Investors reject Banco Sabadell’s only project

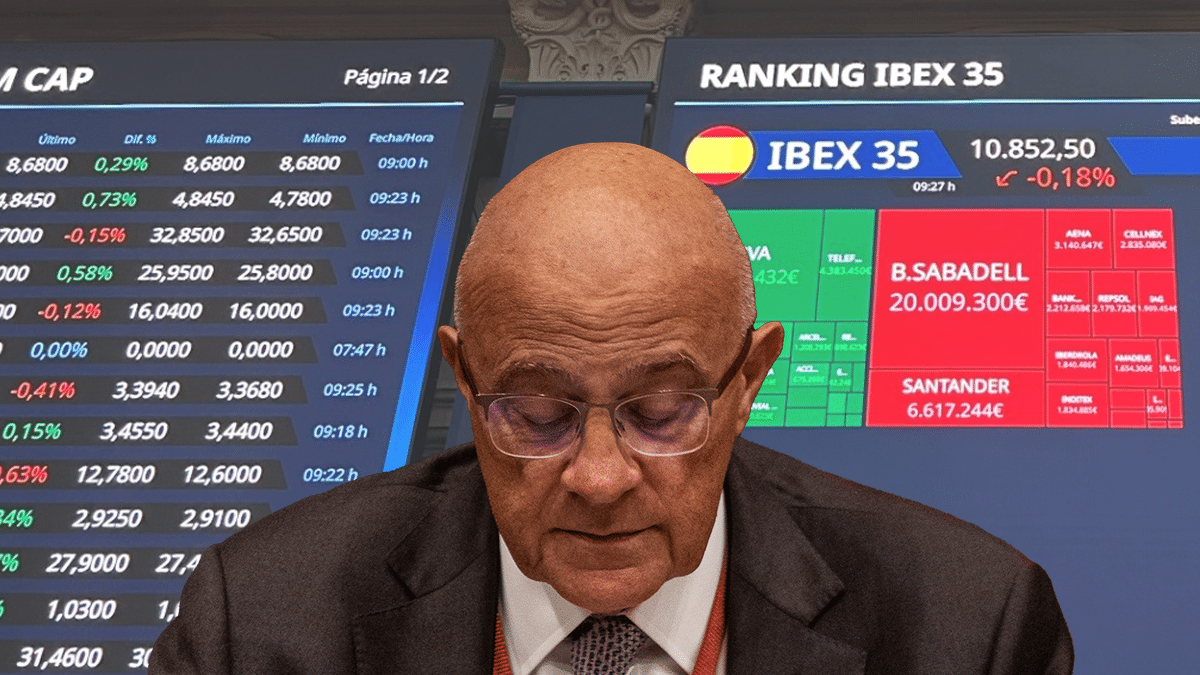

Banco Sabadell abandoned BBVA for the second time in four years. Investors did not take the rejection well and are already down almost 5% since the decision was made public. This evolution of the stock market reflects that the market does not trust an individual project of the organization, despite the Catalan enterprise’s insistence that its future will be more profitable. A long-term plan that Sabadell wants to demonstrate to the market.

After the market closed on Monday, Banco Sabadell announced through the National Securities Market Commission (CNMV) that it had rejected an “undesirable” merger proposal from BBVA. Minutes later, the organization, chaired by Carlos Torres, issued a statement expressing regret over Sabadell’s decision. Thus, the ball was back in BBVA’s court. Now the market is waiting for a new offer, but this time it also contains some cash.

On April 30, Banco de la Vela confirmed that it was again interested in Banco Sabadell. This news caused movement in the market. The Catalan company rose strongly on the stock market that day, while BBVA fell. That is, the market considered that it was a good operation for Sabadell, but not for the Basque bank. From this date until the closure on May 6, before the refusal became known, Sabadell earned more than 800 million euros.

However, since the merger was rejected until this Wednesday, the Catalan enterprise has fallen and lost 489 million euros. Despite the fact that in two sessions he left almost 5%, Sabadell is still earning €326 million since this whole process began. Investors are not sure of the reasons for the refusal of the Basque bank. In addition, it should be added that Sabadell published a letter that Carlos Torres, president of BBVA, sent to his colleague in Sabadell, Josep Oliu, the day before the board meeting.

In this email, BBVA’s president explains that it is “very important” that Sabadell’s board of directors knows that BBVA “he has no opportunity to improve his economic conditions.” That is, Torres rejected any improvement in the offer of 1 new share for 4.83 shares of Banco Sabadell. A proposal that Sabadell believes underestimates the cost of the plant project.

A few weeks ago Banco Sabadell presented its first quarter results. The company earned 50% more than last year, to 308 million euros. An increase that attracts attention since they paid 192 million euros for the emergency tax on banks, an increase of 20% on the previous year. Moreover, the bank assured that these figures will be repeated in the coming quarters. Cesar Gonzalez-Bueno, the company’s general director, stressed that the results are not excessive: “The market does not think so”.

In fact, Banco Sabadell closed with a gain of 8.73% on the stock market, although the increase was more than 12%. Given this increase, Gonzalez-Bueno assured that they have gained trust in the market. These data forced the company to update its forecasts for 2025. In the application for refusal The Board of Directors confirmed its commitment to regularly distribute any excess capital to shareholders. more than 13% of the CET1 coefficient according to Basel IV. This shows that Sabadell is committed to continuing to grow.

However, now it seems that the market does not believe this and therefore the stock market is falling. On the other hand, there is an evolution that BBVA has gone through. The Basque company fell sharply when it announced its offer. From that day until Monday, May 6, he lost €6.188 million on Ibex.. A situation that worried Sabadell as it criticized “volatility” in a statement rejecting the merger.

This was also a point that Torres took into account in the email he sent to Oliu. This decline is one of the reasons, according to the BBVA president, why “there is no possibility of further increases.” “This situation absolutely does not allow us to pay more premium than we already offer, because if we did, it is foreseeable that our value would fall again (even by an amount greater than the premium increase we would make) “, he states decisively.

But since May 6 last year, BBVA has been able to recover some of what it lost in those days. The bank grew by 4.57% in two sessions, corresponding to 2.627 million euros.. This improvement in the stock market means that capitalization losses have been reduced to 3.561 million euros, which is almost half of the previously lost amount.