On Tuesday, the Treasury is holding its first auction of 6- and 12-month bills for February.

Next week the State Treasury will attend its first bill auction in February with the appointment referral rate for 6 and 12 months. This debt repayment comes at a time when households have established themselves as the main holders of this type of paper, ahead of banks or other investors.

Certificates valid for six months or a whole year were last put up at auction on January 9, bidding at which total 5.056 million euros in treasury bills. Interests to which these bills were proposed varied unevenlywith increased profitability after 6 months, but less reward for those after 12 months.

In particular, the interested parties paid certificates in the amount of 1,036.65 million euros over a six-month period, with a demand of 2,572.65 million euros. The marginal yield of this type of paper was 3.635% noting an increase from the 3,630% proposed in the previous proposal.

12-month profitability fell slightly

At the auction of 12-month bills, a body dependent on the Ministry of Economy placed 4.019 million euros against requests of 6.151 million from investors. marginal interest rate 3.314%which is slightly lower than the previous 3.327%.

The auction comes after the Governing Council of the European Central Bank (ECB) recently decided maintain interest ratesso the base rate for refinance transactions will remain at 4.50%, while the deposit rate will remain at 4%, and ease loan at 4.75%. The issuing institution thus left rates unchanged for the third straight meeting since it hit the brakes at its October meeting after ten consecutive hikes in the price of money, taking it to its highest level in more than 20 years. years.

Monetary Policy Decisions influence treasury auctions, where the rewards offered to investors have increased in recent months along with rising rates. This has led to increased interest in debt purchases, especially in the case of households purchasing Treasury bills.

Households remain the main holders

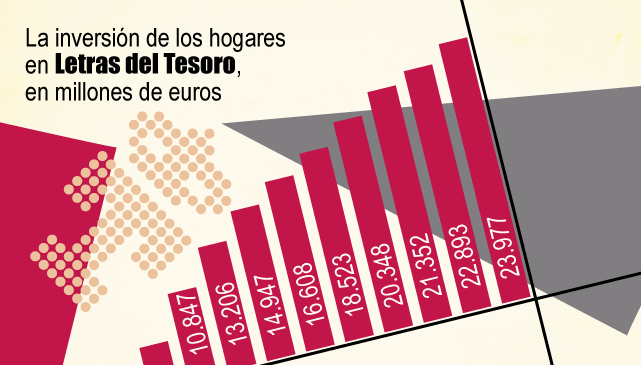

And the fact is that households and private non-profit organizations serving households (Isflsh) have gone from €950 million in treasury bills in November 2022 to 23.977 million in the same month of 2023becoming fourth month in a row the largest holders of this type of short-term debt.

According to the latest data published by the Bank of Spain and collected by Europa Press, high yield on short-term securities had a very significant impact on the distribution of treasury bill holdings, in which households and non-financial institutions markedly increased their participation last year, from a quota of 1.3% in November 2022 to more than 30% in 2023.

Having increased their holdings by 4.7% compared to October, households are in November for the fourth time in history as the largest holder of Spanish treasury bills, ahead of foreign investors (16.737 million), who have been reducing their investments in this type of debt since July. The next holders of treasury bills are foreign investors. monetary institutions (10.918 million), money market funds and other financial intermediaries (10.189 million), non-financial corporations (6.015 million) and government administrations (4.104 million).

2024 Treasury Funding Program

Treasury’s 2024 Funding Strategy sets out new funding needs about 55,000 million this year, which represents a reduction of 10,000 million compared to 2023. For its part, the expected gross output will amount to 257.572 million euros.2% higher than in 2023 due to increased depreciation, with the main part to be covered by the issuance of tools in the medium and long term in order to maintain the average life of the government debt portfolio.

Concerning regular broadcasts Treasury securities are planned to hold 48 regular auctions of government bills and bonds and obligations. In addition, in 2024, the Treasury will again use syndication to issue certain certificates of government obligations. Other goals for 2024 include maintaining diversification of the investor base and commit to issuing green bonds as a building block of the financing programme, thereby strengthening the market for sustainable finance in Spain.