BBVA’s takeover proposal for Sabadell and its possible impact on the banking situation | Financial markets

The hostile takeover that BBVA has undertaken of Sabadell will represent a new turn in banking concentration and will inevitably keep Sabadell’s more than 11 million clients on edge, concentrated primarily in Spain and, to a lesser extent, in the UK and Mexico. . There are months of uncertainty ahead, during which BBVA will have to get government approval for its proposal…

To continue reading this article about Cinco Días, you need a Premium Subscription to EL PAÍS.

The hostile takeover that BBVA has undertaken of Sabadell will represent a new turn in banking concentration and will inevitably keep Sabadell’s more than 11 million clients on edge, concentrated primarily in Spain and, to a lesser extent, in the UK and Mexico. . There are months of uncertainty ahead, during which BBVA will have to get government approval for its proposal, which will be heavily criticized by the government, although it may please the ECB and Sabadell shareholders. Meanwhile, banking operations will continue under the clear premise that the terms of the contracts signed with the bank cannot be changed, regardless of the outcome of BBVA’s takeover bid. If he had finally stayed with Sabadell, what had been signed in the mortgage would have remained on the same terms as the consideration for the mortgage.

But as a result of the merger of two banks, there are always changes in the product showcase offered to the client and in their characteristics. The acquiring bank’s commercial policy will usually be imposed, so if the acquired bank has previously been more aggressive in its mortgage offerings, it may no longer be so. Or, if you had a reduced investment fund offering, you can expand it. The storefront for savings and investments that Sabadell customers will find if the bank is taken over by BBVA will obviously be different. What offers await Sabadell clients in this case? Will they be more or less attractive than your current bank? Meanwhile, both BBVA and Sabadell will have to avoid losing customers along the way.

Rewarded Accounts

Currently, both banks are conducting active campaigns to attract new customers by registering online accounts. Sabadell offers until the end of the month a nominal return of 6% in the first three months for opening an online account, which begins to earn 2% from the fourth month. The offer is equivalent to an APR of 3.06% on a maximum balance of €20,000, to which a 3% refund on direct debit electricity and gas bills is added. The account, which has no fees or other requirements, also provides access to a free debit and credit card with no issuance or maintenance fees. BBVA also has a no-fee online account, although it is not paid. It allows you to return up to 60 euros on gas, electricity, telephone and internet bills for one year if you have 400 euros in your account.

Financial sources indicate that Sabadell’s commercial policy is more aggressive than BBVA’s in retail banking. After all, the Catalan-born company does most of its business in Spain and has had to return to business in recent years to restore profitability and solvency, where customer service is key. And the direction has been set by its CEO Cesar Gonzalez-Bueno, who took over the company in 2021 and whose long track record includes promoting ING, a benchmark for online operations and commercial dynamism, in its early days in Spain. “In recent years, Sabadell has had an urgent need to attract customers. Its commercial strategy is more aggressive, although it now also requires closer ties in return,” explains Antonio Gallardo, head of research at the Association of Financial Users (Asufin).

Mortgages and consumer loans

Gallardo also hints at the risk of losing business in the coming months, especially for Sabadell. “There will be clients who will not want to join BBVA and will choose to leave given the likelihood that the takeover bid will be successful. And others who withdraw savings from another bank if, in the event of a merger of both banks, they exceed the maximum savings amount of 100,000 euros protected by the Deposit Guarantee Fund,” he explains.

