for Short Term Holder. SOPR is an acronym for Operational Expenditure Ratio (SOPR).

Taken together, this metric shows whether Bitcoin holders who bought the coin within a 155-day period are selling at a loss or at a profit.

Change is closer than you think

If the value is less than 1, it indicates that holders are selling at a loss. However, values greater than 1 indicate that they are being sold at a loss.

At the time of publication, AMBCrypto found the value to be exactly 0.99 based on data from Criptoquant. This value makes it a crucial moment for BTC as it could move in any direction.

In the past, a reading below 1 meant the end of a downtrend. Thus, if STH-SOPR remains below the threshold for some time, the Bitcoin price could prepare to recoup some of its recent losses.

Source: CryptoQuant

However, this does not mean that Bitcoin’s $61,000 or $60,000 prediction will not come true. But this means the coin’s value may not fall to $54,000 before a reversal begins.

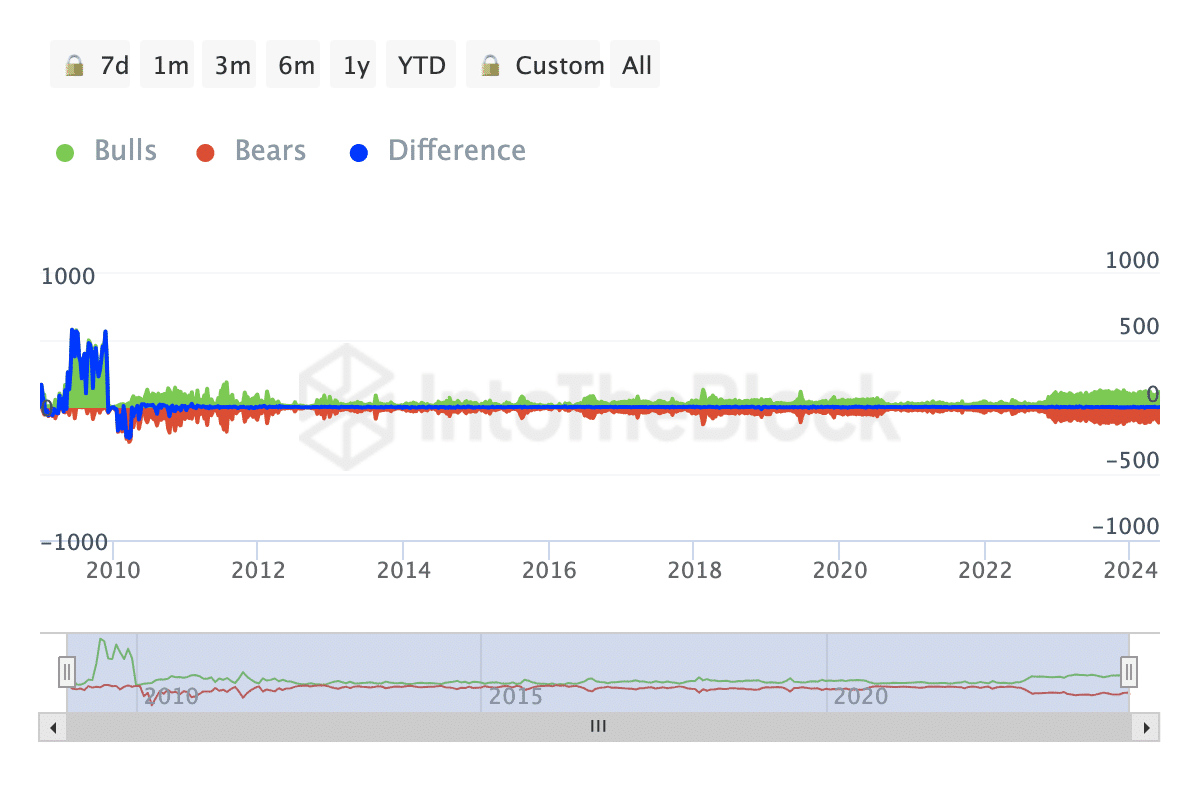

Another indicator that forms the basis of the forecast is the bulls and bears provided by IntoTheBlock.

