Spanish Stock Market, Hunting Ground: How to Invest in the Midst of Takeover Craze | Financial Markets

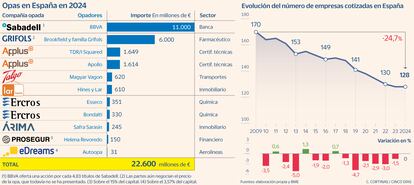

The year 2024 will be remembered in the corporate operations sector for the avalanche of takeover bids against Spanish companies. The resumption of deals that had been suspended in recent years and the low valuations of some listed companies have turned the Spanish stock market into a paradise for investors, especially opportunistic funds and venture capital, with up to 10 transactions worth around €23 billion. And the ability to analyze the offers that companies are planning is key to dealing with the wave of takeover bids.

BBVA’s takeover bid for Sabadell, Magyar Vagon’s takeover of Talgo, Safra Sarasin’s acquisition of Árima or the deal agreed by Brookfield with the Grifols family to take over a pharmaceutical company are the most interesting deals on the table. And although the business world seems to be falling into lethargy in August, they will take centre stage again after the summer.

“The key is to consider that the proposed price is truly attractive, meaning that the company cannot reach this valuation on its own within one or two years. Sometimes the proposed amount does not go beyond this potential because the takeover offer is formulated opportunistically after a significant price drop, often as a result of temporary circumstances of the company or the market that, once overcome, will no longer punish or stop its share price,” explains Antonio Aspas, co-founding partner and advisor at Buy & Hold.

The most complex operation in terms of size and terms is the one undertaken by BBVA to acquire Sabadell. This takeover offer is valued at 11 billion euros, although it is based on a share swap proposed in May. BBVA is offering Sabadell shareholders one share for every 4.83 shares they hold in the Catalan company. When the operation was launched, this represented a premium of 17%, but at the current price, a Sabadell shareholder would earn only 2%. This is one operation in which shareholders should closely monitor the price movement, since the premium could disappear at any time. BBVA is up 14% this year, while Sabadell is up 72%.

The experts interviewed also note that the type of buyer may prefer incentives that go beyond price. In this sense, when it comes to competitors, you can add synergies (cost savings) that will improve the business. This is precisely the trick that BBVA uses as bait (it predicts savings of 850 million euros per year after the Sabadell merger), which should lead to an improvement in business and dividend distribution.

The takeover bid that is putting pressure on Talgo is in a similar situation. On April 7, the Hungarian group Magyar Vagon submitted a takeover bid for 100% of Talgo. To convince shareholders, the company offered a price of 5 euros per share, which at that time represented a premium of 20%, and at current prices – 15%. The total transaction amounted to 619 million dollars. Magyar Vagon’s approach was approved by the main shareholders, the Trilantic fund (it controls 40% of the capital), but also met with resistance from the Spanish government. Moreover, in recent weeks, the interests of the Czech Skoda have crossed the path of the Hungarian group – an approach that Talgo rejects in any case.

Similarly, the chemical Ercros has sparked a takeover war between Italy’s Esseco and Portugal’s Bondalti, rivals of the Spanish firm. Esseco is offering €3.84 a share, while Bondalti is slightly lower at €3.60 a share. Ercros is currently listed at €3.78, although either company can raise its offer during the takeover period, and the process will end in a closed auction that in any event gives the final upgrade option to the first bidder (in this case Bondalti) if the prices differ by less than 2%.

Stock market within reach of takeover bid

The reason for the investment appetite of Spanish companies is the low valuation on the stock market of some listed companies, which puts them on display. Although the Spanish selective market soared by 23% in 2023, during the Covid-19 pandemic and in the following years, the Spanish stock market suffered several setbacks (it fell by 15% in 2020 and by 5.5% in 2022). In this scenario, there are companies that are still trading below their book value and even further from the potential value that analysts attribute to them. And there, venture capital and funds have entered with force.

“Since the vehicles private capital They are raising more capital, a process that has become more important in the Spanish market because they have a lot of liquidity and resources waiting to be used. However, the rise in interest rates has slowed down this activity due to the higher financial costs they have incurred due to the high leverage they usually operate with. If interest rates fall again, we can foresee a new wave of operations of the same nature,” predicts Antonio Aspas, co-founding partner and advisor at Buy & Hold.

