The Euribor rate drops to 2.5%: its lowest level in two years, making the mortgage €1,500 cheaper.

Euribor, the main benchmark for mortgage lending in Spain, is clearly moving lower at the end of November and will make mortgages significantly cheaper starting this month. In fact, the final sign On the last day of the month it is 2.461%.the level is already clearly below the average for the eleventh month of the year.

This is a significant decline that leaves historical levels at the lowest since September 2022 for this indicator and sharply reduces its trajectory compared to the average achieved in September: The closing price at 2.506% was clearly down from 2.691. noted in October last year. This also reflects the biggest annual fall in Euribor in 15 years.

The main consequence is more than positive for those who have a 12-month mortgage and review their mortgage annually: and this is for an average house loan of €150,000 for a term of 25 years, and a differential that adds at the Euribor rate of 1%, The monthly fee is reduced by just over 127 euros, which is a little more than 1,520 euros in savings per year.compared to what I paid a year ago.

The reasons for the reduction are clear. The ECB lowered the rate and intends, given the weak growth of the eurozone, to continue to increase this reduction, which was even discussed among market experts, in order to further activate the GDP of the eurozone’s single currency partners.

However, there are several risks in the environment: one of them is Donald Trump’s potential tariffs on European exports to the US, which could have an impact, while it also appears that the Fed’s rate cuts, which have very different growth dynamics from the US. , may slow further decline in 2025already with the president-elect in the White House.

