Side B of the BBVA-Sabadell merger: the client has fewer choices

The trickle of bank disappearances that Spain experienced after the property bubble burst in 2008 did not just take away dozens of brands recognized in their longtime territories. It also suppressed to a large extent … the ability to choose from more people when taking out a loan, signing a mortgage, finding a good deposit or simply opening an account.

Concentration processes entail “threats”, as the National Markets and Competition Commission (CNMC) has repeatedly pointed out. And this risk of limited choice lies at the heart of the operation through which BBVA announced its desire to take over Banco Sabadell.

If the integration continues, the result will be a second bank in Spain, very close to CaixaBank and ahead of Santander. Together, these three corporations cover almost three-quarters of Spain’s financial business. The other quarter of the pie will be distributed among no more than seven entities that continue to operate, but not without the temptation to merge.

For CNMC, one of the organizations that will have the final say in the operation if it is finally successful, it will be important to analyze the presence of this structure in certain regions. And the resulting bank may be the only one physically present in fifty zip codes. This is how competition measures the degree of intrusion. By neighborhood.

Competition restrictions

In the last major banking merger to take place in Spain, the CNMC identified 86 areas in which CaixaBank and Bankia would have a position bordering on a monopoly. According to the agency’s analysis, the new firm would be the only organization with an office in 21 of those codes; and in other regions, competitive pressure will be insignificant. For this reason, CNMC has committed the company to support Bankia customers in the affected regions for three years under the same terms and conditions they signed up for in their products.

As part of the alliance between Unicaja and Liberbank, the organization led by Cani Fernandez discovered threats (he also called them that) to clients in several areas of the province, such as Cáceres. And here, too, it was forced to comply with the conditions, not to worsen prices compared to competitors, calling for transparent information to be provided to the most affected buyer. That is, the one who had only one bank where he lived.

Influence

“These types of concentration lead to worse competition and financial exclusion.”

Antonio Pedraza

President of the Financial Commission of the General Council of Economists

According to Antonio Pedraza, president of the Financial Commission of the General Council of Economists, “this type of concentration leads to worse competition and financial exclusion.” In the first case, he recalls what happened to bank deposit rewards during these two years of rising interest rates: “It smells like an oligopoly,” he insists in his analysis, pointing out that interest rates on savings in Spain have remained low. minimal compared to what happened in the rest of Europe, where he argues there is more competition.

Moreover, Pedraza points to another reality: the financial isolation resulting from the high concentration of banks. “The fact is that not everyone can open an account now, because you have no solvency, no positive reviews… A small account is a hindrance,” he explains. “The exception is not only that there are no offices, but also that some clients with low deposits are no longer attractive” to the bank.

“There is high competition”

Despite the risk that this intensive consolidation process will eventually push certain clients and regions off the map – with a particular focus on rural areas – the financial sector says the degree of competition in banking in Spain is still “fierce”. They remember that small and medium-sized companies (SMEs) “finance themselves cheaper” than German ones.

They also explain that there are more and more “online” banks operating in Spain and that they represent an opening of the market with new offers and banking products compared to large institutions. “These are important players that are aggressively gaining market share,” indicate the sector. In addition, BBVA notes that the merger will allow it to expand its product offering to customers due to the complementarity of BBVA and Sabadell.

Prices and conditions

“The merger of BBVA and Sabadell will further increase pricing power”

In practice, a possible merger would leave customers with one less choice, so regulators will be closely monitoring the progress of the transaction in this difficult balancing act between creating larger, more capable and reliable organizations without implying poorer services.

The European Central Bank (ECB) has itself been calling for these mergers in the sector for years, albeit in a cross-border manner that cannot be achieved without the existence of a true banking union, in which the lack of a common deposit guarantee fund complicates alliances between banks in different countries.

In any case, the European bank supervisor will look favorably on the transaction between BBVA and Sabadell, since the resulting organization will be able to confront American competitors – and some Asian ones – the real financial monsters that have left European banks far behind. groups from the Old Continent from a business perspective.

A difficult balance

But the shadow of an oligopoly, in which fewer and fewer businesses take on the majority of the activity, has been a concern for years. “The consolidation of the banking sector after the financial crisis in Spain was more intense than in other neighboring countries,” the Fitch rating agency points out. Its experts agree that the merger of BBVA and Sabadell will “further increase the pricing power” of the country’s largest banks.