This metric compares addresses that bought more than 1% of 24-hour trading volume to those that sold more than 1% over the same period.

Bulls point to low inflation

If the number of purchased addresses exceeds the number of sold addresses, then this is a bullish signal. However, if there are more addresses being sold, this is a bearish forecast.

At the time of writing, the Bulls And Bears indicator was +2 in favor of the bulls. While this may not have an immediate impact on BTC, holding the position over the next few days or weeks could help end Bitcoin’s correction.

Source: IntoTheBlock

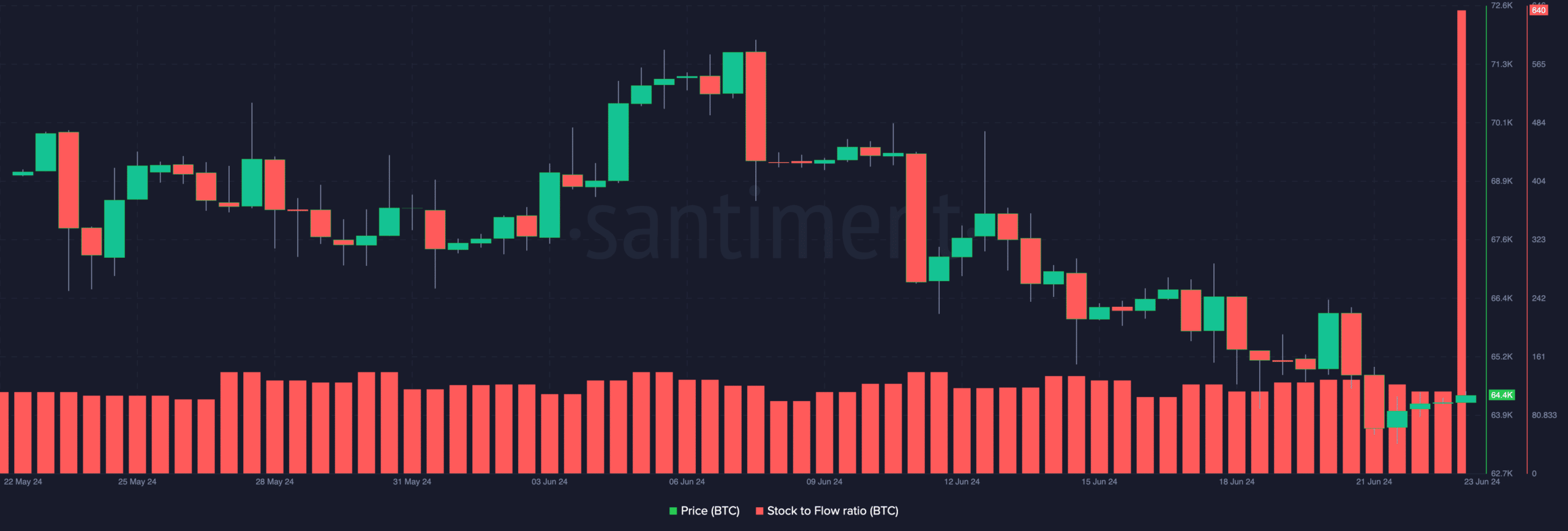

If this were the case, Bitcoin’s price could begin a move that would take it back to $66,000. Last on the list of indicators supporting rising prices is the stock-to-flow ratio, which jumped to 640 on June 23.

The stock-to-flow ratio measures an asset’s vulnerability to inflation and shortages. If the value is low, it means there is a high level of inflation. Thus, price increases may be difficult in the medium to long term.

Read the Bitcoin (BTC) price forecast for 2024-2024.

However, high values indicate that Bitcoin has a low inflation rate. It also means that the security can maintain a high level of price appreciation over time.

Source: Santiment

Given the state of the mentioned data, BTC may recover in a short period of time. However, the forecast may not be valid if large investors in BTC continue to sell part of their assets.

This is an automatic translation of our English version.