Euribor provides the largest deferment on mortgage loans in almost three years | Financial markets

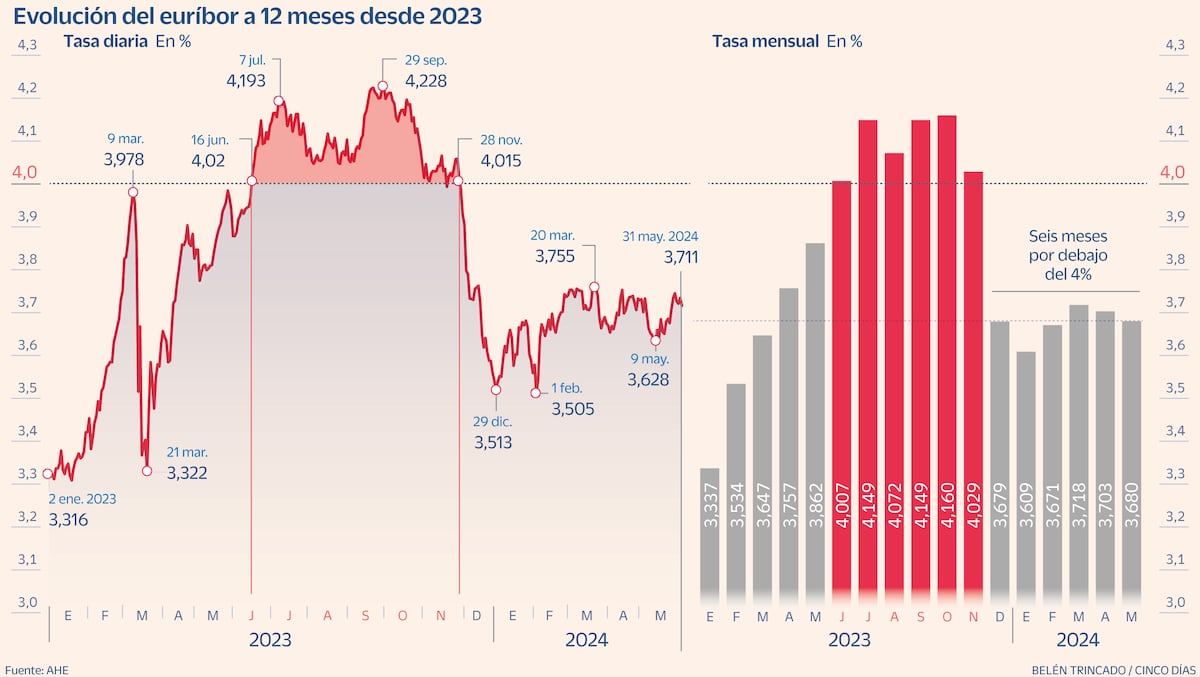

Euribor continues its logical course of decline, given the inevitable decline in interest rates in the eurozone, which the market takes into account – on June 6, if there are no surprises – and ends May with another monthly fall after April. The Mortgage Index Mostly sets the May average at 3.680%, down from just a year ago (3.862%), putting variable mortgage payments down for the second month in a row.

In particular, if the loan review is annual, for an average amount of EUR 150,000 over 25 years and a difference of 1% plus Euribor, the account will become cheaper by approximately EUR 16 per month or EUR 192 per year. In the case of an outstanding capital of 300,000 euros, the savings would be about 33 euros per month or 396 euros per year. While the decline is still small, it is the largest reduction in mortgage payments since July 2021. “The truce in mortgages continues not so much because of the sharp drop in Euribor, but because the figure is already being compared with the figures in the spring of 2023, when a pronounced rise began,” says Estefania Gonzalez, spokesperson for Kelisto.es. Last year, Euribor exceeded the 4% barrier for the first time since the end of 2008.