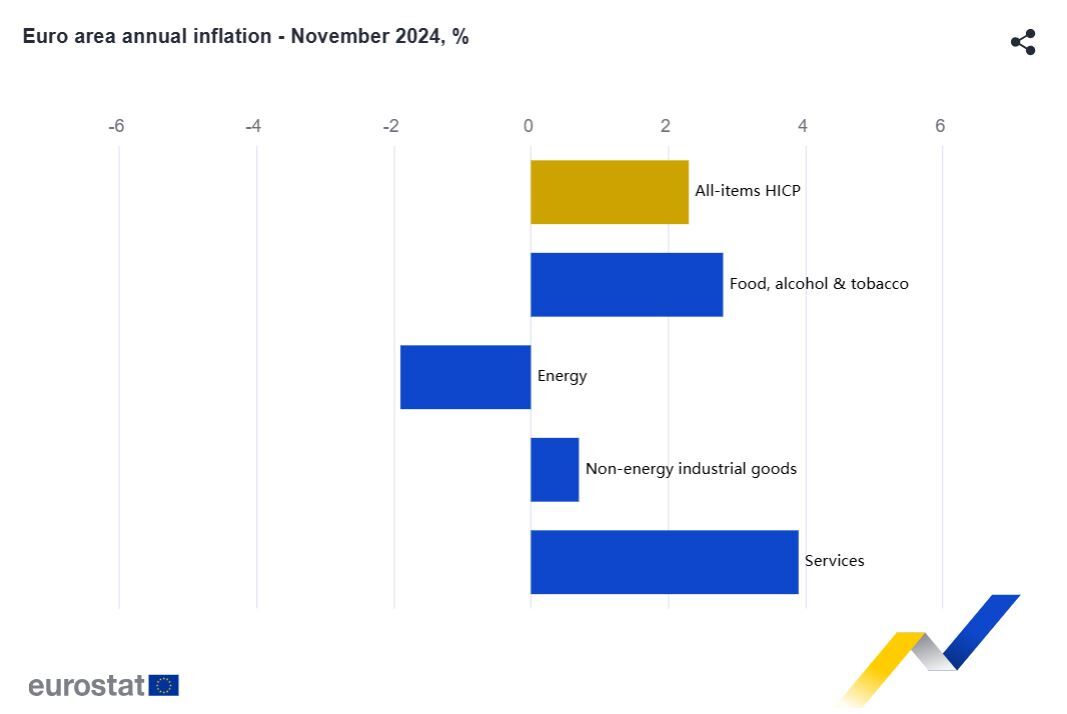

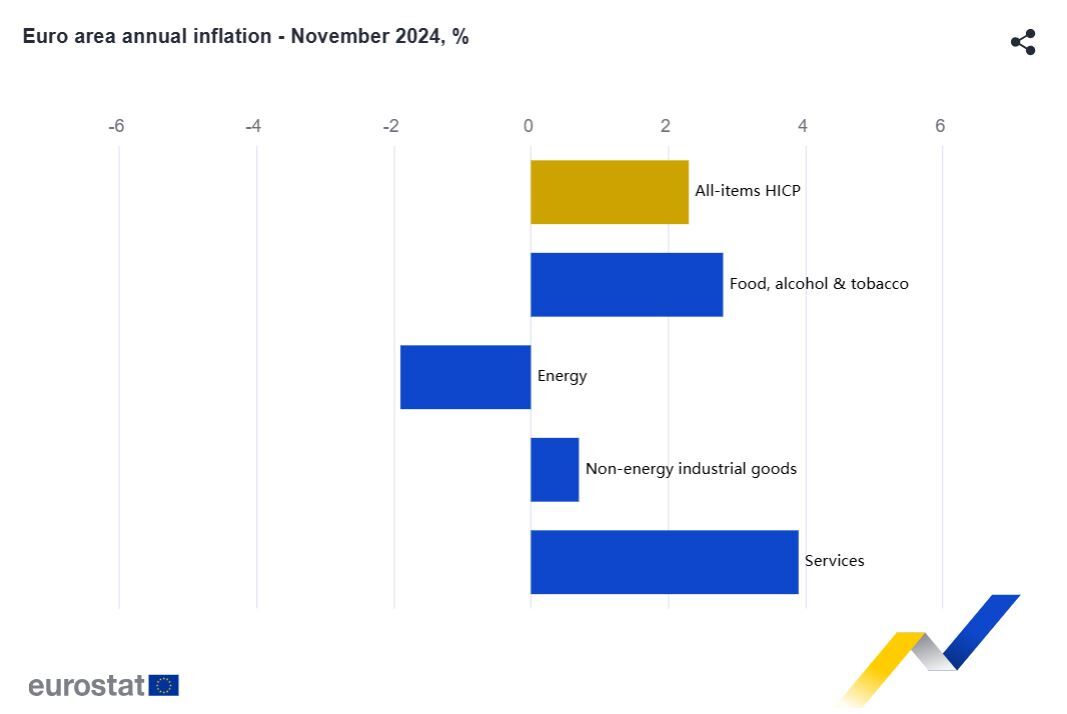

To this should be added the inflation rate. This week we learned that eurozone inflation reached 2.3% in November, according to preliminary data, the highest level since July last year.

This is also the second consecutive increase in the price indicator, with an overall increase in all countries, which the ECB has already declared as a risk. With higher prices, sharper rate cuts in the eurozone become more difficult.

According to market analyst Manuel Pinto, “we continue to think that Interest rates should fall to between 1.50% and 1.75% by the end of 2025.which will lead to a significant drop in Euribor over the next year. For the rest of this year, we are hopeful that it could still fall to levels close to 2.30%, with the ECB meeting on December 12 being a key event in the coming weeks.

“We expect a 25 basis point rate cut, which has already been priced into the market, but we believe the most important will be the downward revision of economic growth forecasts. which will mean a more aggressive program of cuts than expected, leading to a reduction in the Euribor rate.. As for inflation, recently the market expected an increase, while inflation in the service sector, which is most dependent on the labor market, began to slow down,” the expert points out.

He also notes that “poor economic data has intensified in recent weeks, as has the case for PMI or investor confidence, and political instability is gradually increasing in the region’s two major powers. confirms our view of the few existing tools to stimulate growth, leaving the ECB as the main driver in the common area.”