Concentration

75%

Deposits

Some of the money saved by the Spaniards will remain in the hands of the three large groups if the merger of BBVA and Sabadell is completed.

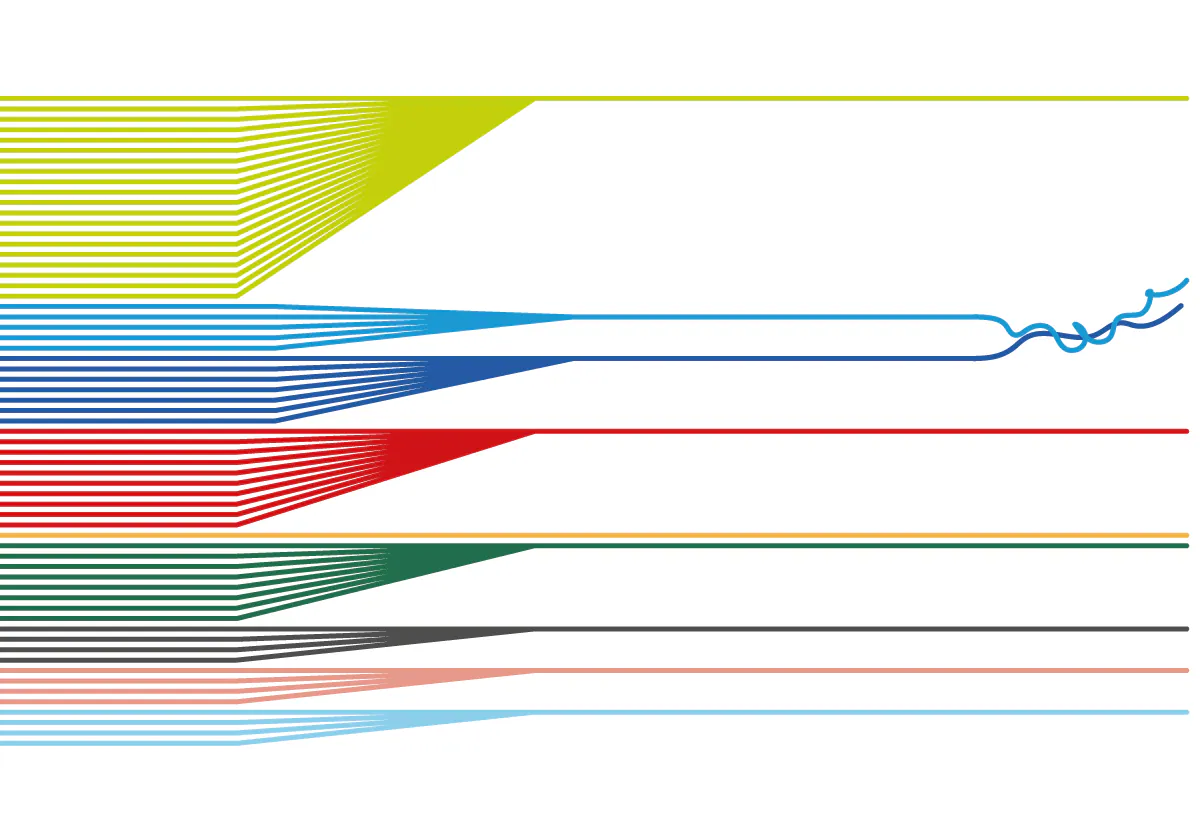

The numbers speak for themselves. The addition of BBVA and Sabadell would mean that the three main institutions (CaixaBank, the bank resulting from this possible merger, and Banco Santander) would account for more than 75% of deposits and loans in Spain. According to the analyzed data (which compares the balance sheet performance of each enterprise with the total outstanding balance of loans and deposits of the Bank of Spain), these three main enterprises will already leave far behind their closest competitor, Bankinter, which will remain with a quota of 7%.

The organization now headed by Gloria Ortiz was the only one – and quite successfully – that managed to survive without marrying anyone during those 15 years of banking crisis, during which Spain went from 55 organizations acting alone to just a dozen. .