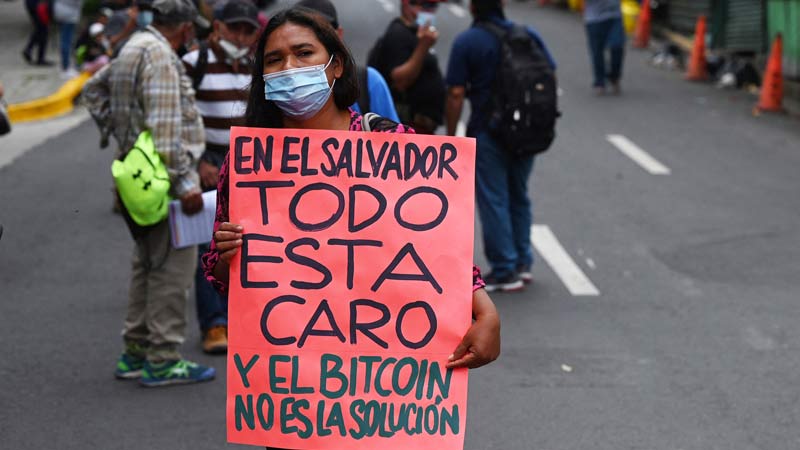

Science Magazine Confirms Almost Zero Acceptance of Bitcoin as a Currency in El Salvador

The prestigious scientific publication conducted its research based on a survey of 1,800 households and analysis of Chivo Wallet transactions on the blockchain. It highlights the failure of the Bitcoin bet, which has had no impact on the daily lives of Salvadorans.

The American journal Science is one of the most prestigious in the world in the field of scientific dissemination. It is the expression body of the American Association for the Advancement of Science (AAAS). In one of his latest articles, he attempted to answer the question of whether cryptoassets such as Bitcoin could be used as currencies in practice. That is, as a tool for exchanging everyday goods and services.

To do this, the researchers focused on the first country to declare Bitcoin as legal tender: El Salvador. And the answer is stunning: despite all the efforts and huge investments of the government in its promotion, it was impossible to accept this asset as a currency in this Central American country.

Its use is minor and currently corresponds to a small group of tourists who are enthusiastic about this culture, or people who have already used cryptocurrency for investment. The period of greatest use was the first month of the law that made Bitcoin legal tender in El Salvador, just as part of the collection of the $30 bonus with which the Bukele administration intended to encourage its adoption.

According to the researchers, to come to these conclusions, they had to turn to alternative sources, since no information about the Bitcoin rate is publicly available. One was a face-to-face survey of 1,800 households supported by the social polling company CID-Gallup.

It consisted of 74 questions focused primarily on the public’s adoption of Bitcoin as legal tender, including the software created by the El Salvadoran government to support its adoption, Chivo Wallet, in which $3.5 million was invested in the development. In practice, Chivo Wallet turned out to be one of the weakest links in the chain, since its short development period did not allow all its systems to work correctly.

For the study’s authors, the fact that the survey was conducted in person was critical to its success.

“Given that adoption of Bitcoin through Chivo Wallet requires access to both a mobile phone and an internet connection, a telephone or online survey that relies on respondents having access to either method of communication, adoption costs will be mechanically underestimated,” they write. In their survey, they interviewed families from 14 departments of the country and included participants from rural areas.

However, the survey was not the only tool for checking the volume of cryptocurrency use. They supplemented the analysis with Blockchain verification of all transactions in which the Chivo Wallet ecosystem participated.

“We not only examined the overall transaction volumes conducted through the Chivo wallet, but also separately analyzed the patterns of deposits and withdrawals, and also identified the relationship between the survey results and the blockchain results,” they wrote.

results

The survey found that 40% of respondents downloaded the Chivo Wallet app in September 2021 when it launched. Month after month, the number decreased until the number of downloads reached 0 in 2022.

One element that has caught the attention of researchers is that, contrary to government propaganda, Chivo did not serve to provide banking services to a population that did not have bank accounts. Most of all, the application was downloaded by people already familiar with electronic payments.

“These results suggest that the introduction of the Chivo wallet primarily provided an additional means of payment among those already banked rather than stimulating greater financial inclusion among those who are unbanked,” they wrote.

The study found that 50% of respondents said they do not use Bitcoin because they do not understand or trust it. Additionally, a similar percentage expressed doubts about the Chivo Wallet software itself. Currency volatility ranked only 10% among the reasons for refusing to use a crypto asset.

Thus, the government intended for Bitcoin to be used by people who at the time were not educated enough to even use it. Thus, only one in five respondents said they continued to use Chivo Wallet after receiving the $30 bonus. And yet they did this not to transact in Bitcoin, but in dollars.

As for companies, only the largest continued to accept cryptocurrency for payment. But they did not keep their profit on this, but decided to almost always immediately exchange it for dollars.

71% converted sales to dollars and then cashed them out, 17% converted sales to dollars and stored them in a Chivo wallet, and only 12% of businesses stored their Bitcoin sales in a Chivo wallet.

“We found that 11% of companies have increased prices since Bitcoin became legal tender, consistent with the hypothesis that companies may be able to pass on the costs of cryptocurrency to customers,” the study said.

“This is a fundamental problem. Salvadorans already have a globally accepted currency that is stable. The move to a volatile, speculative digital asset was like migrating from the best of worlds to the worst. In Christian language this was nonsense. A solution to a problem that didn’t exist,” says economist Rafael Lemus.

A few days ago, President Nayib Bukele, on vacation, triumphantly posted on his networks that the price of Bitcoin had risen, thereby assuring that his bet had paid off. A Science study indicates that this is not true.

“The bet was not on price, but on use, which is a failure of hundreds of millions,” commented economist Tatiana Marroquín on her X account.

BACK TO TITLE PAGE