Ethereum Futures Signal Bullish Despite Falling Prices – What’s Next for ETH?

- Ethereum Funding Rates Underscore Growing Optimism, But Sentiment Remains Cautious

- A decrease in active addresses and an increase in leverage ratios revealed mixed trends in the retail and Ethereum futures markets.

Ethereum has recently experienced significant price volatility, which has caused mixed reactions among investors. After rising above $2,700 on October 30, Ethereum has renewed investor optimism. However, this view has recently been called into question by the latest downward move.

Over the past 24 hours, the price of Ethereum fell 5.1%, hitting a low of $2,475 before stabilizing at $2,496 at the time of writing. This price drop has sparked debate about the strength of the Ethereum market, with particular focus on investor sentiment regarding Ethereum futures.

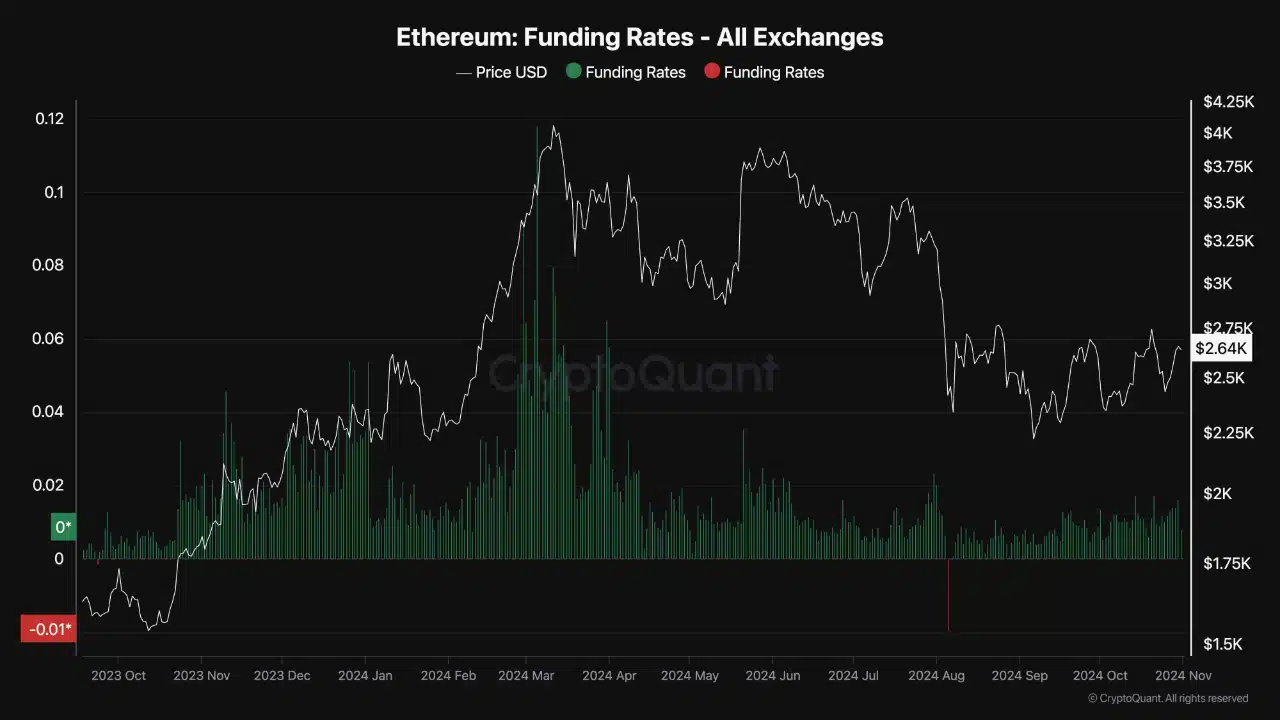

However, despite the recent price pullback, CryptoQuant analyst stood out that Ethereum futures market funding rates showed a positive outlook among traders. The financing rate, which reflects the balance between buyer and seller optimism, has been trending upward recently.

Ethereum Futures Funding Rates and Investor Sentiment

Positive financing rates are a sign that there are greater demand long positions in Ethereum futures, indicating optimism among futures traders. However, these rates remain below the bullish peak seen in March, during which Ethereum price had a strong bullish trend. This means that while optimism exists, it has not yet reached a sufficient level to cause a major breakout.

Ethereum futures funding rates provide insight into market sentiment by showing the level of bullish or bearish pressure among traders. Positive funding rates indicate a greater willingness of traders to hold long positions, which is a sign of bullish sentiment. Negative rates imply the opposite.

Source: CryptoQuant

The current bullish trend in Ethereum funding rates hints at a growing propensity to buy into the futures market, especially as investors anticipate potential price increases. However, lower financing rates compared to levels earlier this year suggest that while sentiment has improved, it may not yet be strong enough to drive significant price increases.