In any case, the bid frenzy is not unique to Spain, given the multinational nature of the big investors. In fact, according to Bloomberg calculations, the largest US venture capital funds have more than $700 billion (around €640 billion) of capital available for investment in the face of the prospect of a resumption of operations. “The macroeconomic environment, inflation and interest rates have improved, markets are open and the trading market is back,” said Scott Nuttall, co-CEO of private equity giant KKR, presenting the quarterly results.

In fact, operations have already begun in recent months. According to Financial TimesBetween Ares, Apollo, Blackstone and KKR alone, $160 billion, €146 billion, was invested in the second quarter. KKR reached an agreement with education technology company Instructure; Apollo plans to buy Travel Corp; Blackstone and Goldman are exploring alternatives to take L’Occitane private; and Carlisle bought KFC’s Japanese operations.

In Spain, the fund’s biggest deal this year is Brookfield’s acquisition of Catalan pharmaceutical company Grifols, valued at around €6 billion. The deal, which is currently under negotiation, has received the approval of the company’s founding family, who are seeking to buy it and delist it from the stock market. There is no price for the shares yet (the company has A shares and B shares). It is an operation that could serve as a financial rescue, taking advantage of the stock market’s slump following a Gotham City Research report that accused the company of irregularities in its accounts and drove down the value of its shares. Grifols has lost 40% of its market value this year.

J. Safra Sarasin, a Swiss investment bank and manager of the Brazilian Safra family, submitted a takeover bid for 100% of Árima Real Estate SOCIMI on May 16. The company’s offer is 8.61 euros per share, valuing the transaction at 245 million. When the takeover was announced, the premium to shareholders was 39%, although the price has since risen, almost neutralizing it. In any case, the offer is below the par value of 10 euros per share.

For their part, the I Squared and TDR funds, the Amber vehicles, emerged victorious in the war with Apollo for Applus+. The companies paid 12.78 euros per share, valuing Appplus+ at 1.649 million. The shareholders benefited greatly from this battle between the funds. The company’s shares were trading at 7.59 euros in May 2023, shortly before the signs of interest in Applus+ were announced, and they were already expecting an offer. In just a year and a half, investors have received around 70%.

More transactions, less quotes

Experts predict that investor interest in Spanish companies will continue in the coming months. “The current low valuations, compared to their historical averages and to companies in the same sector listed on other markets, make it easier to formulate takeover bids on the Spanish market. However, the truth is that many small and medium-sized Spanish listed companies have reference shareholders who are also aware that the current valuation is heavily penalized and, therefore, may require higher premiums than those collected by buyers to accept their offer. A factor that may provide some protection against overly opportunistic transactions,” Aspas explains.

Among the investment banking pools, the energy sector stands out. In three and a half years, Naturgy has suffered two unsuccessful takeover attempts. The most recent was that of Taqa and Criteria Caixa, the first shareholder with 26.7% of the capital, which sought to take control of the gas company. Despite the unsuccessful attempts, the market continues to bet on Criteria to find a new partner that will provide stability to the investment that the holding company led by Angel Simón considers strategic. However, the price of gas on the stock market has fallen by 18% this year.

Solaria is also attracting attention from the market. In fact, the company itself has admitted that it has received offers that it rejected as unattractive. The stock has depreciated by 38% this year, so it has an attractive price that puts the company on the market. Goldman Sachs has also included Audax Renovables, a company owned by Catalan businessman José Elias, on its list of possible acquisitions. The company has risen by 47% this year, but market experts remember that its capitalization is still less than $ 1 billion, which allows funds to tighten the barrier.

On the other hand, although takeover bids are of interest to the investment world, they usually result in delistings, and in the case of Spain, they reduce the already meager list of companies on the stock market. According to the Spanish Stock Exchange and Markets (BME), the number of listed companies has fallen by 42 over the past 15 years (excluding those listed on the alternative exchange BME Growth). While in 2009, 170 companies could be traded, now 128 can be traded in bids and offers only, a decrease of 25%.

If BBVA’s takeover bid for Sabadell and Brookfield and the Grifols family’s operation for the Catalan pharmaceutical company are successful, the Spanish stock market will lose two more listed companies. In addition, the Hines fund and the Lar group have filed a takeover bid for the real estate company of the same name, and in the prospectus they have already left the door open for exclusion, so the continuous market could lose another participant.

Keep up to date with all the information Five days V Facebook, X And LinkedInor in our newsletter Five-day program

Newsletters

Subscribe to receive exclusive economic information and financial news that are most relevant to you.

Register!