Monetary base grew by 16% in June: what are the reasons

Monetary base grew strongly in JuneAccording to the Central Bank, it has grown 16.2% monthly, seasonally adjusted in real terms and recorded growth for the third month in a row. This implied an increase in the amount of money. 3.4 billion dollars. Year-on-year, it fell by 15% in real terms.

The main explanation for these data can be found in the process disarming passes banks within the framework Migration of paid debt from BCRA to Treasury. A process that began almost at the very beginning of the administration, which the government decided to accelerate in May and which now intends to culminate in the adoption of new monetary regulation bills.

“In response to the growth in demand for transaction money, the monetary base registered an increase in month-end balances by $3.4 trillion in June. It should be remembered that both the increase in currency in the hands of the population and the fact that deposits. Unpaid types affect the demand for the monetary base, firstly, in full, and secondly, through the reserves that are deposited in the current account at the BCRA. This expansion in demand for the monetary base was provided by the BCRA. disarmament of the passive repo position of financial institutions and the interest paid on these remunerated obligations,” the Central Bank said in its monthly monetary report published this Friday.

Consulting firm LCG estimates that BCRA has injected $2.6 billion into the passive repo by canceling it. The firm noted that much of that pesos should return to the central bank when the Treasury buys dollars to pay off the debt next week.

Another factor in the monetary expansion in June was the payment of interest accrued on repo transactions. for about $553 billion. “It should be noted that the fall in the volume of passive repos and the successive decline in interest rates on them have led to the interest rate expansion in real terms being reduced to less than one-fifth of what it was at the end of 2023,” he said. organization chaired by Santiago Bausili.

The economic team intends to finally close this money emission tap in the coming days.when you replace them with new ones letters on monetary regulation for banks that will be issued by the Treasury (which will be responsible for paying interest based on the larger budget adjustment), although they will have the option of being bailed out by the BCRA.

There was no monetary expansion on the foreign exchange front in June. This is in response to the problem of rebuilding the reserves that BCRA had due to the cessation of foreign exchange purchases. In fact, closing with a sales balance of US$84 million resulted in a slight reduction in the monetary effect.

“However, the broad monetary base (the sum of liabilities paid in pesos and the monetary base) continued to decline and registered a monthly decline of 23.2% in constant prices and seasonally adjusted terms. Thus, it amounted to 6.2% of GDP, the lowest record in the last 20 years,” the BCRA said.

BCRA Measures Recovery in Money Demand

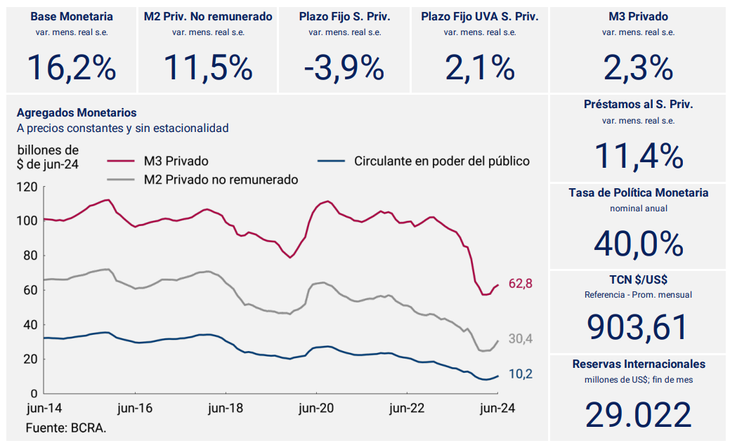

The expansion of the base coincided with improving the demand for money. “The broad monetary aggregate, private M3 (or includes currency held by the public and private sector peso deposits, both on demand and in time) is Increase by 2.3% “at constant prices and adjusted for seasonality,” the report states.

However, compared to last year, this aggregate figure fell by 33.5%, and as a percentage of GDP it would have been 10.8%, which is a record, similar to the figure for the previous two months.

However, the growth of M3 is fundamentally explained by the growth of non-remunerated instruments, as term deposits fell by 3.9% monthly, seasonally adjusted and in real terms.