WIF Set For Potential Double Up To $4.80 Is What’s Driving It!

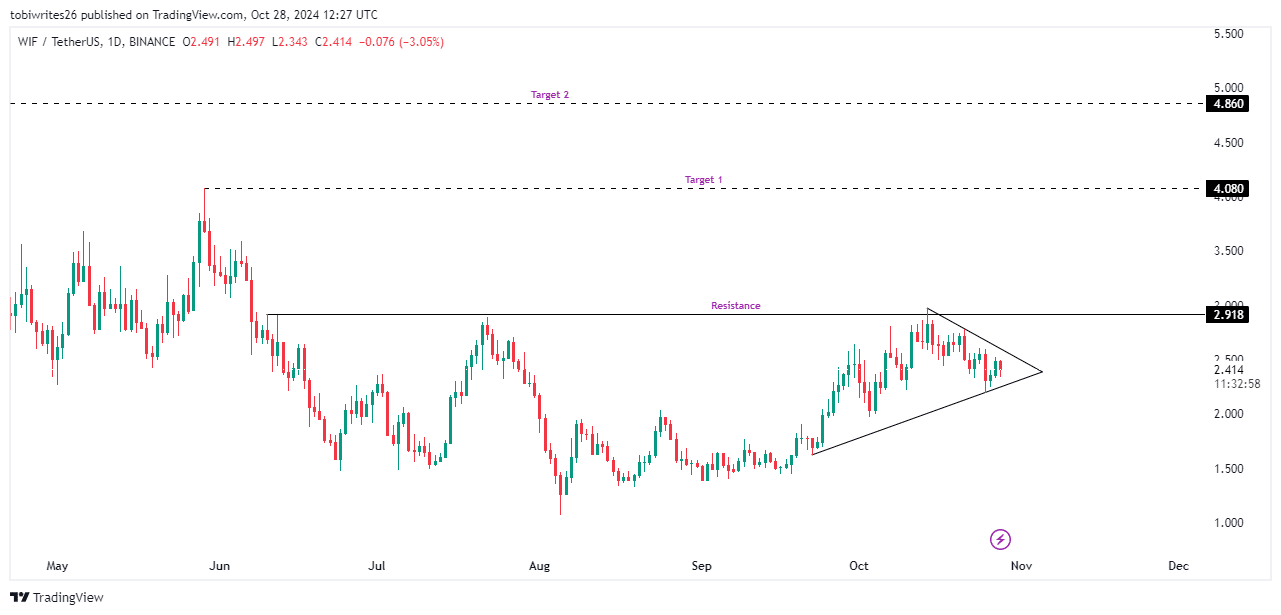

- WIF is trading within a symmetrical triangle pattern, a technical setup that suggests increased momentum among market participants.

- Analysis of key indicators showed that market participants are actively preparing for WIF to move into bullish territory.

Over the past week dog hat (WIF) faced volatility and recorded a decline of 6.65% to a price of $2.44 at the time of publication. This level was previously breached during a rally in October before strong resistance triggered a pullback.

Now WIF is making another attempt to rise, with chances to overcome the resistance that previously limited its growth. If successful, WIF could be poised for a major move towards $4.80.

Key pattern points to possible rally

WIF is trading within a symmetrical triangle, a technical pattern that is often considered the main catalyst for bullish growth. This pattern forms when converging support and resistance lines create a narrowing price range.

If this pattern materializes with strong momentum, WIF could break through the resistance level at $2.918, a level that has repeatedly limited price action in previous attempts.

If the rally begins, WIF could potentially double to a long-term target of $4,860 and an interim target of $4,080.

Source: Trade View

To gauge market sentiment and its alignment with this bullish formation, AMBCrypto analyzed on-chain metrics and found additional bullish signals that supported this forecast.

