Bitcoin: Over 1 Million Addresses Now Hold 1 BTC as Market Watches Recovery

- Several indicators online suggested that BTC charts would soon turn green.

- Market indicators also pointed to rising prices.

Bitcoin (BTC) has been struggling lately as bulls have failed to take control of the market. However, such slow price action has not stopped investors from holding at least 1 BTC.

The intention of investors holding 1 BTC clearly means that they expect the price of the king of cryptocurrencies to rise.

Demand for BTC is growing

CoinMarketCap data showed that Bitcoin investors had a terrible month last month as the coin’s price fell more than 8%.

In fact, the price of the coin has corrected by 4% over the past seven days. At the time of writing, BTC was trading at $61,611.07 with a market capitalization of over $1.2 trillion.

Despite the recent price correction, it was optimistic to see that over 85% of BTC investors are still making profits, according to data from IntoTheBlock. Another interesting fact was revealed in a recent tweet.

from IntoTheBlock.

According to the tweet, there are over a million addresses that hold 1 BTC. This has been a clear long-term trend as more and more people strive to achieve “solid coin” status.

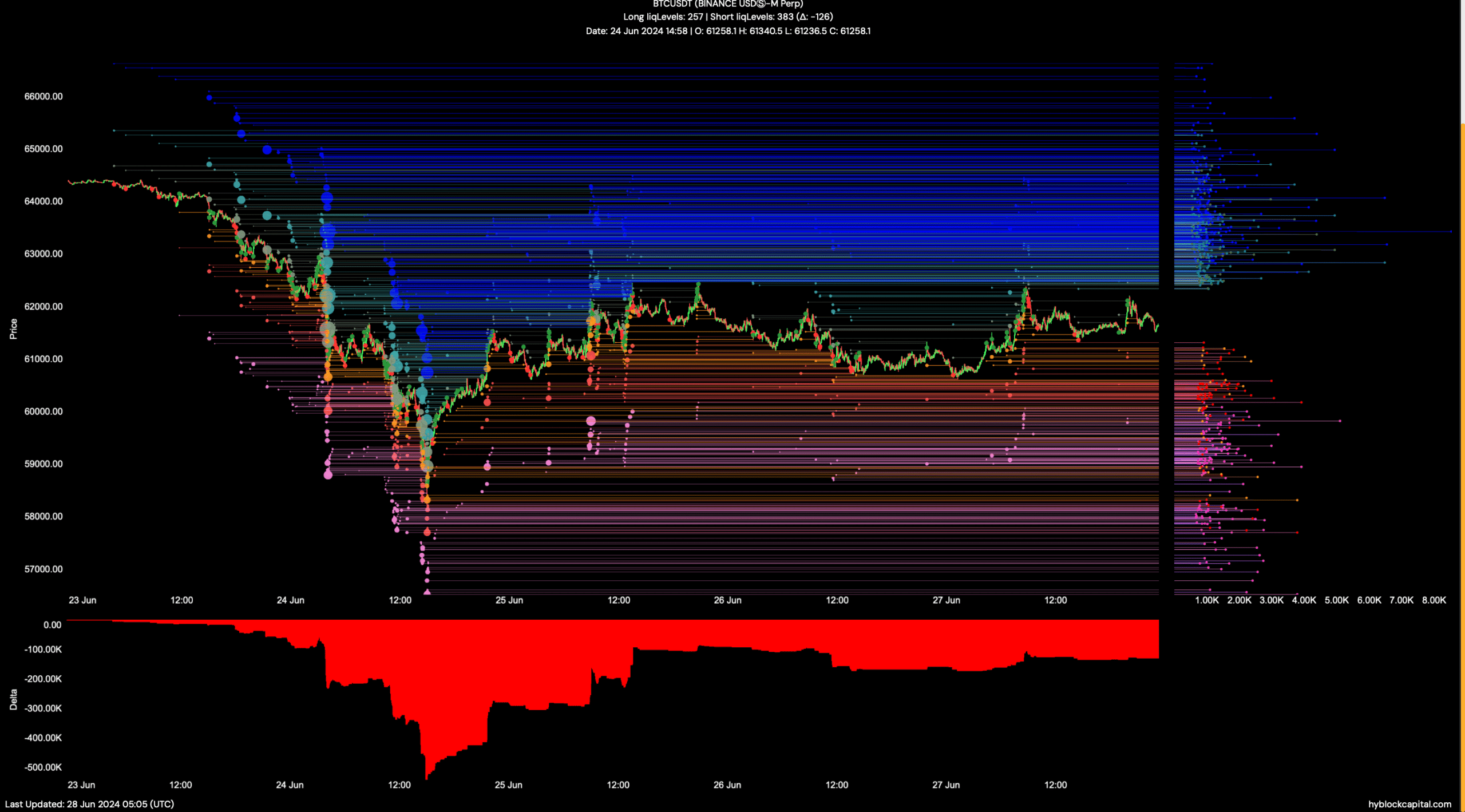

In addition, AMBCrypto’s assessment of Hyblock Capital data also showed that investors are willing to hold BTC. According to our analysis, cumulative BTC liquidation data has dropped sharply after touching -500k a few days ago. This meant that investors expected the price of the coin to rise again soon.

Source: Hyblock Capital.