ETH’s ability to break through resistance and maintain bullish momentum depends in part on a sustained rise in funding rates. Higher rates will reflect greater demand for long positions, which could increase buying pressure on ETH.

To continue the rally, increasing funding rates will indicate greater investor confidence. This could help Ethereum overcome existing resistance levels, which could lead to an increase in its price.

These sentiments, combined with market trends, could determine Ethereum’s trajectory in the coming weeks.

Active addresses and leverage ratios indicate market trends.

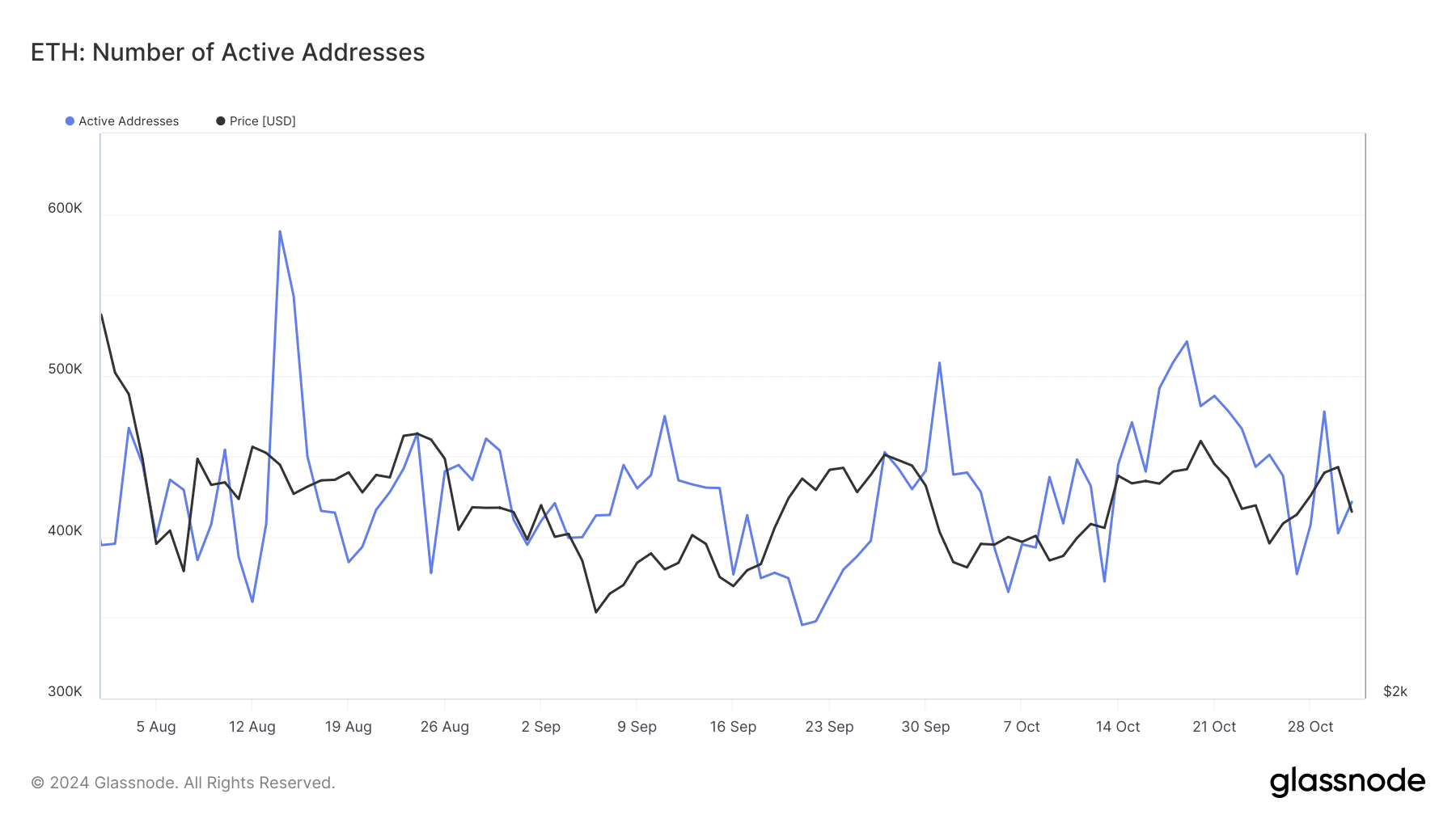

Outside of the futures market, active Ethereum addresses (an indicator of retail interest) were forecasting a downward trend. Glassnode data indicated that the number of active addresses had dropped from more than 550,000 on August 14 to approximately 421,000 at the time of publication.