Markets have tempered expectations for rate cuts from early 2024 amid dragging inflation and delayed the cut schedule in response to warnings of central bank vigilance and improving macroeconomic conditions. in the eurozone, which affected the dynamics of the Euribor rate, which is falling more slowly than expected. In fact, the indicator is trading at levels close to the levels at the beginning of the year, and has been recording growth for several days now. The European Central Bank (ECB) is now concerned about rising wages, which could lead to increased pressure on prices. So while the organization’s recent statements confirm a rate cut in June, they also warn of contractionary monetary policy through 2025.

Ruben Segura-Cajuela, chief European economist at Bank of America, doesn’t think back-to-back cuts in June and July are realistic, but doesn’t rule out another cut in October. In his opinion, “the next decisions of the ECB are to slow down the pace, and not necessarily to initiate the cycle of cuts itself.” Manuel Pinto, analyst

From fintech Ebury argues that “from June onwards, the size of the Euribor fall will depend on the pace of the next ECB rate cut.” The firm is now forecasting a total of three cuts this year, so it estimates Euribor will trade in the 3.6%-3.7% range in the short term before ending at around 3%-3%. 2024. But he warns that if the next inflation data turns out to be unexpectedly higher, the ECB could adopt a slower pace of cuts this year. What the US Federal Reserve does will also inevitably have an impact: if it doesn’t cut rates in September, it will be more difficult for the ECB to continue on a downward path, given the risk of causing excessive euro depreciation.

In Spain, the consumer price index rose to 3.6%, and in Germany to 2.4%. In the eurozone, prices were still rising 2.6% year-on-year in May, according to published data, slightly above expectations. Inflation in the region remains above the ECB’s target and all indications are that it will not fall sustainably below 2% in the short term. Until this happens, experts doubt the ECB’s actions after June. Consensus expects at least a second rate cut this year. “The second contraction will be entirely data-driven and will likely not occur until September or October, especially as the economic cycle continues to improve,” Renta 4 emphasizes.

Consulting firm Accuracy doesn’t believe central banks are going to make “aggressive” rate cuts. “Market consensus has significantly reduced the number of cuts planned for this year from seven to one or two,” says firm director Alberto Valle, who explains that this means the market will be dealing with “relatively high” rates. during 2024 and part of 2025, resulting in the Euribor rate ranging from 3.5% to 3.7%.

In the same vein, Pinto believes that given that “the ECB’s priority has been, is and will be price stability, rates will remain high and we will see a maximum of two cuts during the year, which could lead to a rate hike.” In the coming weeks, the Euribor rate will exceed 3.80%.” Kelisto estimates that the medium-term Euribor rate is 3.6% and will gradually decline until the close of 2024 at around 3%.

For its part, the Funcas group predicts that rates will fall more slowly than expected, so that at the end of 2025 the deposit rate will still be above 2.5%, 20 basis points higher than the previous forecast. They forecast the Euribor rate to fall to 3.2% at the end of this year and to 2.8% at the end of 2025. Bankinter estimates it at 3.25% and 2.75%, respectively, and CaixaBank at 2.78% and 2.45%.

Mortgage offer is being prepared for sale

The latest statistics reflect a drop in the number of mortgage contracts in March, which experts attribute to the seasonal effect of Easter, as well as an increase in average interest rates. Analysts predict that after the ECB’s June rate cut there will be a return to easing conditions for access to mortgage loans and a strong return to demand that was still waiting. “That’s when the mortgage war between financial institutions will resume,” says Fotocasa research director Maria Matos. Although the situation with mortgages in banks has not changed much in recent months, experts still estimate moderate adjustments, almost all downward. ING beat the ECB and recently cut the price of all its mortgages by up to 0.60 points, depending on the fixed term of the mortgage. “The trade war will intensify in the second half of the year,” says Estefania Gonzalez, spokesperson for Kelisto.es.

Follow all the information Five days V Facebook, X And LinkedInor in our newsletter Five days program

Newsletters

Sign up to receive exclusive economic information and financial news that matter most to you.

Register!