The Era of Earning 4% Risk-Free Is Coming to an End: A Guide to Squeezing Out Paying Accounts and Deposits | Financial markets

Achieving 4% returns with virtually no risk has been relatively easy over the past year and a half, but that time is coming to an end. The predicted interest rate cuts that the European Central Bank (ECB) will implement starting next week will reduce supply and interest paid by banks on deposits and interest-bearing accounts, which are favorite products…

To continue reading this article about Cinco Días, you need a Premium Subscription to EL PAÍS.

Achieving 4% returns with virtually no risk has been relatively easy over the past year and a half, but that time is coming to an end. The predicted interest rate cuts that the European Central Bank (ECB) will implement starting next week will reduce the supply and interest paid by banks on deposits and interest-bearing accounts, which are favorite products for getting extra money from accumulated savings. . But before they make cuts, there are still options to squeeze out the most conservative savings.

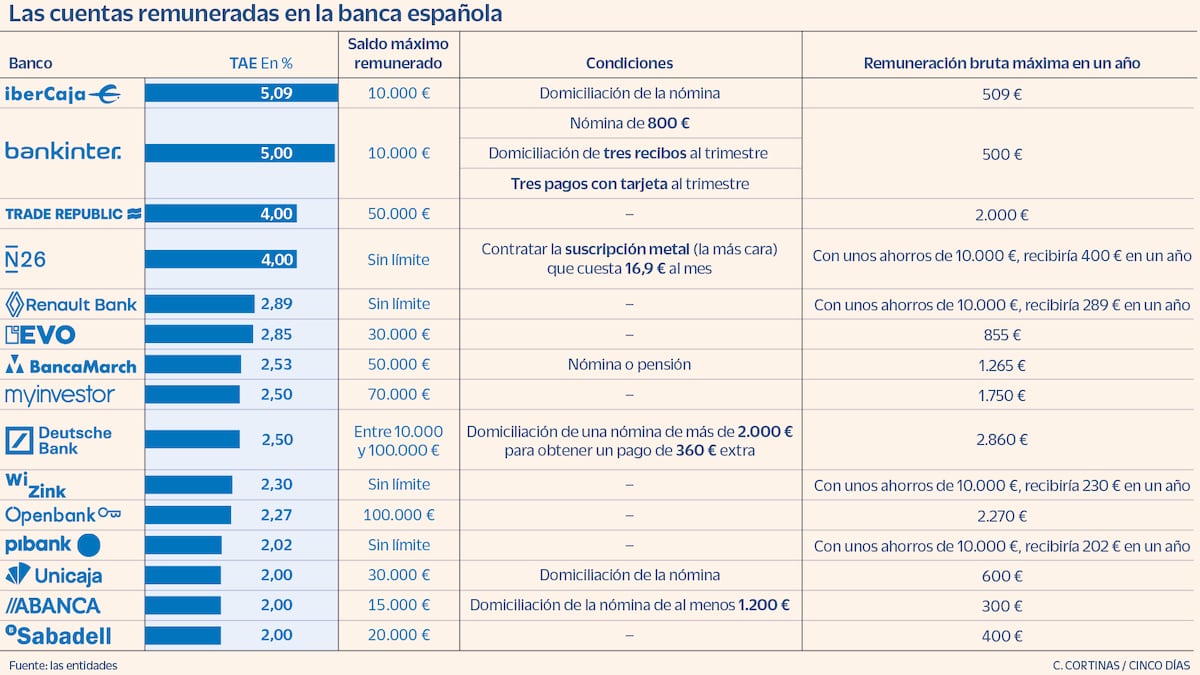

In the case of paid accounts, you can receive interest from 2% to 5%. Overall, large Spanish banks lag behind in terms of deposit rewards (relative to other European markets), given that they have excess liquidity from savings accumulated by households in recent years and do not need to launch deposit capture offers. more. But smaller businesses took advantage of the no-shows to attract customers. It’s an easy way to earn extra money through savings, and it’s the cheapest way for banks to finance their operations.

