This is why AVAX bears may take control of the level above $30.

- The market structure on the higher time frame was bearish, but the momentum has started to change.

- The lack of demand was causing concern and adding to the bearish bias.

Avalanche (AVAX) may receive Solana (SOL) ETF. Current request approved.

A recent report from AMBCrypto notes that regulators are becoming more open to cryptocurrency spot ETFs that meet certain criteria.

The price action of AVAX last week turned bullish in the short term, but the trend on higher time frames remained bearish. Traders can use the resistance zones that become important to formulate their AVAX trading plans.

The dynamics have changed in favor of the bulls.

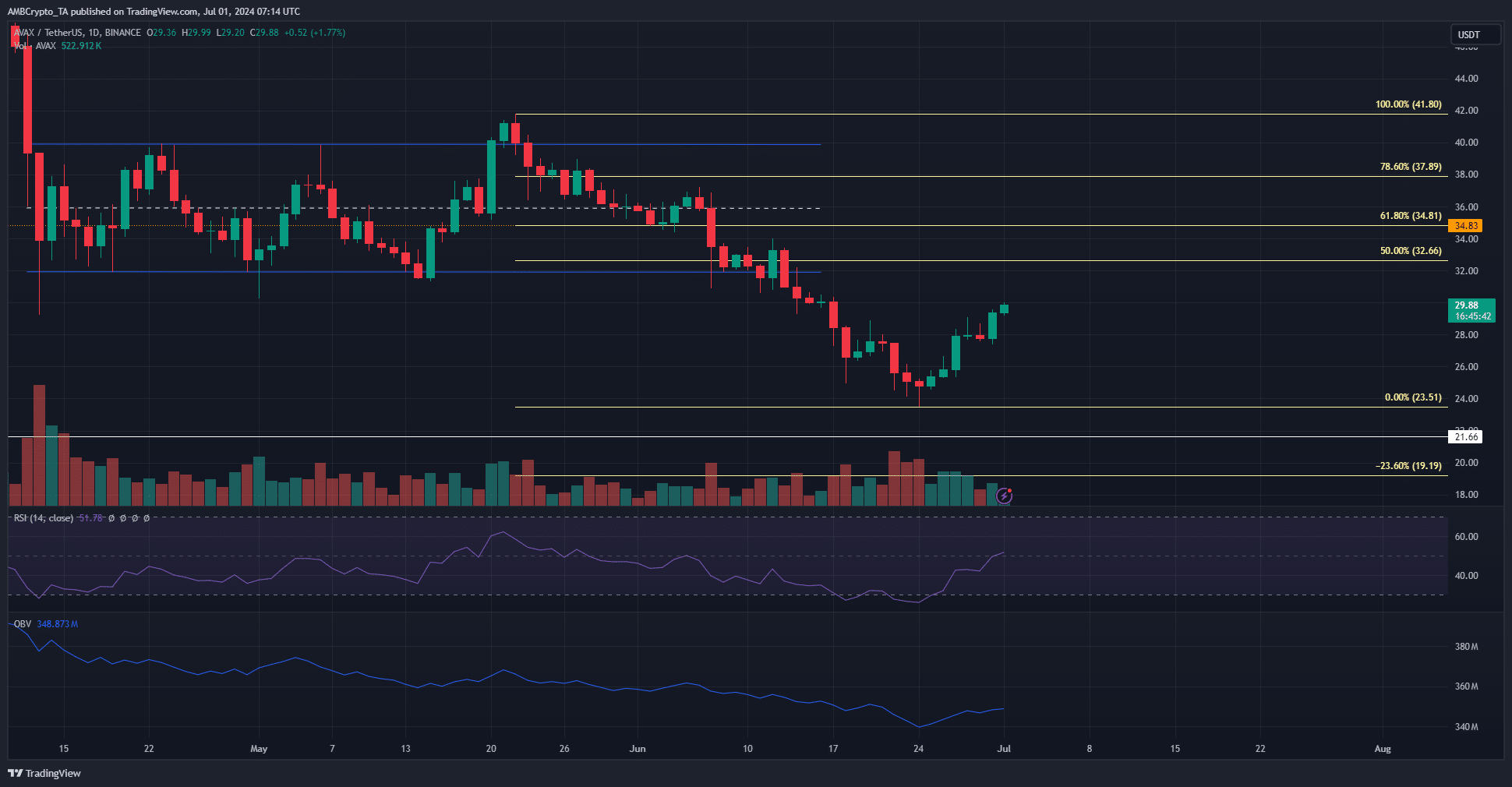

Source: AVAX/USDT on TradingView.

The RSI on the daily chart was above the neutral 50 level, showing that momentum was changing. This could be an early sign of recovery, but the price action remained firmly bearish. The next significant lower high is at $34.

A move above this level would see the uptrend reverse. However, to support such a price rise, OBV must be in an uptrend. At the close of this issue, it was still in a downtrend.

