The Dow Jones index, with a “hangover” after yesterday’s highs, responds to the IPC with a fall

DOW JONES futures fell 0.18% to 42,432 and S&P 500 futures fell 0.29% to 5,775. NASDAQ 100 futures fell 0.43% to 20,180.

Yesterday, Wednesday, began an optimistic day on Wall Street as the Dow Jones and S&P 500 indices reached new all-time highs. The S&P 500 closed 0.71% higher at 5,792.4 points after touching 5,796.8 points, while The Dow Jones Industrial Average rose 1.03% to a new high of 42,512.. It reached 42,562 points.

The tech-heavy Nasdaq had a slightly more subdued day, although it closed up 0.6%.

All eyes were on this Thursday publication of the consumer price index report for September, which was one tenth higher than expected. Monthly data shows growth of 0.2% and the annual rate is 2.4%, up from 2.5% in August. Economists surveyed by Dow Jones expected monthly growth of 0.1% and an annual rate of 2.3%, which would be the weakest since the end of the pandemic.

Regarding Core inflation, which excludes food and energy prices, rose 0.3% from August to September to an annual rate of 3.3%, up from 3.2% in the previous month.. Economists had expected the core consumer price index to rise 0.2% monthly.

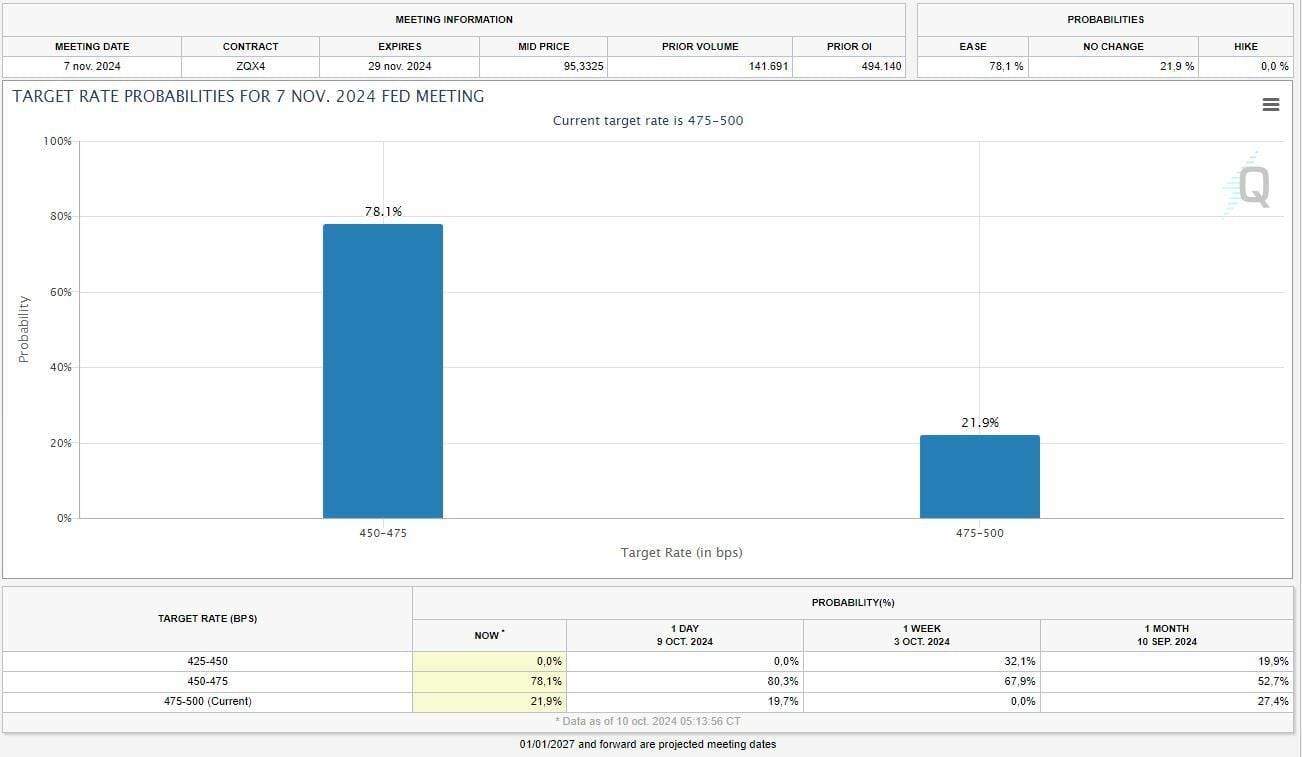

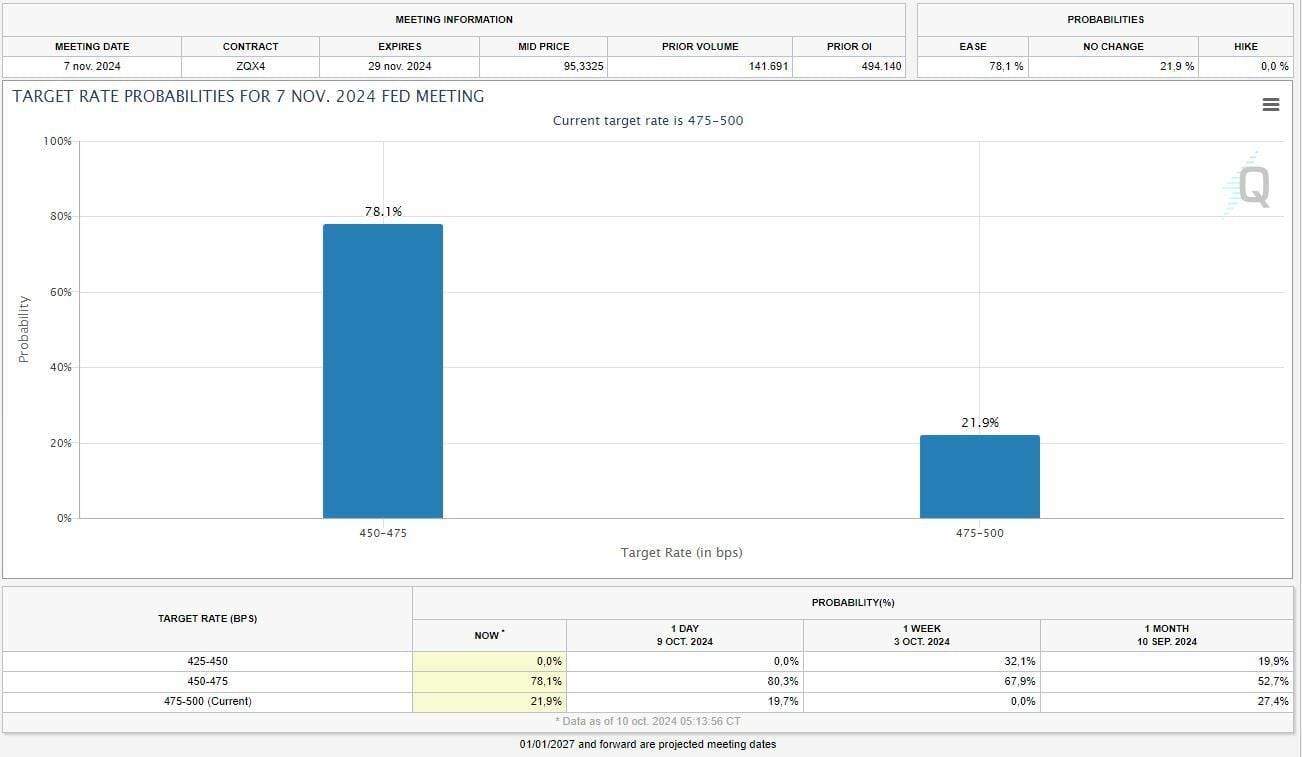

Inflation data is key for investors to clarify expectations ahead of the Fed’s monetary policy meeting in November. Fed futures trading data shows approximately 78% probability of reduction by 25 pointsAccording to CME Group’s FedWatch tool. The option to maintain current levels is 22%, while a 50-point cut like the one undertaken in September appears to be completely ruled out.

Stephanie Roth, chief economist at Wolfe Research, explains that a 50 basis point cut is “off the table” and the question now is whether the Fed will cut rates by 25 basis points or keep them the same in November. “Our base case is that they can cut back,” he said in a statement to CNBC. “The CPI should support that, to some extent the core CPI is 0.3%.”

The fixed income sector is always very sensitive to changes in monetary policy. 10-year yield remains above 4%with an indicator of 4.065%. Two-year bonds remain at 4.049%.

Today’s macroeconomic agenda also includes the usual weekly data on initial jobless claims, which are always closely watched by analysts and also do not bring good news to investors. The number of people seeking government assistance last week was 258,000, above expectations and the highest in more than a year.. Economists polled by Reuters had expected claims to be 230,000. The four-week moving average of new claims, considered a more reliable indicator of labor market trends because it reduces spikes in volatility, rose to 231,000.