Bitcoin Shows Signs of Recovery

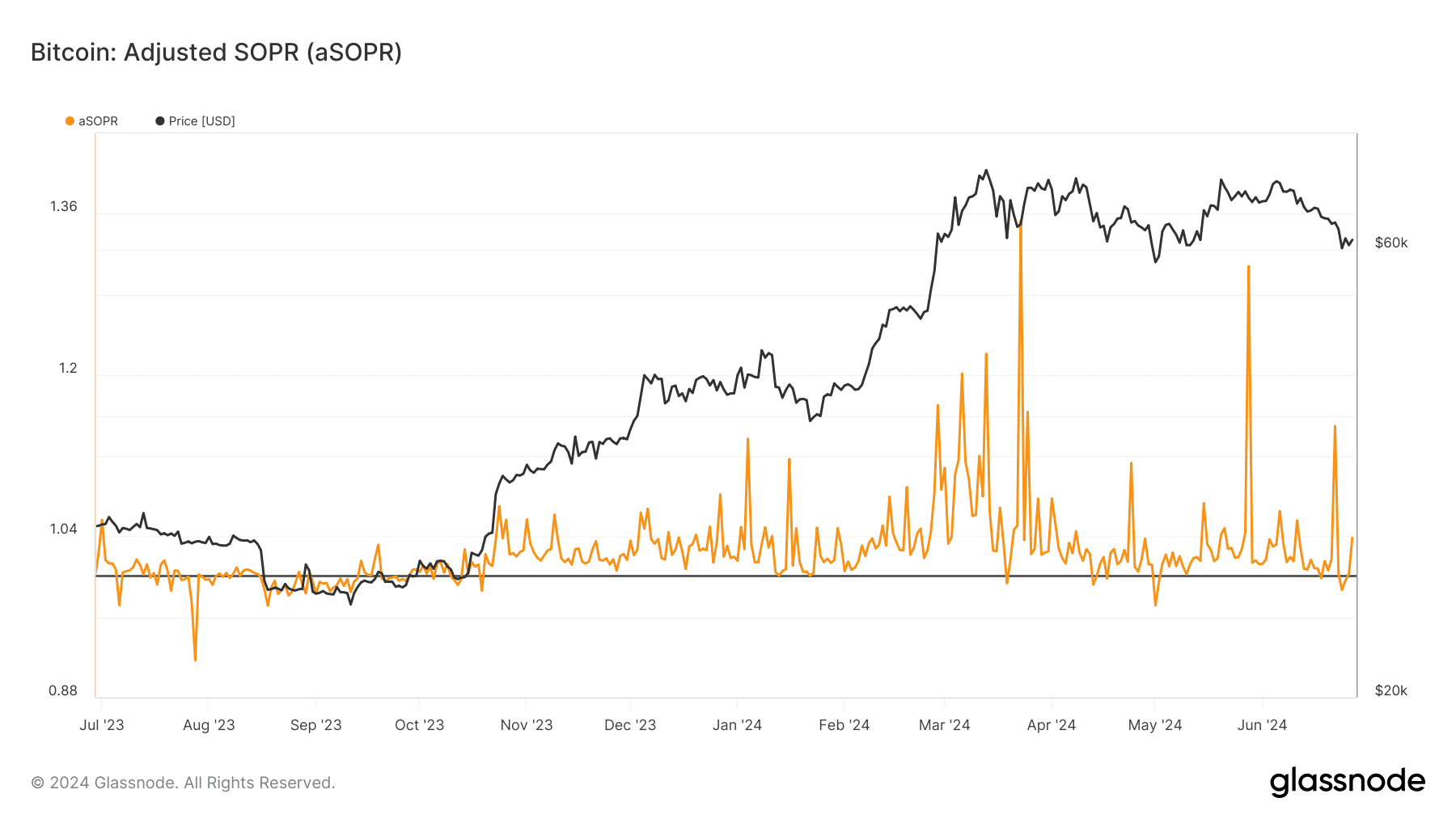

Investor confidence may have started to pay off as the price of BTC has risen marginally over the past 24 hours. On June 25, aSORP BTC fell below the 1.0 threshold.

Whenever this happens, it indicates a possible bullish rally.

Source: Glassnod