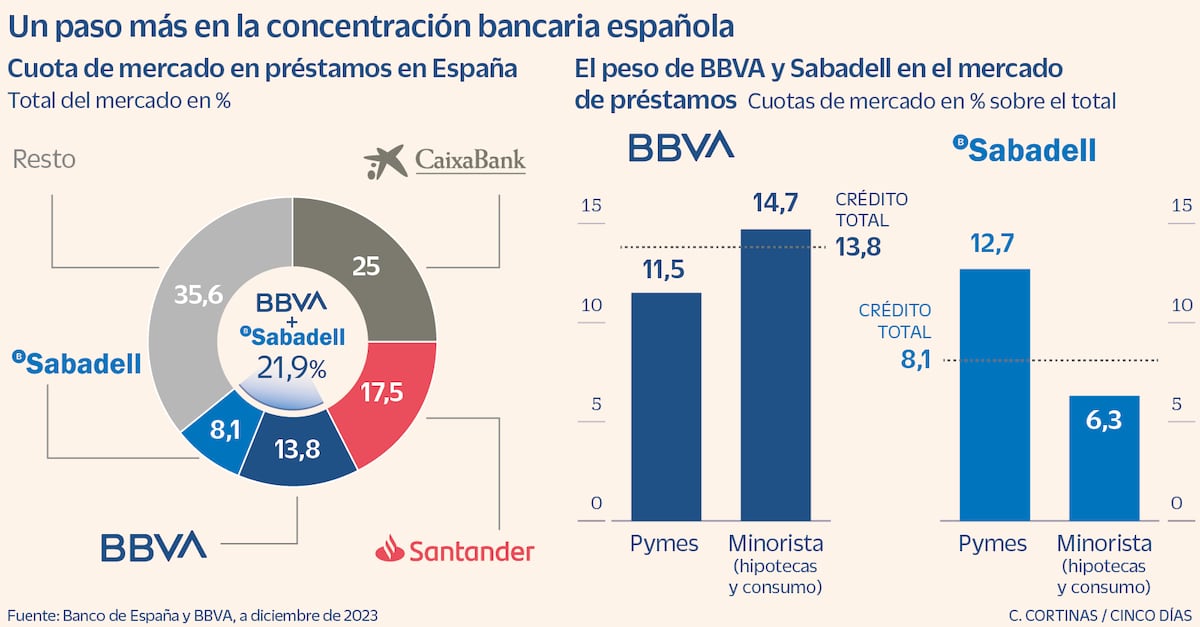

Banco Sabadell’s SME business is particularly sensitive to what might happen with a takeover bid. “With the disappearance of Banco Sabadell, many SMEs will be left without financing,” condemned the Catalan employers’ association Foment del Treball when the operation became known. Sabadell has a long tradition of financing Catalan companies, thanks to which it has gained a significant market share of SME lending in Spain of 12.7% compared to BBVA’s 11.5%. In personal finance with mortgages and consumer loans, Sabadell’s market share is significantly lower – 6.3%, according to data presented by BBVA in its proposal – although its commercial policy in the field of mortgage finance is very active.

“Sabadell is more aggressive than BBVA in mortgage pricing and in principle has a more flexible offer, it refines the terms and ultimately offers the client more,” explains Cesar Betanco from the analytics department of mortgage comparator Hipoo. And he notes that Sabadell offers a fixed rate of 2.3% on mortgages, compared to BBVA’s 2.5%. iahorro explains that “it all depends on the client’s profile, both banks have the same degree of connections, although BBVA may have a better mortgage offer.”

On its website, regardless of the terms that the customer manages to negotiate with the bank, BBVA offers a fixed rate mortgage with a nominal interest rate of 2.9% and an annual interest rate of 4.1% – with payroll direct debit, home insurance and insurance loan repayment – and a variable mortgage at the Euribor rate plus a spread of 50 basis points with the same binding conditions. Sabadell puts blended mortgages at the forefront of its storefront, with a fixed rate option for the first three, five or seven years of the loan term – an option that BBVA hardly sells. With direct debiting of wages and life and home insurance, the fixed rate in the first five years in mixed Sabadell is 2.3% nominal, and Euribor plus 0.9 in the remaining years, resulting in an annual interest rate of 4.49%, as explained in bank. In any case, the company also offers mortgages at a fixed rate in full or at a variable interest rate.

Private financing will be one of the aspects that competition authorities will have to analyze in more depth. The addition of BBVA and Sabadell would therefore result in a company with a 21.9% loan market share in Spain, behind only the 25% of CaixaBank, which rose to first place following the Bankia takeover. “The bulk of mortgages in Spain are still issued by traditional banks. Fintech companies are making almost no loans, and their activities do not compensate for the loss of competition that banking concentration has entailed in recent years. In consumer lending, the diversity of banking offerings has clearly been lost,” they say from iahorro.

The terms under which the mortgage or consumer loan was signed do not change if BBVA’s takeover bid is successful. “Whoever is close to closing a loan with Sabadell should not worry as the same conditions will be maintained if the owner of the bank changes,” they explain from Hipoo. This is exactly what happened in all previous concentration processes, due to the legal security provided by the signing of these contracts. Changes and surprises may occur in products that do not expire, such as checking account costs, or in financial services that renew each year, such as home insurance costs or maintenance costs. debit or credit card.

Asset Management

Banco Sabadell sold its fund manager to French company Amundi in 2020. The priority then was to obtain resources to improve the bank’s solvency, after which the Spanish entity is now responsible only for the marketing of investment funds and not for their management. “BBVA has decided to retain its manager and has a more comprehensive fund offering than Sabadell, in addition to some of the best-selling funds,” sector sources explain. In any case, financial institutions must offer the client an investment product that best suits his needs and risk profile, regardless of whether it is a branded fund or not. And give the client the opportunity to contract with a fund from a third organization rather than their own, although the powerful sales machine that is bank offices often induces depositors to sign up for the fund that their organization is selling to them. According to Inverco at the end of April, the assets of the BBVA investment fund amount to 50.758 million euros, and Sabadell – 13.882 million.

According to banking sources, a battle has begun for Sabadell shareholders, as well as for its clients. The months during which the takeover bid will be processed will test Sabadell’s commercial equipment and also intensify the vigilance of competitors who are always looking for dissatisfied customers who jump the boat in all concentration processes.

Follow all the information Five days V Facebook, X And LinkedInor in our newsletter Five days program

Newsletters

Sign up to receive exclusive economic information and financial news that matter most to you.

Register!