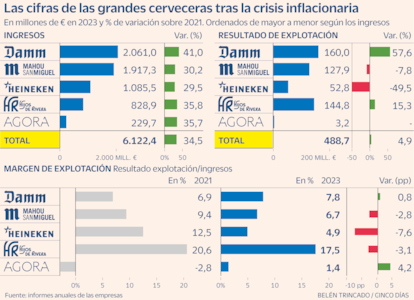

Major breweries will increase sales by 35% from 2021 (but earn only 5% more) | Companies

Over the past three years, amid inflation, the income indicators of large brewing groups have risen sharply, although their profitability indicators have not grown at the same pace. Damm, Mahou, Heineken España, Hijos de Rivera and Grupo Ágora together invoiced €6.122 million in 2023, up 10% from the previous year and representing a new record for the five companies combined. . In fact, for all but Heineken’s Spanish subsidiary, last year’s revenue reached historic levels: Damm’s revenue topped 2 billion million for the first time, Mahou nearly reached that mark, and Hijos de Rivera edged closer and closer to 1,000.

Between 2021 and 2023, the years that cover the bulk of Spain’s inflation crisis, the turnover of these groups increased by 35%, representing an additional income of almost $1,600 million. However, only Damm and the Aragonese group Ágora, which owns the Ámbar brand, improved their operating profit during this time. That is, for Mahou, Heineken and Hijos de Rivera, higher income did not translate into higher levels of profitability on their sales.

Beer, like other consumer beverage categories, saw strong price increases in 2022 and 2023. Light beer saw continuous year-on-year growth from June 2022 to May 2023, the Consumer Price Index (CPI) shows. In the period from October 2022 to November 2023, even then, with a slowing trend, growth exceeded 10%, reaching a maximum of 16% during this period. INE also disaggregates data for “other beers with alcohol,” whose consumer price index increased by almost 18% in March, April and May 2023. A similar trend was observed in the no-alcohol and low-alcohol options.

Margin in recovery

Rising prices led to an increase in income, also thanks to consumption, which, especially in the hospitality sector, maintained despite inflation. But that higher volume of business hasn’t had the same impact on companies’ profits. Commodities such as electricity, glass, aluminum or raw materials such as barley, wheat or corn have increased exponentially. “The cost dynamics are like never before,” Mahou San Miguel CEO Alberto Rodriguez Toquero said two years ago. “A shipping container costs us three times as much,” said Ignacio Rivera, executive president of Hijos de Rivera, also at the height of the crisis.

Annual reports from the companies analyzed show that supply costs rose an average of 53% in 2023 compared to 2021, excluding Damm, whose full financial statements for the most recent year were not available. This explains why the five groups’ combined operating results improved by only 5% rather than 35% of revenue over the period. Additionally, neither Mahou nor Heineken surpassed what they achieved in 2021 in 2023. The latter was saddled with a reserve of 40 million that it registered for the ERE signed last December.

Only Damm and Agora achieved higher operating margins in 2023 than in 2021, while the others were still on track for a recovery expected to end in 2024. The net profit of all of them in 2023 increased by a combined 6%. compared to 2021 figures, but they were 4% lower than 2022 figures due to Heineken’s aforementioned position. Again, only Damm and Agora delivered better revenue, operating results, profitability and net income in 2023 than in 2021.