One of the main shareholders of BBVA sold his stake in the bank in connection with the takeover of Sabadell | Companies

Economic newspaper Financial Times reported this Sunday that GQG Partners, which was one of the main shareholders of BBVA, sold its stake in the bank this summer in response to the takeover proposal that the organization submitted in May for Banco Sabadell.

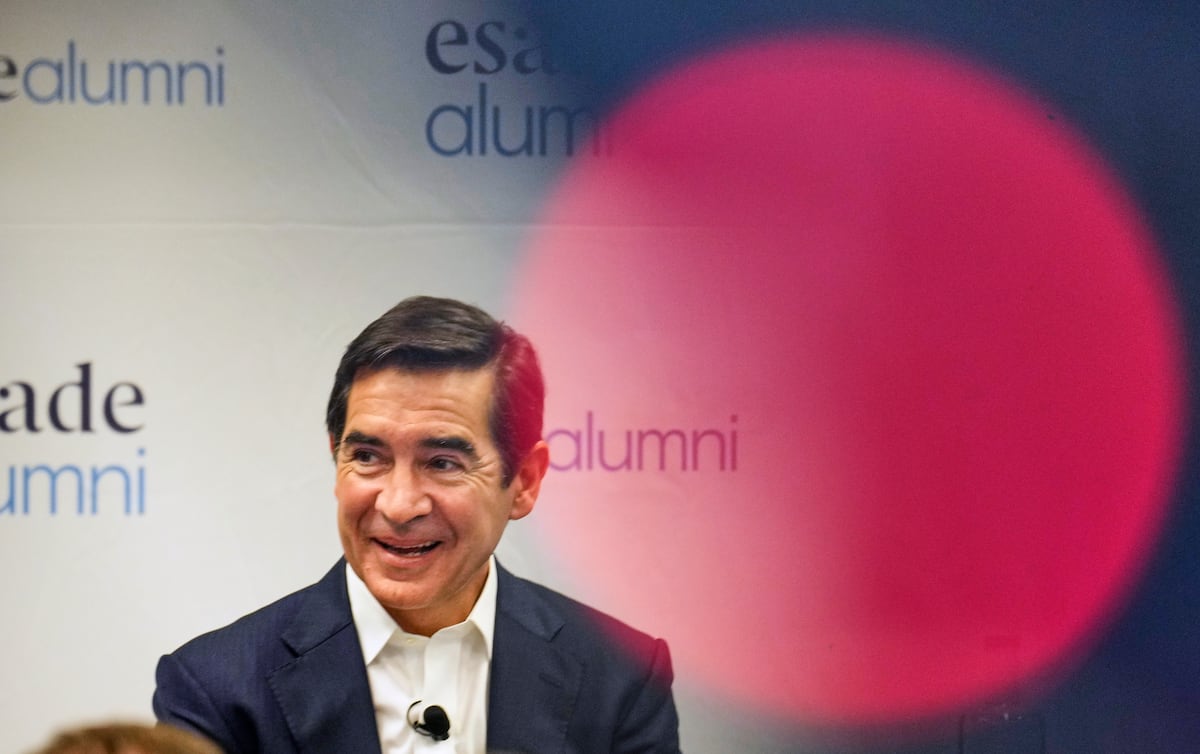

According to the newspaper, the investment fund GQG Partners told BBVA management that it opposed the takeover bid and sold its stake in the company run by Carlos Torres in the summer. Records from the National Securities Market Commission (CNMV) show that GQG Partners owned 3.09% of BBVA in February 2021, which fell to 2.957% in August 2022 and has since recorded no further changes above the threshold of 3% required by law. This is reported by CNMV.

The takeover proposal is pending approval by the CNMV and analysis by the National Markets and Competition Commission (CNMC). The first body has already announced that it will wait to find out the path that the CNMC will take (whether it analyzes it in the second stage or not) in order to decide when it will resolve it on its part. Once CNMV receives approval, Sabadell shareholders will have time to make a statement. Meanwhile, its president Cani Fernandez said CNMC’s analysis will take time because it is a hostile takeover attempt.