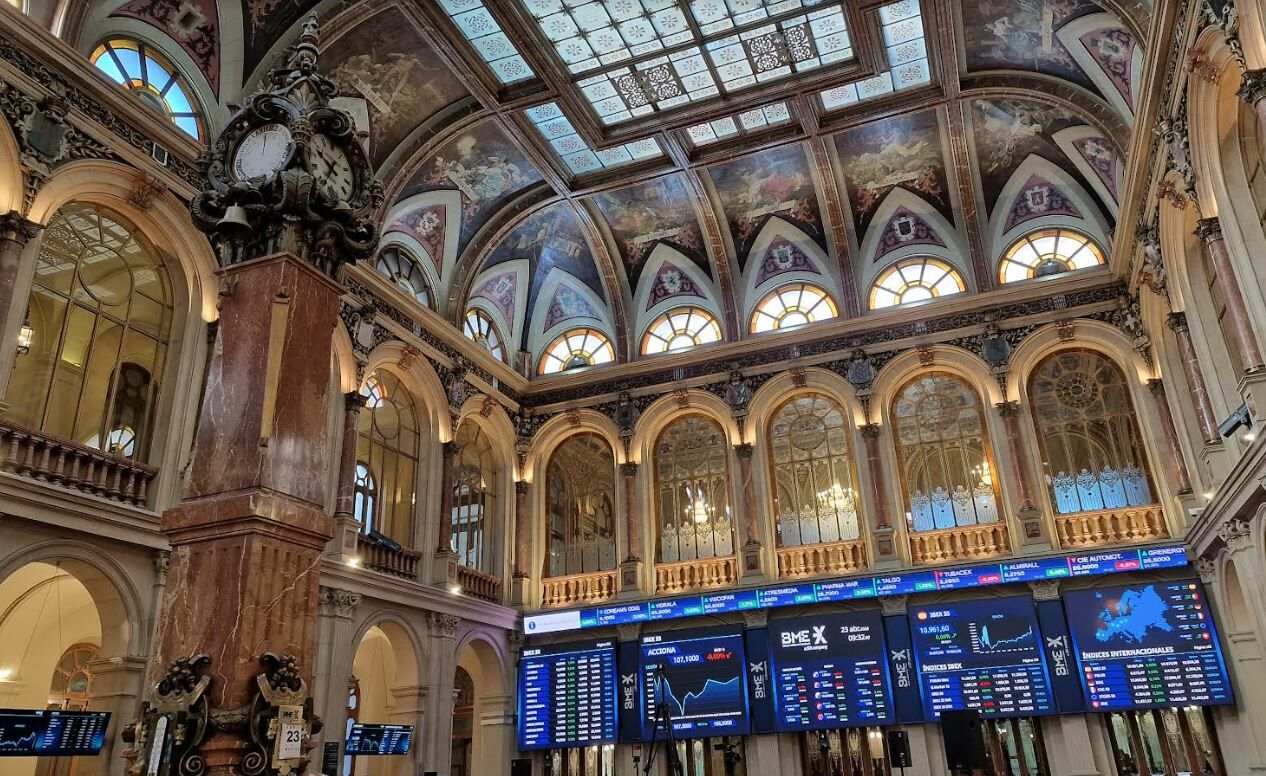

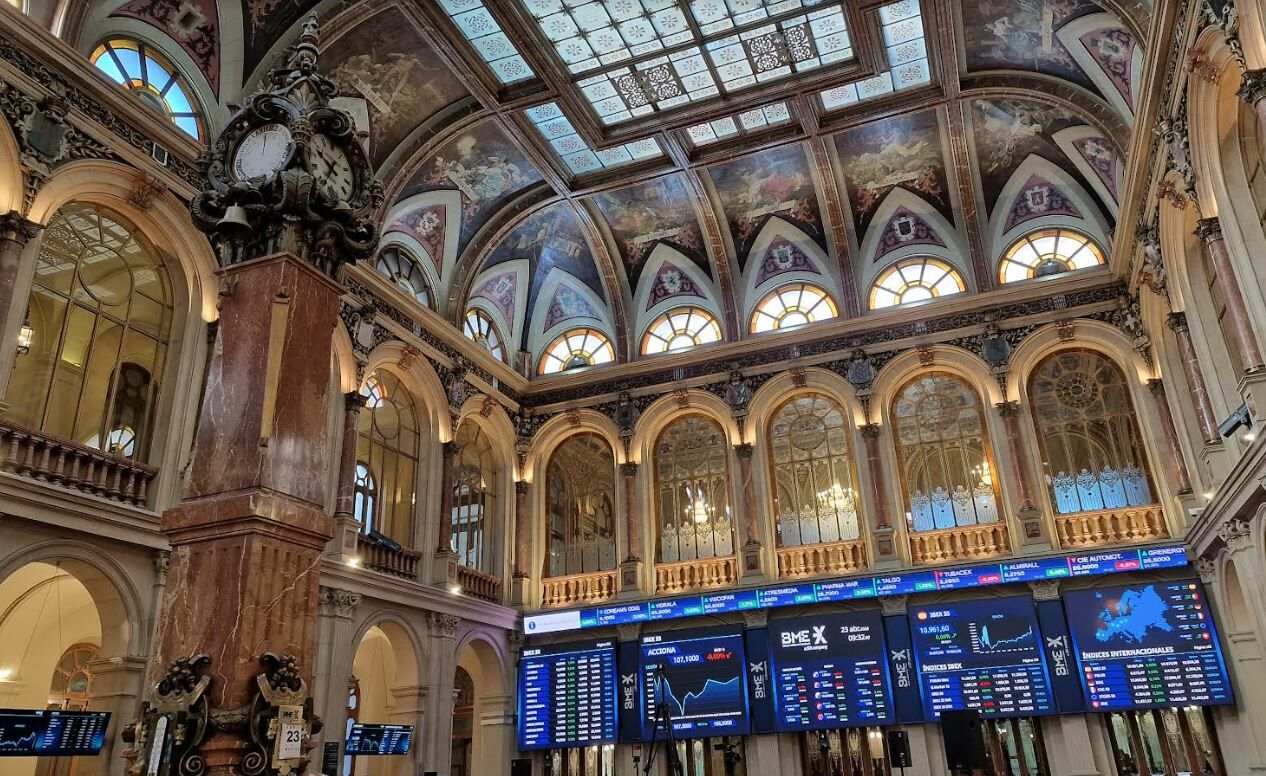

Ibex 35 falls below 11,700 as Trump wins; severe punishment for banks and renewable energy sources

The IBEX 35 index was already down 1.40% mid-session to 11,674.70 points. The biggest penalty came from BBVA, whose shares fell 5.41% due to the possible impact of Trump’s victory on the company’s business in Mexico. Acciona retains 4.98% (its subsidiary Acciona Energías Renovables holds 3.13%). Decrease of more than 4% also at Solaria or Banco Sabadell. IAG (Iberia) shares are in the green with an increase of 3.94%. Acerinox shares rose 3.66%.

The Madrid Select Market is coming off a slightly bullish day yesterday, consolidating above the 11,800 level and recovering from the previous days’ decline. Over the past fifteen days, the index managed to close in positive territory for only six days.

Today, the results of the season are again gaining momentum on the accounts of Logista and Sacyr.

Logista was the first to rise, receiving net profit in the 2024 financial year ended September 30 was 308 million euros.which represents an increase of 13.2% over the previous year. From October 2023 to September 2024, the firm increased its revenue by 4.5% to €12,986 million. Logista’s adjusted operating profit (adjusted EBIT) reached €385 million, an increase of 5.3% compared to the previous year.

For his part, Sakir received Attributable net profit of €74 million for the first nine months of this yearwhich represents growth of 1.3% compared to the same period in 2023, the company reported this Wednesday. Between January and September, the firm cut its Ebitda by 1.7% to €947.8 million, while turnover reached €3,261.8 million, up 0.5%.

Sakir is also in the news after the newspaper Extension published information that the company is bidding to build a hospital in Canada worth 460 million euros.

However, the day with the most results will be tomorrow, Thursday, with scores in particular from Telefónica. The telecommunications company already had a preview of the report from Telefónica Brasil, which operates in the country as Vivo. The subsidiary achieved attributable net profit of R$3,785 million (€602 million at current exchange rates) for the first three quarters of the year, up 10.38% from R$3,429 million (€545.5 million) in the same period period. the previous year, according to reports the company filed Tuesday evening.

