Capricorn 35, live | Boslas points to timid growth ahead of eurozone consumer price index | Financial markets

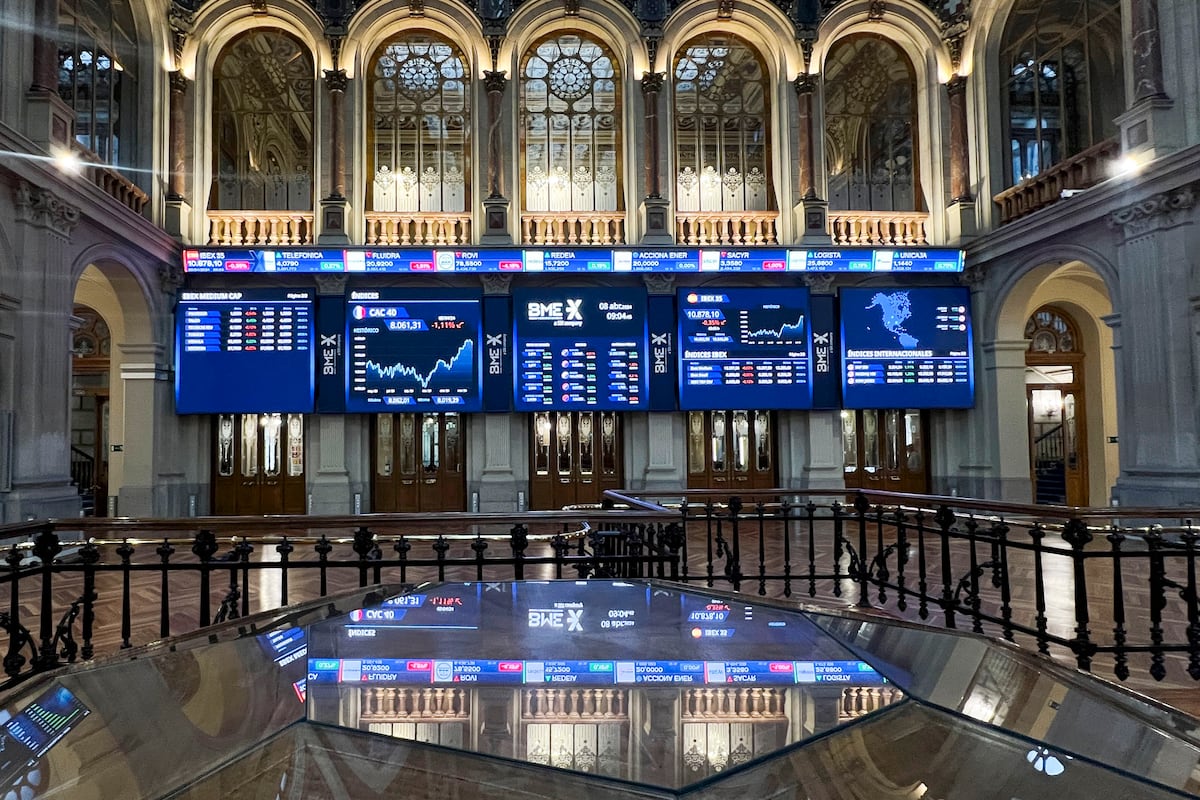

What does Ibex 35 do?

Euro Stoxx 50 futures are slightly higher at the open. The Ibex 35 index rose 1.73% yesterday, its best daily performance in seven months, and approached yearly highs, returning to the 11,300 level. Spanish shares barely gained 0.11% from Monday to Thursday. Over the year it was revalued by 12.24%.

What are the rest of the stock markets doing?

Asia-Pacific stock markets rose early in the morning in Spain.

Wall Street closed lower yesterday following a downward revision to US economic growth forecasts. Although data suggests a cooling of the US economy, which could support the Fed’s rate cut, investors preferred the fall. The Dow Jones fell 0.86%, the S&P fell 0.60% and the Nasdaq fell 1.06% under pressure from Nvidia.

Keys of the day

- US first-quarter GDP came in below expectations last month, with annual growth of 1.6%. This month’s downward revision to 1.3% shows slightly more weakness but is in line with economists’ expectations.

- Dallas Federal Reserve President Laurie Logan said yesterday that there are still concerns about the risks of continued high inflation in the United States, so we must keep all options on the table and respond according to what they indicate. published. There is no rush to lower interest rates.

- The Bank of Spain publishes the balance of payments position for March.

- In Europe, the main focus of the day is the dynamics of inflation in the eurozone. Headline inflation could accelerate to 2.5% from 2.4% in April, while the policy rate may not slow for the first time since July last year.

- In the US, the PCE consumer price index stands out, which is key for the Fed and provides clues about the direction of interest rates. You will be accompanied by an April report on income, expenses and personal savings.

- In Asia, China will publish an index of business activity in the services sector, manufacturing and composite PMI.

What do analysts say?

Bret Kenwell, investment analyst at eToro in the US, on GDP: “After GDP fell in the first quarter compared with the last three months of 2023, investors and the Federal Reserve are keeping a close eye on consumers. While some weakness can be seen as a positive, a complete collapse does not bode well for the economy or the stock market,” he says.

Pedro del Pozo (Mutualidad): “Given the data on the consumer price index in Spain and Germany, the ECB should not have problems cutting rates by 0.25%. If we hope that, given that the levels at which we are moving clearly exceed the goals of the European Monetary Authority, ECB policy will be more data dependence, pay more attention to inflation data, pay more attention to growth data, and pay attention ahead of the next European Central Bank meetings. This implies therefore a certain reduction in expectations for rate cuts in the coming months, in the sense that they are not as progressive.”

What is the evolution of debt, currency and commodities?

The euro falls to $1.0818.

Brent crude, Europe’s benchmark, falls below $82 a barrel.

The yield on 10-year Spanish bonds remains at 3.386%.

Quotes

STOCK EXCHANGE – CURRENCIES – DEBT – INTEREST RATES – RAW MATERIALS

Follow all the information Five days V Facebook, X And LinkedInor in our newsletter Five days program

Newsletters

Sign up to receive exclusive economic information and financial news that matter most to you.

Register!