Source: Glassnod

This drop in the number of active addresses could be a sign that retail investor interest is waning, which could reflect caution in the broader market. Active addresses are a measure of participation and commitment. Additionally, the decline could indicate that fewer investors are actively trading or transferring ETH, which could dampen buying momentum.

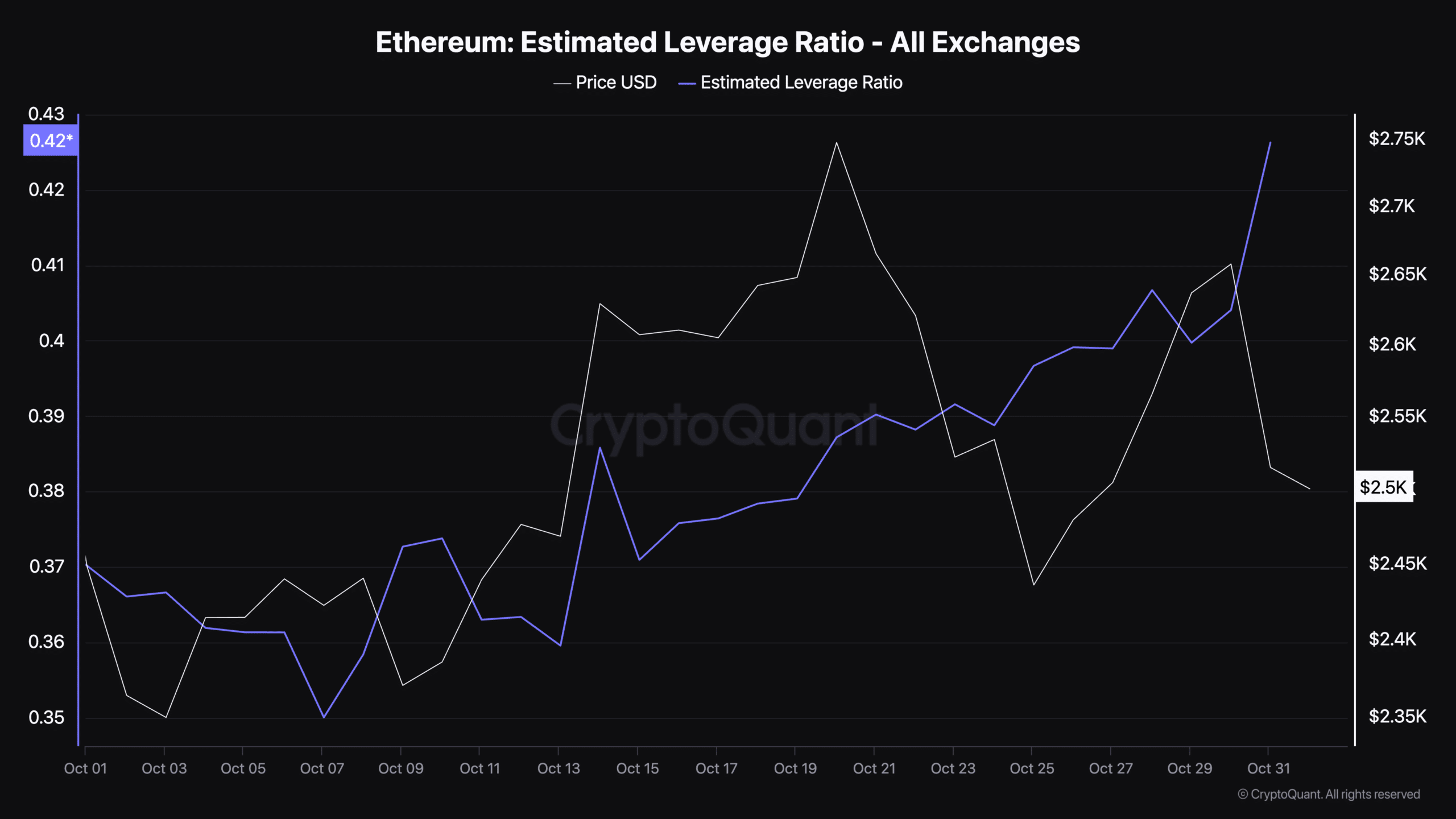

Finally, data from CryptoQuant reported that Ethereum’s estimated leverage ratio increased from 0.35 in early October to 0.42 at the time of publication. This ratio shows the level of leverage, or leverage, used by traders, with a higher ratio indicating more debt.

Source: CryptoQuant

An upward trend in the leverage ratio may indicate that traders are taking on more risk and may be expecting prices to rise.

However, a high leverage ratio can also lead to volatility since highly leveraged positions are more sensitive to price fluctuations. This may result in more violent movements if Ethereum price changes unexpectedly.

This is an automatic translation of our English version.