VAT on electricity rises to 21% today due to price collapse in February

Starting today, your electricity bills will give you an unpleasant surprise. From March 1, VAT on electricity payments increases from 10% to 21%. This is happening paradoxically due to the collapse in electricity prices that occurred in February.

The change will be applied “automatically”, according to government sources, starting this Friday, the first working day of March, when all receipts will be recalculated to reflect the new tax imposition. There is no need to approve any new rules or make changes to legislation.

The government also does not intend to make any changes to prevent the VAT increase. Minister of Economy, Trade and Business Carlos Bodi assured that government measures depend on energy prices, such as increasing VAT on electricity bills from 10% to 21% in domestic contracts. their course.”

The fall in electricity prices in February came as a complete surprise to all market participants. But this happened suddenly thanks to the activation of wind and photovoltaic power plants, which have reduced prices the most and provided the most energy over the past month. In fact, this little more than 41 €/MWh “pool” is explained by the fact that 60% of the light generated last month came from green plants: 31% from wind energy; more than 15% hydropower; and more than 11% of plots, among others.

In addition, the low price situation has contributed to natural gas prices in international markets. Its price is around 23 EUR/MWh, which is the lowest value since the outbreak of the war crisis in Ukraine, when it exceeded 200 EUR/MWh in August 2022.

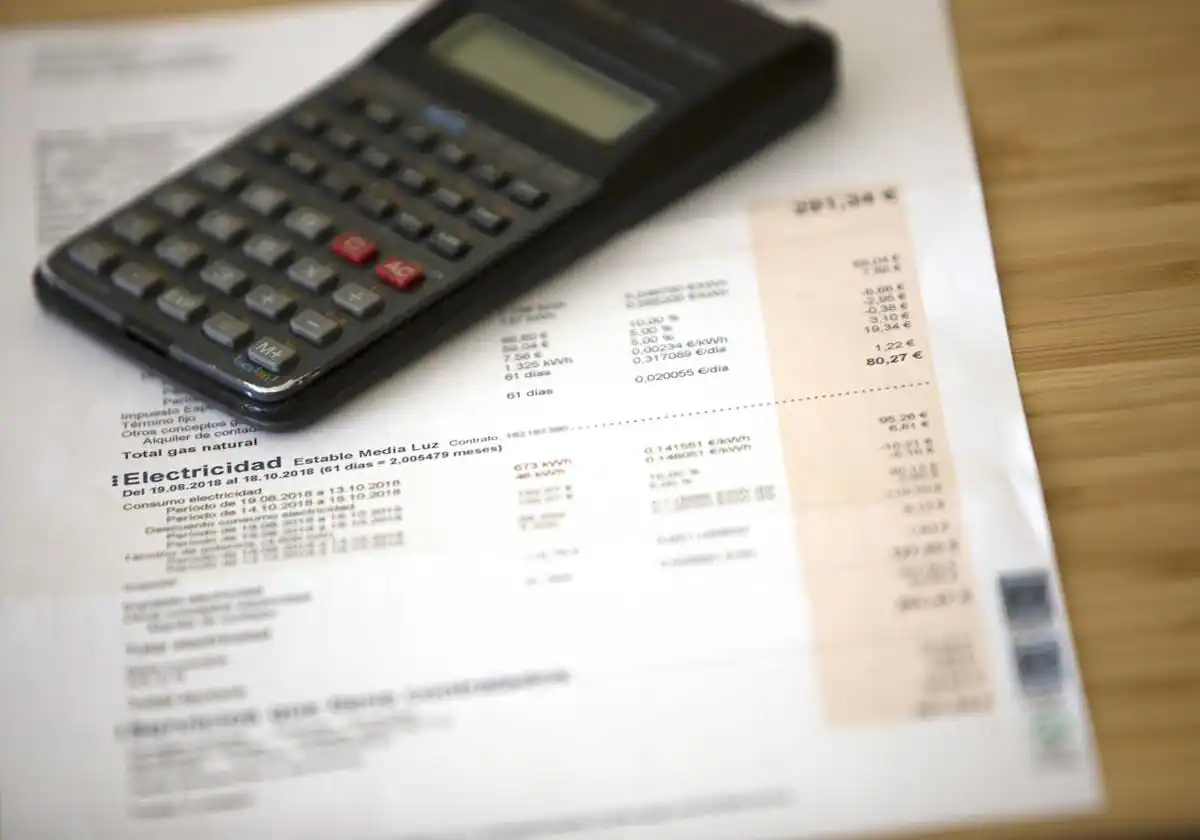

According to industry data, the impact of the VAT increase on a customer’s average annual bill will increase by 15%, rising from €467 to €539 per year. Likewise, for self-employed consumers, this system of adjusting or changing VAT on electricity will also create uncertainty when it comes to paying VAT on a quarterly basis, given that it is one of the major taxes they have to face on a regular basis. , self-employed workers.

Variable VAT every month

In any case, if the average price on the electricity market returns above 45 EUR/MWh in March or in subsequent months, VAT on electricity will again be reduced to 10%.

In the energy sector, they point out that VAT on electricity “will be variable, unpredictable and with difficult to understand rules affecting the bills of all consumers”, so they are asking for a review of this “variable and dependent” VAT mechanism. .variables that are foreign to most consumers.

Likewise, to the VAT changes we must add other tax increases expected between now and next year, such as the special energy tax (IEE), which will gradually increase throughout the year. From January to March it will remain at 2.5%; From April to June it will rise to 3.8% and then reach the 5.1% it was set at before the crisis.

In addition, the unique European Union tax on the cost of production of electricity (IVPEE) will gradually increase. Until March it will have a rate of 3.5%; Then until June it will rise to 5.25%, and then reach 7%, the pre-crisis level.