European stock market is weak relative to the S&P 500 index | Funds and plans

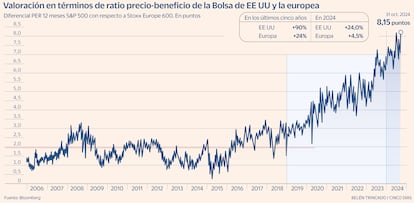

This week’s schedule speaks for itself. As you can see, the difference in valuation in terms of PER (Price to Earnings Ratio) of the Stoxx 600 relative to the S&P 500 is more than eight points, which represents a 20-year high and opens up a debate on this issue. whether the European stock market should end its different behavior towards the United States or not.

This year, the Stoxx 600 index of the Old Continent’s major listed companies is up 4.5%, compared with the S&P 500, the US benchmark index, up 24%. Over the past five years, European stocks are up 24%, while North American stocks are up 90%.

The difference in PER before joining the Magnificent Seven was two points, but since then, as a consequence of higher profitability and faster growth, the difference has widened dramatically. At this point, I think we are close to the peak of the spread as I think we are close to the maximum P/E for the SP&500, which has been seen very rarely in the last 30 years.

At current 12-month PER levels of 22.2 times, we are approaching the 23 times barrier seen only in the 2000 period. Investing at these PER levels typically produced negative returns in the following three cases: years. So be careful with your S&P 500 valuations.

To make a profit in the next three years (an investment horizon that investors rationally have, although the week then eats up) US fixed income, which is already yielding 4.3%, would need to be that in 2027 the S&P500 index will have a profit of share. of $300 and apply the PER 23 times, resulting in an annualized return through 2027 of 4.6%. This is a very demanding PER.

On the European side, I think the weakness of domestic demand and our low growth rates are weighing heavily on us, as are doubts about whether profits, without the effect of inflation, can grow at the rate they are. But the option of buying relatively European companies with a global presence at current prices may make sense. 2025 is presented as an exciting year from a market perspective and the Magnificent Seven option exists, but at a challenging and demanding rate, and on the other hand, it is possible that the Stoxx 600 PER differential will fall into the six-point zone.