from Sega graphics to the most valuable company in the world

Semiconductor giant Nvidia was named the world’s most valuable stock market company on Tuesday – ahead of Microsoft and Apple – thanks to its still ongoing development of generative artificial intelligence (AI) that has boosted its capitalization to 3,000. $34 billion.

Nvidia shares have soared 175% this year, compared with gains of 18.5% for Microsoft and 11% for Apple, which have also alternated the throne of the planet’s highest-cap listed company in recent weeks.

But behind this milestone—the first time the chipmaker has been crowned on Wall Street—is 31 years of history during which Nvidia has grown exponentially, expanding its presence with ever-better GPUs.

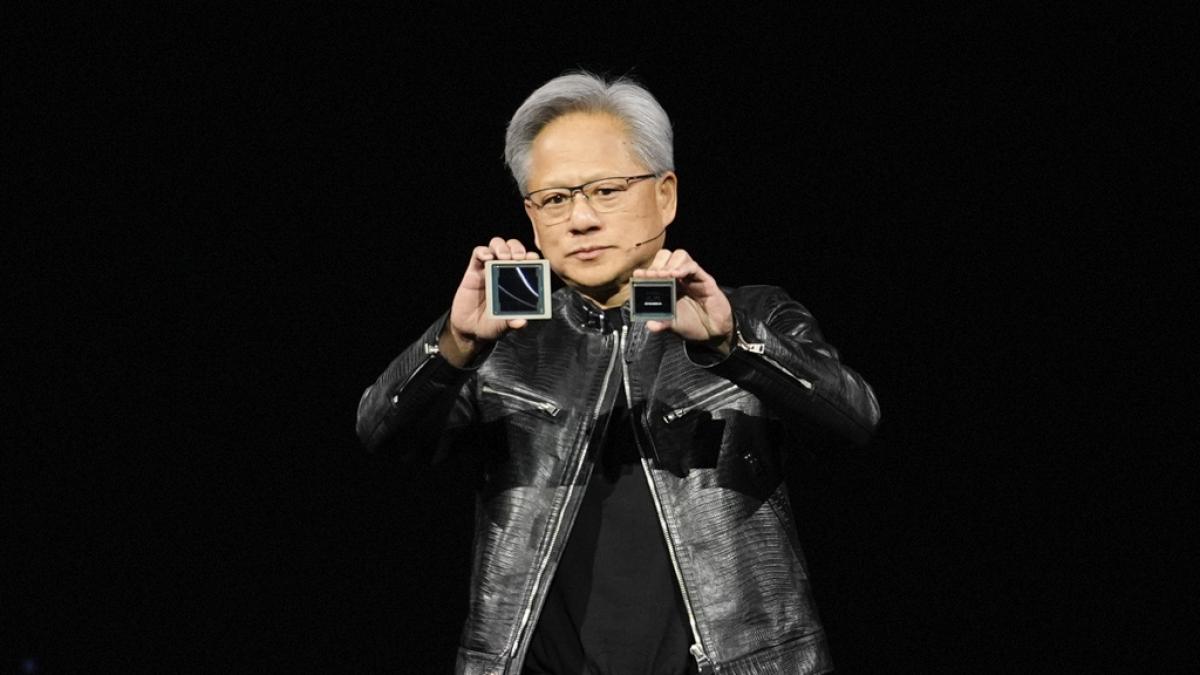

The company, based in Santa Clara, 75 kilometers south of San Francisco, was born in 1993 from the vision of Jen-Hsun Huang, 61, a Taiwanese entrepreneur who graduated from Oregon State University and moved to California to attend Stanford and later created by Nvidia.

Growing Through Video Games

From the start, Huang, along with his colleagues Chris Malachowski and Curtis Priem, dove into the PC graphics chip and multimedia gaming market, where only two dozen companies competed.

The NV1 processor, a graphics card sold under the name Diamond Edge 3D, paved the way for Sega, Japan’s leading arcade video game company, which released the popular Virtual Fighter with Nvidia 3D graphics.

This success led them to release the world’s first graphics processing units (GPUs) in 1999, electronic circuits such as the GeForce 256 that enabled innovation through high-speed mathematical calculations.

By that time, they had also begun their first alliances with Microsoft, which chose Nvidia to develop graphics cards for its famous Xbox console in the early 21st century.

In 2001, the company joined the selective S&P 500 index, becoming the fastest semiconductor company to reach $1 billion in revenue.

Its connection to the video game market was demonstrated again just five years later when, in 2005, Nvidia announced that it was developing processors for Sony’s popular PlayStation 3 gaming console.

Later, the next decade saw the development of powerful GPUs, which quickly adapted to the needs of brands like Apple (in its revolutionary MacBook) and Android tablet processors.

Generative AI fever with no end on the horizon

2016 marks the beginning of what would become the No. 1 semiconductor company in the United States by market capitalization four years later in its love affair with artificial intelligence.

However, Nvidia’s big growth, which reached a market cap of 2 billion just 79 days ago, came with ChatGPT, OpenAI’s “chatbot” that uses its microchips, in 2022.

The challenges of generative artificial intelligence in companies such as Microsoft, Apple or OpenAI, among others, have increased interest in semiconductors due to their enormous ability to create texts, photographs and videos from digital orders formulated in everyday language.

It’s unclear how far the “goose that lays the golden eggs” artificial intelligence phenomenon that catapulted Nvidia will go. In fact, not only are investors not anticipating failure, but they are wondering which of the three listed companies—Microsoft, Apple or the company Huang co-founded—will be the first to reach the record $4 billion market cap.