An assessment of AMBCrypto data on CryptoQuant also revealed quite a few bullish indicators. For example, the BTC Relative Strength Index (RSI) was in an oversold position. This can help increase buying pressure and, in turn, increase its price.

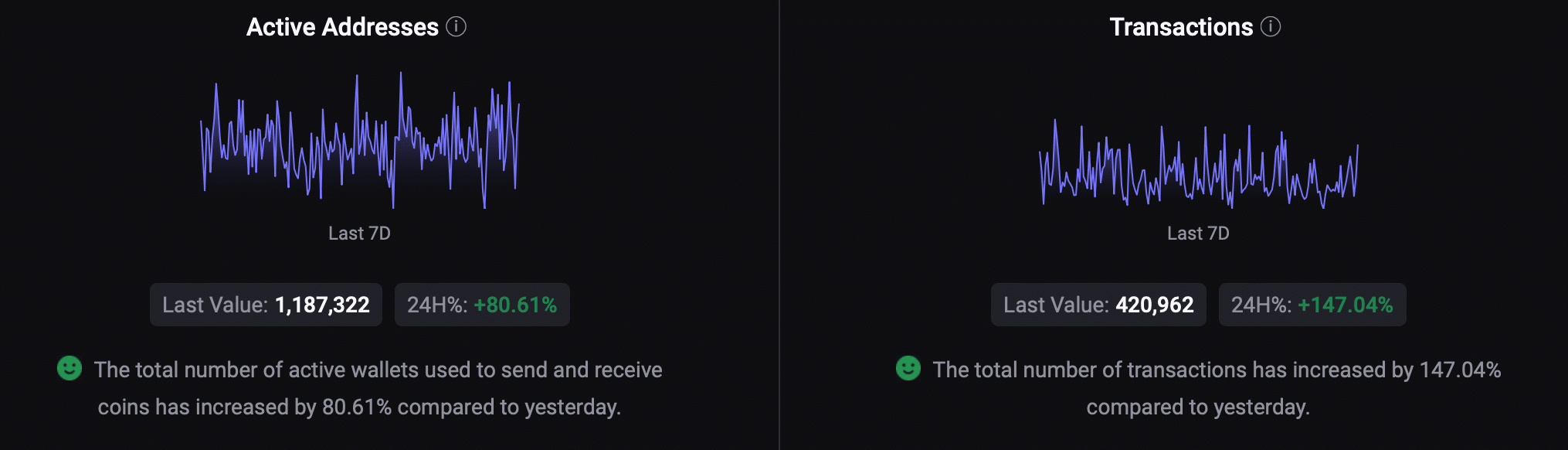

Other bullish indicators included active addresses and transaction volume, as both metrics increased over the past 24 hours.

