Celestia’s Bulls are experiencing some success, but will it be enough for a TIA condition?

- Celestia has shown bearish sentiment in the short term.

- The price action on the daily chart gave an early signal of a trend change.

Celestia (TIA) had a strong uptrend in November and December 2023, but its progress stalled in the $15-$20 zone in the first half of February.

Since then, the token has shown a relentless downward trend, losing 70% over the past five months.

There are early signs that this bearish trend may be starting to reverse. So it remains to be seen whether the bulls will be able to drive a recovery, but here is what traders should consider before looking for trading positions.

Bullish Breakout for Celestia

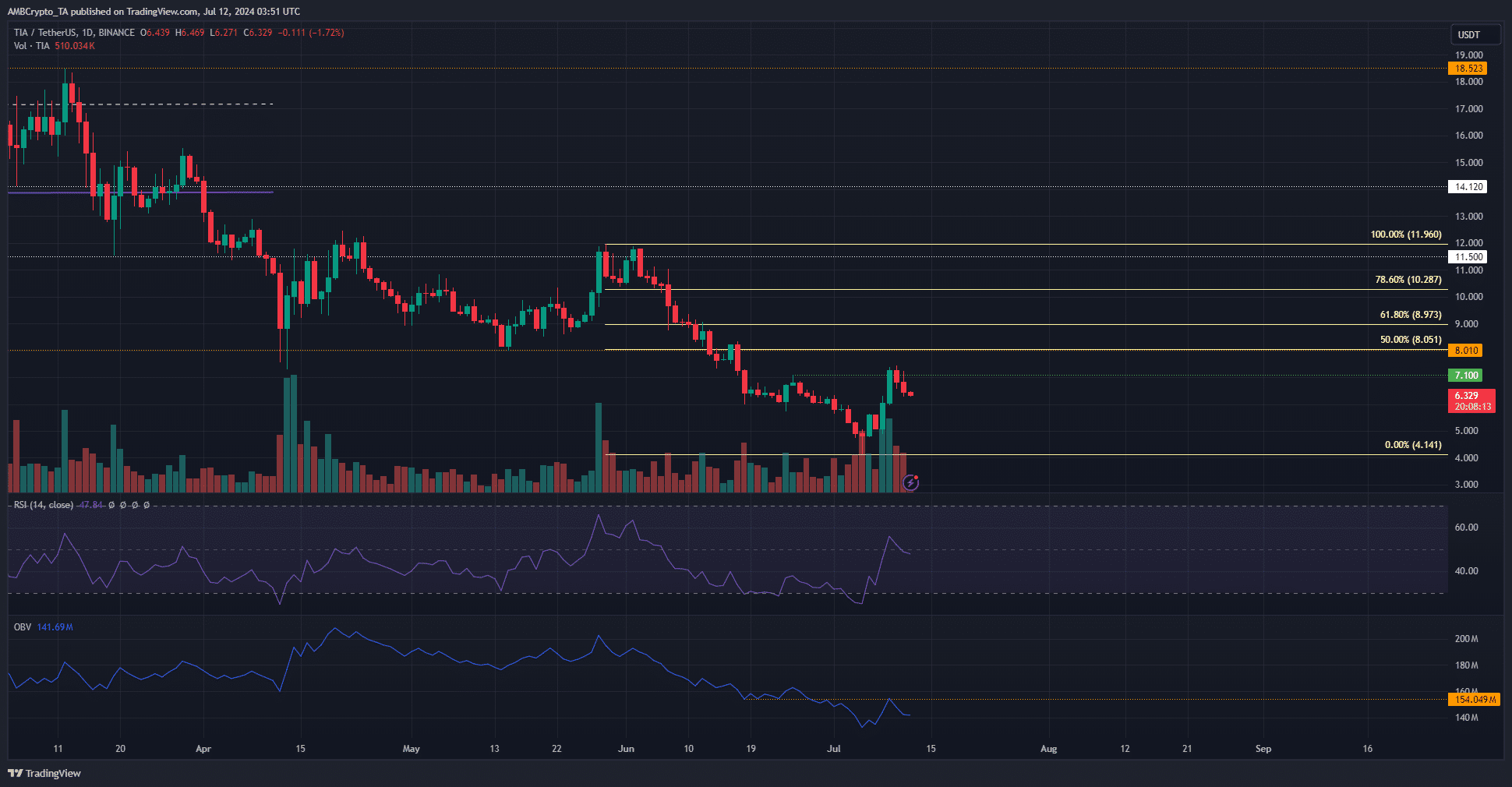

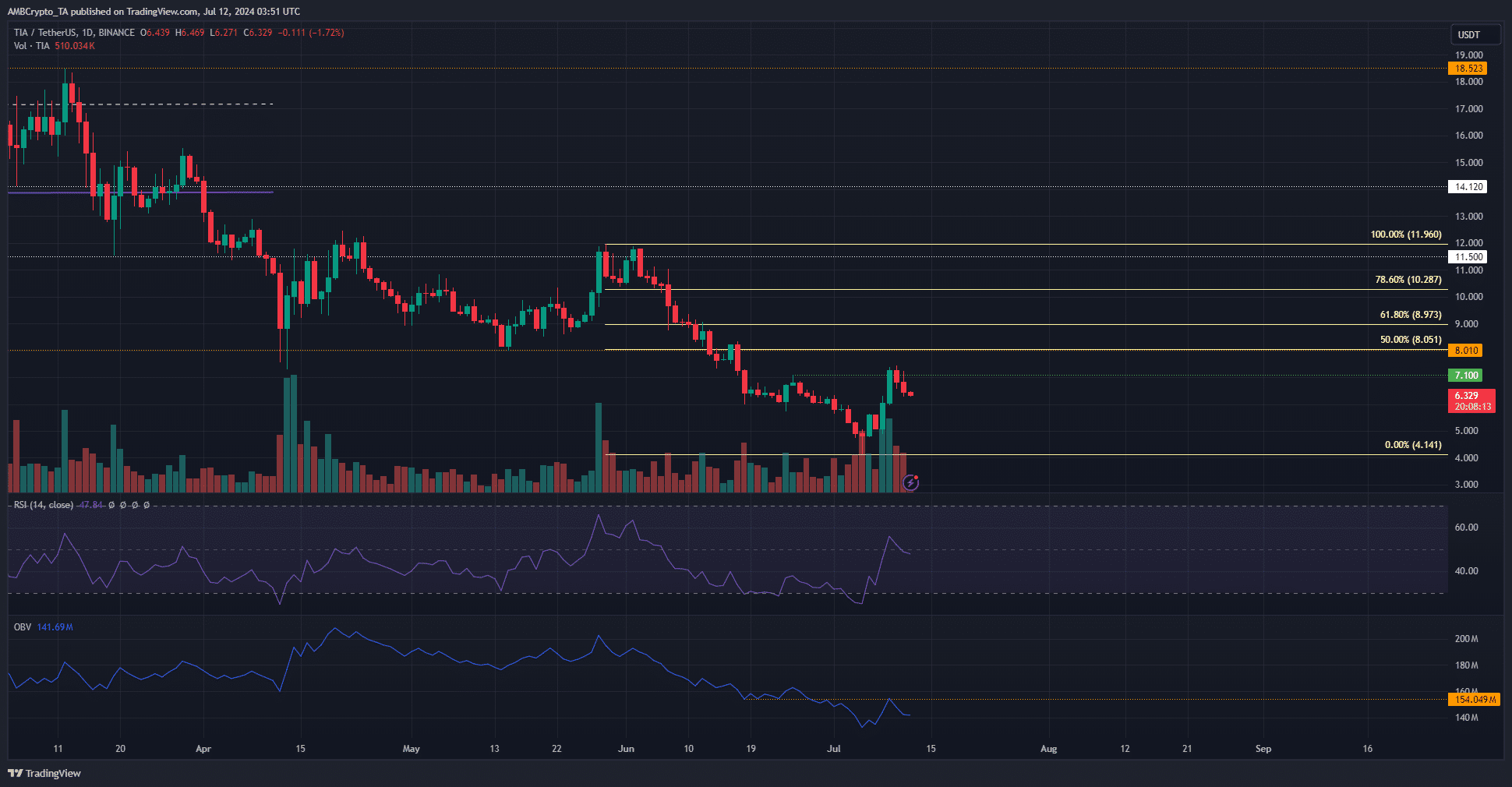

Source: TIA/USDT on TradingView.

TIA’s bearish trend ended in April and May and seemed to have formed a range between $8 and $12. In mid-June, the $8 support level was broken and turned into resistance.

OBV, which had been rising in the second half of May, also fell quickly along with prices.

The bulls may be taking a break again. The most recent high was $7.1, and TIA closed the daily trading session above that level on July 9, indicating a change in market structure.