In the business sector, earnings season is starting to turn heads again as we look ahead to the week’s highlights tomorrow with reports from JPMorgan and Wells Fargo.

One of the main players today is Delta Air Lines, whose shares fell by more than 6% on the eve of the opening. The airline has reached earnings per share were $1.50 in the third quarter, compared with expectations of $1.52.while revenues of $14.59 billion were also below expectations of $14.67 billion.

The good news is that Delta expects to expand its earnings in the fourth quarter thanks to robust travel demand and strong bookings for the year-end holidays. The airline forecast fourth-quarter adjusted earnings of $1.60 to $1.85 per share, compared with Wall Street estimates of $1.71.

This morning, reports from Domino’s Pizza also became known, which is moving downward ahead of the opening. The pizzeria chain has reached Revenue was $1.08 billion, below analysts’ expectations of $1.1 billion.while adjusted earnings per share were $4.19, above expectations of $3.65.

U.S. comparable store sales rose 3% in the third quarter, slightly below Wall Street’s forecast for 3.55% growth and less than the 4.8% increase in the previous quarter.

According to analysts’ recommendations, Nike shares rose 1.5% on the eve of trading after Truist upgraded its recommendation from “hold” to “buy.”. The firm believes Nike’s “fundamental recovery remains a long-term vision,” but some short-term efforts by new management, such as beefed-up marketing and improved wholesale relationships, should reassure investors that “better” times are coming. company.

Worst news for PayPal Holdings, which falls after Bernstein downgrades his advice from “overweight” to “like the market”. The analyst firm believes the company’s potential is uncertain given its shares are up 40% in just three months.

An increase of about 1% for Tesla in anticipation of the company holding its event on robotaxi. Investors expect Tesla to not only unveil the Cybercab robotaxi prototype, but also announce advances in driver assistance features and artificial intelligence capabilities.

In commodity markets oil prices are rising today. While the supply side continues to assess downside risks due to tensions in the Middle East, the demand side is expected to increase fuel prices following Hurricane Milton’s passage through Florida.

Thus, American futures for West Texas oil rose by 1.61% to $74.43 per barrel, and the European benchmark Brent rose by 1.57% to $77.74.

The euro fell 0.05% against the dollar to end at $1.0937 apiece ahead of inflation data.