Ibercaja pays the highest percentage: 5.09% per year while the client manages the salary. Of course, the maximum paid balance is 10,000 euros (lower limit than other offers). If the customer maintains this balance for a year, he can earn a maximum of 509 euros gross. Similarly, Bankinter offers 5% in the first year on a maximum of €10,000, with the requirement of direct payroll debit, three receipts per quarter and making a minimum of three card payments every three months. By fulfilling these conditions, the client can receive up to 500 euros per year.

At a slightly lower level, Trade Republic rewards 4% of the amount of money in the account. The German neo-broker sets a limit of 50,000 euros so that a client can earn a maximum of 2,000 euros per year. N26 has just launched a promotion that will also reward customers with a metal subscription (the most expensive, at €16.9 per month) with 4% savings. The advantage that a neobank offers is that it does not set a maximum limit on the balance due, so all the money deposited into the account will go to your benefit.

The bank is tightening its offers the most in the interest rate range from 3% to 2% per year. Renault Bank offers 2.89%, and also does not set a limit on the balance of the reward (for example, if the client has 10,000 euros left, the client will receive 289 euros after a year). EVO, the digital bank of the Bankinter group, pays 2.85% for a maximum amount of 30,000 euros, Banca March 2.53% for amounts over 50,000 euros (provided that payroll or pensions are living), MyInvestor pays 2.5% for amounts over 70,000 euros (maintaining this figure). the client will earn 1,750 euros per year), WiZink 2.3% without limiting the maximum balance and Openbank 2.27% over 100,000 euros (allows you to earn 2,270 euros). Sabadell pays 2% of €20,000, which means it allows you to earn a maximum of €400 gross in one year.

Given the variety of offers, there are three aspects to consider when choosing which reward offer is best: the savings available, the annual interest rate paid by the bank, and the maximum balance that is payable. Typically, banks that offer a higher APR will pay less money. Conversely, those who offer a lower APR pay more. In this sense, the client must consider the amount of his money in order to get the maximum benefit from it.

Deposits deflate in the long term

As for deposits, the offer is similar, with interest concentrated between 3% and 4%. The disadvantage of these products is that the money invested is locked and cannot be used until the end of the agreed period, be it three, six or twelve months. The advantage they offer over accounts is that they have no limits on the maximum amount of money paid out, and if there are limits, they are much higher, so the customer can find options to ensure that all of their savings benefit from the rewards.

Please note that APR refers to annual interest, but deposits that pay the highest interest are only paid for three months. That is, the final reward that the client will receive on a three-month deposit is a quarter of what he would have received if he had maintained the balance for twelve months. For example, with a balance of 10,000 euros with an annual deposit with a payment of 4% at the end of the period, the client will receive 400 euros gross. With the same balance, at the same interest rate, but for a period of three months, the client will earn about 100 euros.

Since interest rates are higher now than they will be in a few months, shorter terms offer better returns. Cetelem pays 4%, and Italian bank BFF pays 3.8%. A little further, EBN offers 3.1%, and MyInvestor and SelfBank – 3%. When extending the term to six months, the yield drops by half a point: Cetelem pays 3.5%, EBN 3.1%, BFF 3.55%, MyInvestor 3% and SelfBank 3.1%. And after 12 months, the offer is fixed at around 3%: Cetelem offers 3.2%, Pibank 3.14%, EBN and Banca March 3.1% and BFF, WiZink, MyInvestor and SelfBank 3%.

And if you want to take a deposit for one year, the offer is focused exclusively on a yield of 3%: Cetelem pays 3.2%, Pibank 3.14%, EBN and Banca March 3.1% and BFF, WiZink, MyInvestor and SelfBank 3 %.

Follow all the information Five days V Facebook, X And LinkedInor in our newsletter Five days program

Newsletters

Sign up to receive exclusive economic information and financial news that matter most to you.

Register!