The RSI also jumped above the neutral 50 level, indicating that bullish momentum may be taking control.

However, OBV failed to break through local resistance, meaning that buying pressure was not strong enough to trigger a rally. This could lead to TIA consolidation in the $6-8 zone.

Futures traders are bearish

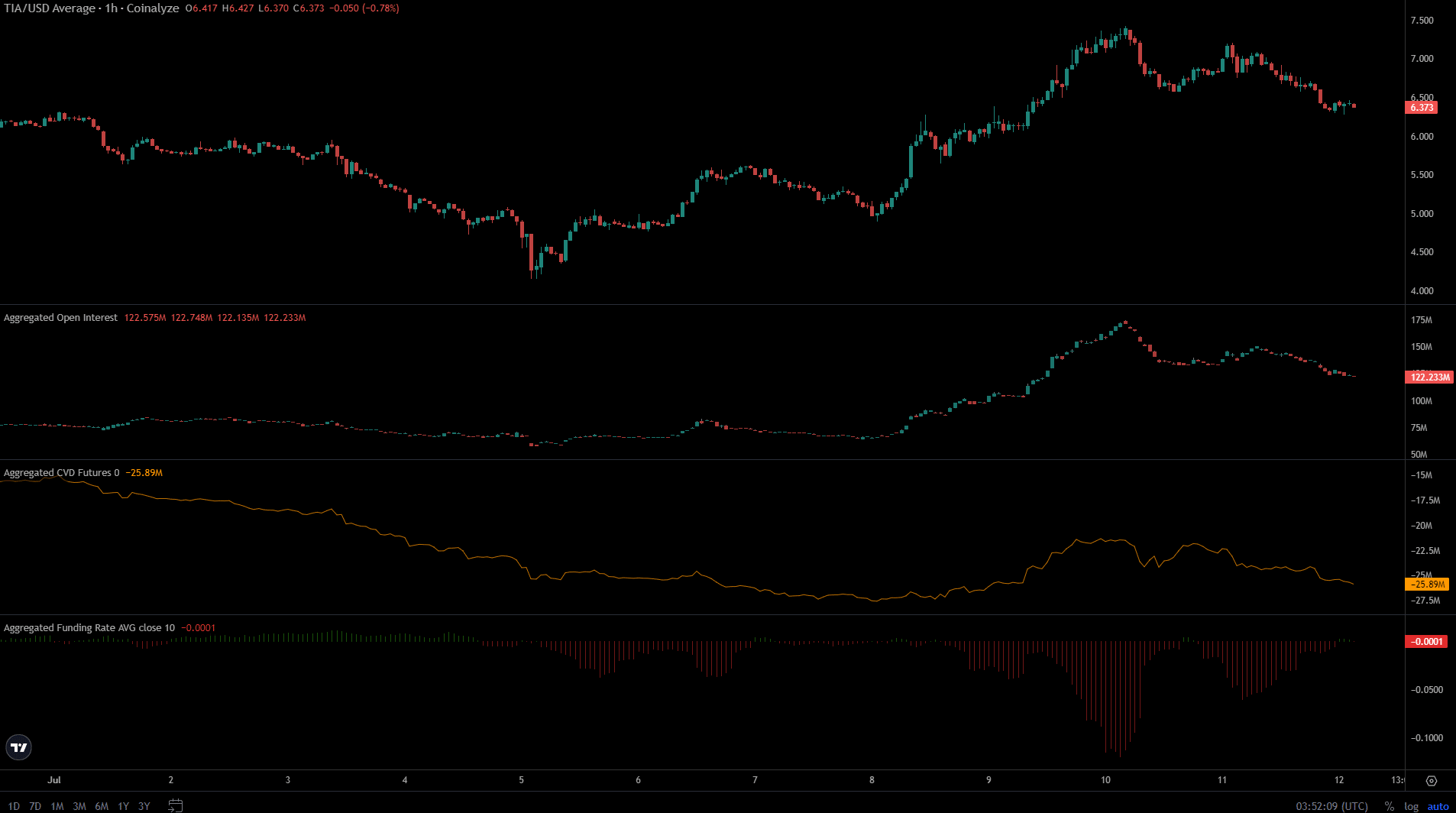

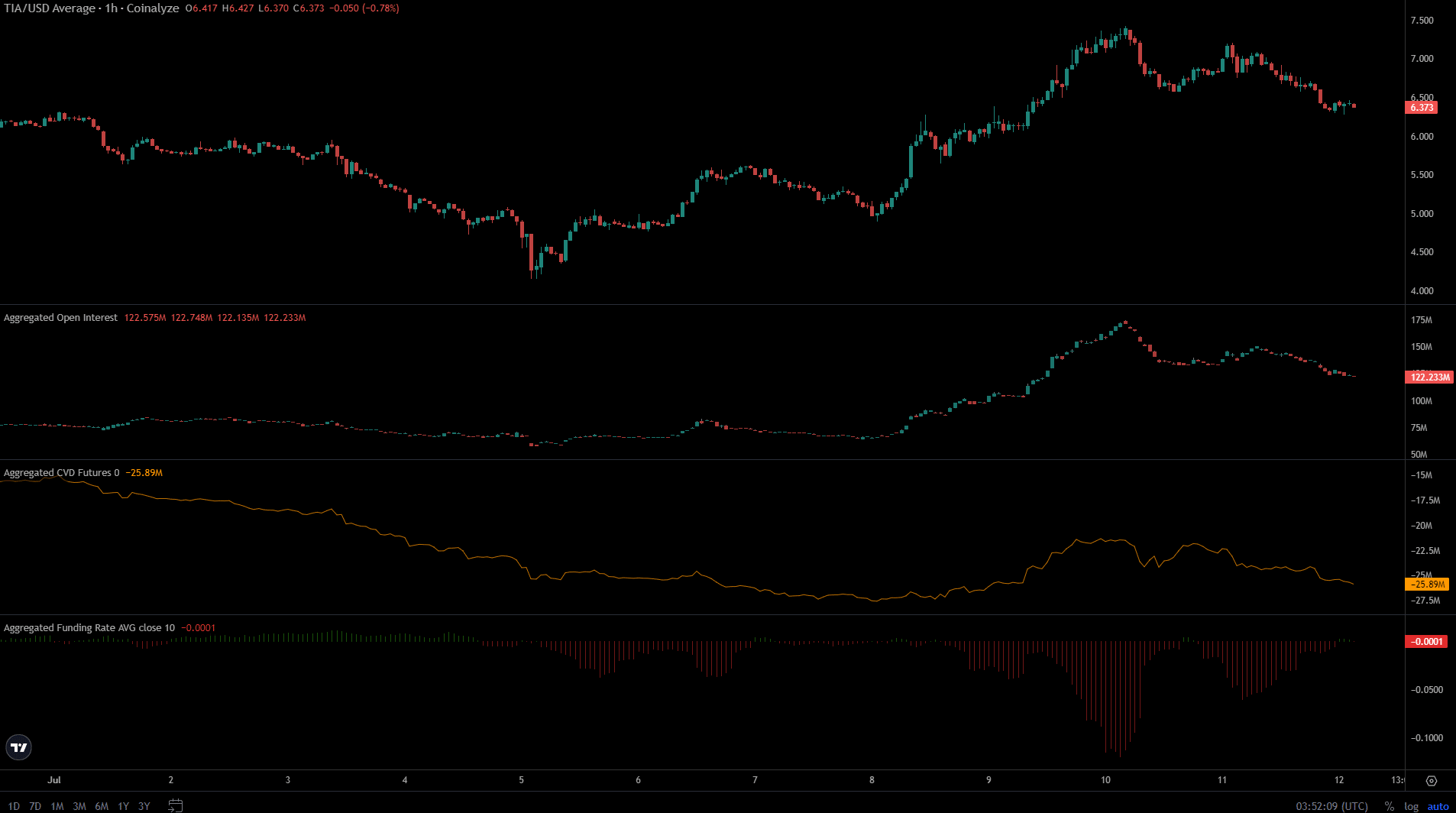

Source: Coin Analysis.

Since July 10, TIA has fallen 14.8%, and open interest has plummeted from $174 million to $122 million, a 29.9% drop. The funding rate has also been bearish over the past two days.

This showed that despite OI’s rise earlier this week, speculators were not confident that TIA would start a recovery and were happy to bet on a price reversal.

Whether it is realistic or not, here is the market cap of TIA in BTC.

The spot cardiovascular index has also fallen over the past two days, dashing bullish hopes for a recovery.

The breakout of the market structure on the daily chart was an encouraging sign, but the lower time frames reflected bearish sentiment. Swing traders may look for buying opportunities in the $5.75-$6 support zone.

Disclaimer: The information provided does not constitute financial, investment, trading or other advice and is solely the opinion of the author.

This is an automatic translation of our English version.