Source: CryptoQuant

Read Bitcoin (BTC) Price Prediction 2024-25

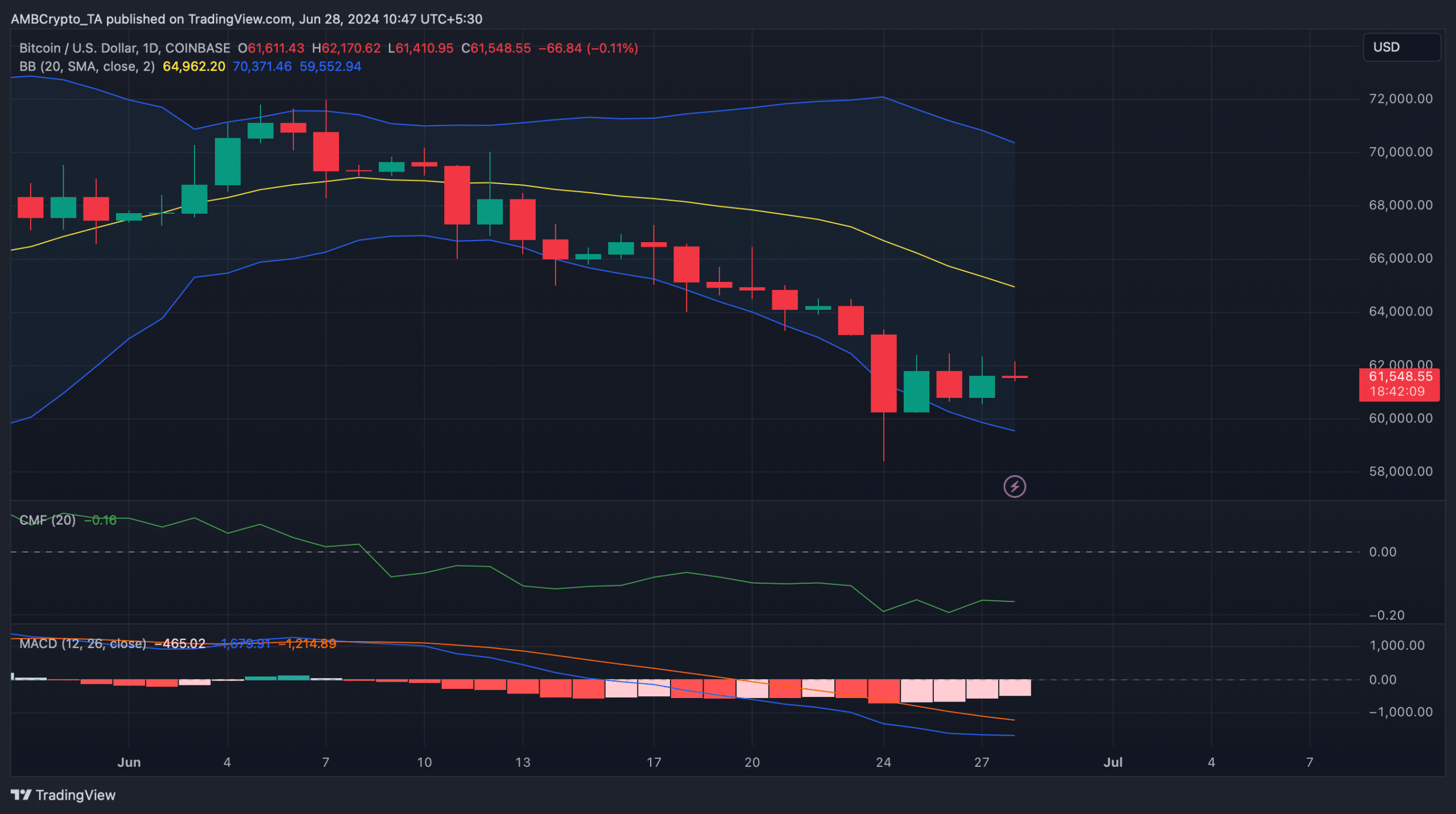

We then planned to look at the daily Bitcoin chart to get a better idea of whether a bullish rally was about to begin. We found that the BTC price began to recover after touching the lower boundary of the Bollinger Bands. This usually leads to a bullish rally.

The MACD also showed the possibility of a bullish crossover in the coming days. However, Chaikin Money Flow (CMF) remained bearish as it was well below the neutral mark.

Source: TradingView

This is an automatic translation of our English version.