BBVA activates an operation to expel Oliu from Sabadell, but the government is now in hiding

The government is now criticizing BBVA’s hostile takeover of Banco Sabadell. “The government rejects BBVA’s decision to propose a hostile takeover of Sabadell, both in form and in substance,” indicate sources in the Ministry of Economy.

A radical change of opinion on the part of the executive, since until now, with the voice of the Minister of Industry Carlos Bodi and the Minister of the Presidency, Justice and Relations with the Cortes Félix Bolaños, they have not conveyed any reluctance to absorb.

Carlos Bodi’s department notes that “this operation could potentially harm the Spanish financial system.” Economía stresses that “this would mean increased levels of concentration, which could have a negative impact on employment and the provision of financial services,” and warns that “excessive levels of concentration would create additional potential risks to financial stability.” as the Governor of the Bank of Spain pointed out.”

The ministry adds that this takeover “will also affect territorial cohesion due to the presence of these financial structures in the territory.”

Hostile takeover for influence

However, as reported in Confidencial Digital, Moncloa encouraged BBVA’s hostile takeover bid for Sabadell.

Video of the day

Garcia Ortiz sticks to his position: “I’m not resigning, disapproval

“The Senate is an undemocratic mistake.”

They explain that this scenario is part of an interventionist strategy that the government has adopted as the most powerful business entity in the country. Thus, through FROB he has already taken control positions in Telefónica, Indra, CaixaBank and is preparing to enter Naturgy. A background that raises a shadow of suspicion regarding the executive’s intentions regarding BBVA and Sabadell.

The presidency does not view this operation with skepticism. The government of Pedro Sánchez, through the Bank of Spain, also wants to promote bank mergers in accordance with ECB requests.

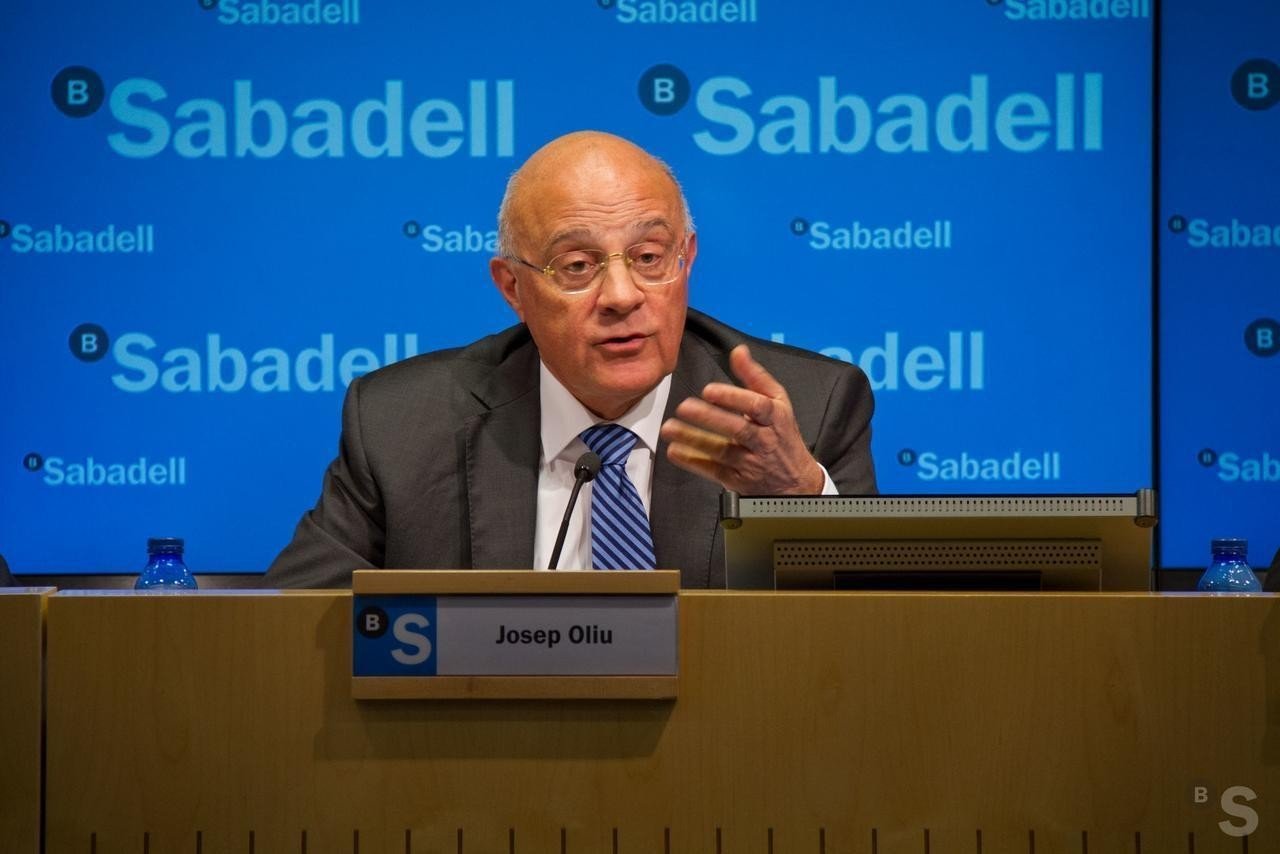

Remove “critic” Josep Oliu

As if this were not enough, since the ECD is recognized in the economic team of the President, Moncloa now saw the opportunity to remove with this maneuver one of the bankers most critical of Sánchez, Sabadell President Josep Oliu, who came to propose a few years ago to create “a kind of right-wing Podemos.”

To this we must add that the current president of Sabadell is also not liked by the top leaders of the Catalan independence movement, the indispensable partners of the PSOE leader.

Moncloa expects that BBVA will play to its advantage in this situation. Regardless of whether he raises the price or makes a takeover bid, Oliu’s friendly offer of three board positions and a vice president will be rescinded. In this case, the current Sabadell managers will be left without power.

Bolaños and the Corps took sides.

In the banking sector, they point out that the position expressed a few days ago by Félix Bolaños, Sánchez’s right-hand man, Moncloa strategy architect and justice minister, was particularly striking.

The fact that it is not part of the government’s economic structure has not stopped it from clearly stating that this is “good news” since it considers it positive to “have solid, leading and leading structures in the EU and in the world” since the Conglomerate that emerged as a result operations, will become the second largest Spanish bank by assets.

Economy Minister Carlos Bodi, for his part, defended the guarantees of competition in the Spanish financial system, until this Wednesday, and did not oppose this integration.

Now the government is turning its position 180 degrees and categorically rejecting the takeover proposal. This is therefore in line with the position of the second vice president and leader of Sumar, Yolanda Diaz, who a few days ago warned of a “systemic risk” of the merger operation between BBVA and Sabadell.

Carlos Torres is risking his future

Carlos Torres is risking his future by taking over Banco Sabadell. He suggests that his second attempt to integrate the company cannot fail as it would mean a new setback in BBVA’s strategy and his mandate is under greater pressure from shareholders’ funds.

A week after the proposal presented by BBVA, at the market close this Monday, Sabadell categorically rejected the “unwanted, indicative and conditional” merger by acquisition, as it understands that it “significantly undervalues” its project and its growth prospects.

Read more