25,000 million with which he controls Ibex 35

He is the “owner” of Ibex 35 and the government of Pedro Sánchez has targeted his investment. To date, BlackRock has flown under the executive radar. Not for large selective companies, accustomed to bringing to the National Securities Market Commission (CNMV) new positions of this investment bank.

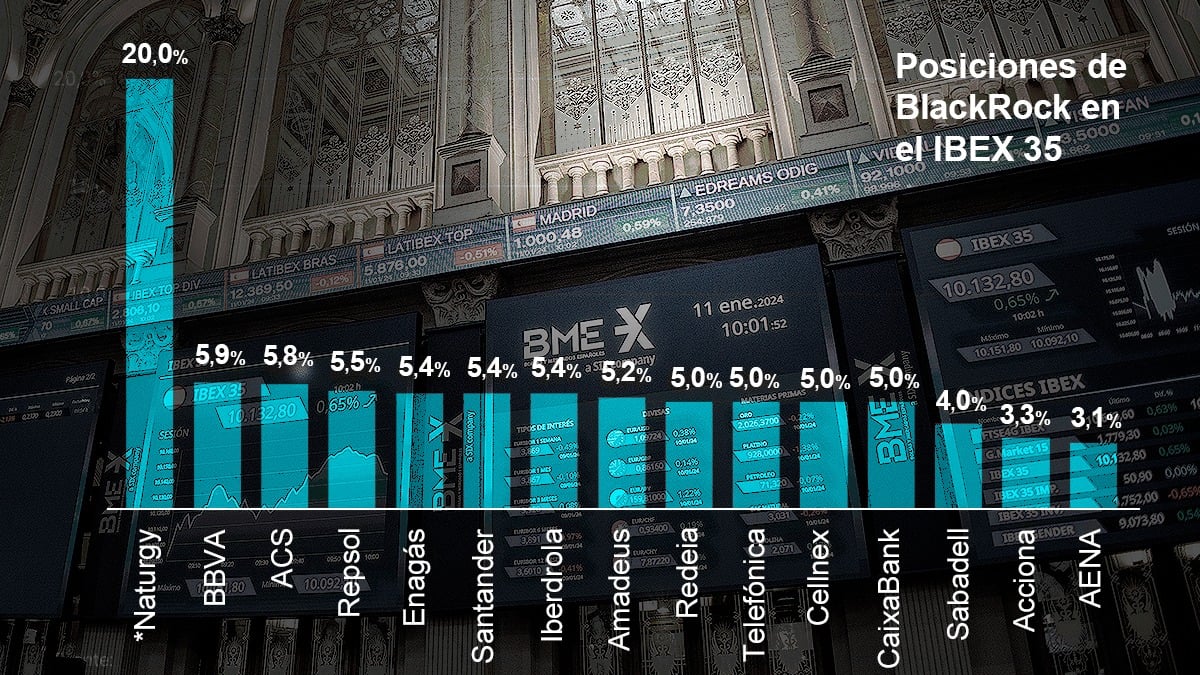

The investment group has shares in twenty Ibex 35 companies. Or what is the same almost 25,000 million distributed in shares of Spain’s largest companies following a recently announced new operation. The world’s largest fund announced the purchase of infrastructure fund Global Infrastructure Partners (GIP) for approximately $12.5 billion (€11.415 million at current exchange rates). GIP owned 20% of Naturgy, one of the companies designated as strategic by the government.

The acquisition exposed the executive’s concerns. In order for a fund or any investor to acquire 10% of a strategic company, it must inform the state about it, and it will give approval or not. With the acquisition of GIP’s business, BlackRock now owns a stake in the energy company, and Moncloa knows it will have to go through government verdict. “The government must prevent absorption 20% Naturgy from BlackRock,” Sumar economics and treasury spokesman Carlos Martin said in a message posted on social media.

Given the government’s plans, BlackRock issued a statement opposing Economía greenlighting the operation: “Large government deficits mean that mobilizing capital through public-private partnerships will be essential to finance infrastructure in an increasingly scarce environment higher interest rates, companies are exploring partnerships on their infrastructure assets to improve return on invested capital or raise capital to reinvest in their core business.

But besides Naturgy, BlackRock He has a thing for Spanish energy companies. In particular, almost 50% of the nearly 25 billion euros invested in Ibex 35 belong to this sector. So much so that he is the largest shareholder Enagaswith 5.42% for approximately 225 million euros.

It owns the same stake in Iberdrola, but the stake is worth about 3,900 million euros, which is about 1,500 million less than what it will receive in the acquisition Naturgy. Oil company Repsol It also appears in his portfolio worth €890 million (5.5%). The company maintains a position in Redeia (formerly Red Eléctrica) with a 5% stake. Solarium closes investment appetite in energy matters with about 80 million involved.

Another strategic company invested

The government of Pedro Sánchez has increased interest in Telefonica, one of the companies that is also considered strategic because of its fundamental role in network access, its cybersecurity business and the countless contracts it has signed with the state in important areas such as this. defense

BlackRock is a holder 5% Telefoniki with an investment of approximately 890 million euros. Thus, the institution is one of the main owners of the operator. Thus, both the government and the “owner” of Ibex 35 will clash in the telecommunications company, as the government will increase its participation to 10%.

Telefónica is not the only technology company in which BlackRock maintains a position. Amadeus, a company that provides technology services to the travel sector, is making another big bet on the Ibex 35 with a 5.2% stake. Cellnextower company, which is expanding its activities around the world, 5% of the shares belong to an investment fund.

Banking, another star sector

BlackRock maintains a strong interest in Spanish banking. The investment fund is the first shareholder in BBVA and Santander. This year the investment bank has seen rate hikes help it boost its exposure to Spanish banking as shares of companies in the Ibex 35 strengthened last year.

Unicaja and Bankinter are the only institutions that do not have BlackRock in their shareholding. Thus, the fund owns 5.9% of BBVA, 4.99% of CaixaBank, 3.96% of Sabadell and 5.4% of Santander. Outside of banking, the U.S. bank’s largest position is in swimming pool maker Fluidra, where it maintains an 8% stake.

Investment appetite at BlackRock also shifts to Fluidra. In fact, he is the company’s largest shareholder, with his stake rising to more than 6%. The latest acquisition took place in November last year.

The real estate sector is not free from BlackRock’s tentacles, although it is true that the amounts invested in Colonial does not exceed 130 million euros. The bank owns 3.9% of shares.

All the keys to news and breaking news, in El Independiente WhatsApp channel. Join here