One of the main characters of the day is IAG (Iberia), which rises to new annual highs. “The price is attacking a very important resistance level, so the uptrend may continue in the coming sessions/weeks,” says analyst Alvaro Nieto.

On a rolling basis, we’ll have to pay attention to Gestamp’s price, which is updating its 2024 guidance to reflect lower growth, lower operating leverage and lower free cash flow generation. Following this announcement, JP Morgan lowered its target price for Gestamp from €3.20 to €2.90. This gives a potential of 7% from yesterday’s closing price.

Meanwhile, JP Morgan raises the price of Coca Cola Europacific Partners to 78 euros.

Ercros recorded a net loss of 7.8 million euros in the first nine months of this year, compared with a profit of 5.7 million euros made in the same period in 2023, the Spanish chemical company said as Portugal’s Bondalti Ibérica and Italy’s Esseco launched public procurement proposals (OPAs), which are currently ongoing.

The macroeconomic agenda this Wednesday is focused on the publication of the final reading of the bill. Eurozone Composite PMI in October, which at 50.0 is above market expectations. On the other hand, we know the eurozone producer price index (-3.4% year on year) and German factory orders (+4.2%), which are key to assessing the industrial climate of the leading European power. In the US, we’ll see weekly mortgage applications as well as the release of the October Composite PMI, which previously stood at 54.3.

Euphoria on Wall Street before Trump’s victory

However, all attention is focused on the vote count in the US elections after yesterday’s presidential elections. Finally, Republican Donald Trump defeated Democrat Kamala Harris, winning the election with 277 electoral votes compared to the current vice president’s 224. The threshold for victory was set at 270. He also clearly won the votes – 70.84 million to Harris’ 65.93. Or, what is the same thing, 51% of the total compared to 47.5%.

Congressional projections point to Republican control, although that is not yet official. Yes, it’s in The Senate, with 51 seats compared to Democrats’ 42, will have a Republican majority..

With this data in hand, US futures are pointing to a decidedly bullish opening, with DOW JONES index futures up 2.93% compared to 2.36% for the S&P 500 and 1.84% for the Nasdaq 100. Election results aside, we’ll have to pay today Focus on Apple price EU antitrust regulators set to fine under rules The bloc’s historic moves have been aimed at curbing the power of big tech companies, making it the first company to be sanctioned.

The tone in European stock markets is far from the euphoria on Wall Street, although consistent growth remains. Germany’s DAX added 0.98% to 19,443, France’s CAC 40 added 1.47% to 7,515, London’s FTSE 100 added 1.22% to 8,271 and the EURO STOXX 50 rose 0.83% to 4,909. points. The Italian stock market rose 0.64%.

Investors may be somewhat “concerned about the impact that a potential trade war between the eurozone and the United States could have on the results of many European companies with significant exposure to the US market,” said Juan J. Fernandez-Figares of Link Gestión. . However, the expert reminds that “you don’t have to go crazy, because what they say in the election campaign is one thing, and how you act after the elections is another.”

Asian stock markets closed higher this morning, while the Japanese stock market took advantage of the yen’s weakness to lead gains. Tokyo’s Nikkei 225 index rose 2.16% to 39,428.50. The Hong Kong stock market broke the positive trend, closing significantly lower.

In terms of currencies, the dollar is celebrating Trump’s victory with strong gains against its major international peers. The euro fell 1.61% against its US counterpart, with the exchange rate at $1.0752 for each currency.

The dollar’s strength was also evident in oil prices, which fell more than 1%, while US crude oil inventories also rose more than expected. Europe’s benchmark Brent fell 1.28% to $74.56 and US West Texas futures fell 1.26% to $71.08.

In the fixed income sector, the US 10-year yield surges to 4.412%, a level not seen since early summer. It is worth considering that in the midst of a US election hangover, the US Federal Open Market Committee (FOMC) is beginning a two-day monetary policy meeting, at which it is expected to cut monetary policy by 25 points. types.

Meanwhile, the ten-year Spanish bond offers a yield of 3.09%, leaving the risk premium over its German counterpart at 70.30 points.

Bitcoin reached an all-time high of $75,000.