The volume of purchases is not yet large enough, so the trend on the daily chart remains bearish. Fibonacci retracement levels (pale yellow) showed that a bearish reversal is expected at $34.8 and $37.9.

Short-term sentiment on AVAX was bullish.

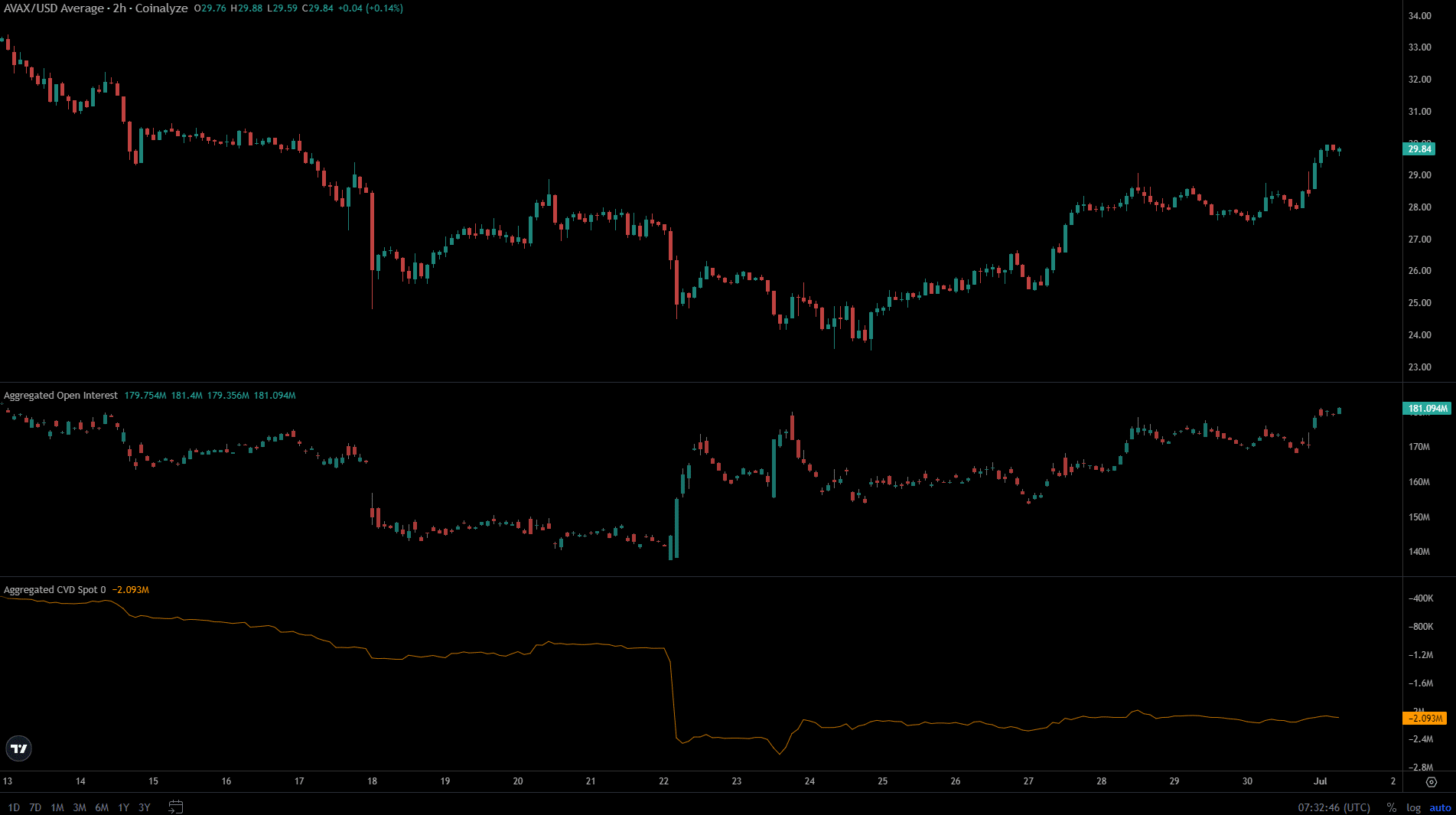

Source: Coinalize

While the trend on the upper time frame has been bearish, traders on the lower time frame have benefited from the recent price rally. At press time, open interest has increased from $140.2 million to $181.1 million.

Read Avalanche (AVAX) Price Forecast 2024-2025.

On the other hand, the CVD spot continued to move sideways. Together, they indicated speculative interest but a lack of organic demand, raising the possibility that the longer-term bearish trend will remain strong.

Traders can expect bears to take control above the $30 level, but a move above $34 and $37.8 would invalidate the downtrend.

Disclaimer: The information provided does not constitute financial, investment, trading or other advice and is solely the opinion of the author.

This is an automatic translation of our English version.