The bullish pattern is supported by increasing trader activity

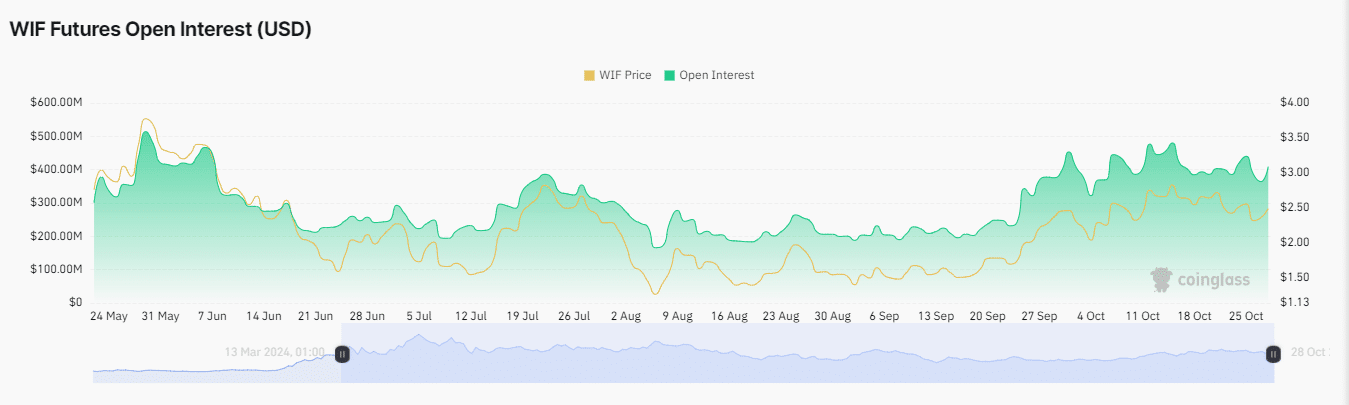

Open interest (OI), a metric that measures the number of outstanding derivatives contracts, especially in the futures market, highlighted the rise in buying activity, according to Coinglass.

At the time of publication, OI increased by 3.95% to reach $396.52 million and its graph showed an upward trend. This increase coincided with a 40.8% increase in WIF volume, bringing total trading volume to $857.60 million.

In addition to the increase in OI, the financing rate also increased, amounting to 0.0065% at the time of publication. This suggests that long-term traders have been actively funding positions to maintain price stability, indicating bullish sentiment on WIF.

Source: Coin Glass

If both indicators maintain positive dynamics, WIF bounce.

Increased cash flow

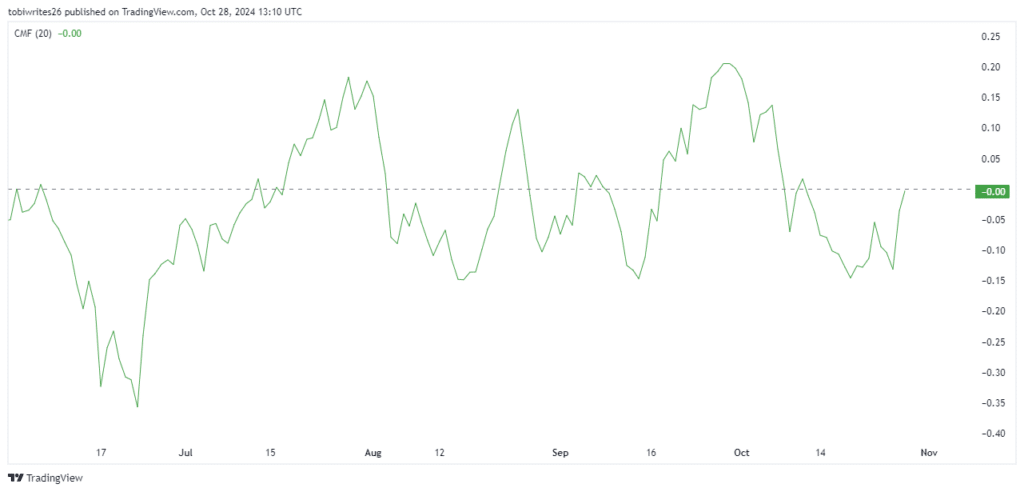

Finally, on-chain activity indicates a growing buying trend as traders continue to go long with significant liquidity flowing into WIF purchases.

The Chaikin Cash Flow (CMF) indicator also recorded significant gains, moving from negative territory to neutral at 0.00.

Source: Trade View

This rapid transition from negative to neutral implied a strong acceptance of liquidity in the market, which is a sign of sustained bullish momentum.

This is an automatic translation of our English version.