The ECB and the Bank of Japan open the 2024 central banking season. What can we expect?

/ Lagarde arrives at this new assignment with questionable growth (Germany in recession, falling research…) and inflation that follows the expected path (slight recovery of the headline rate together with controlled and downward expectations). A macro-statement that will therefore reflect this reality: downside risks and a balanced view of prices.

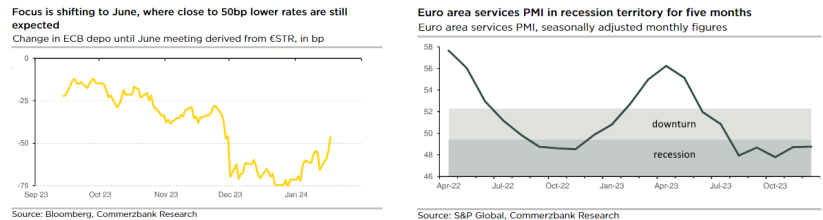

/ The data, although weak due to growth, is not new, as is the impending rise in inflation in Germany due to the effect of the end of energy price support measures. This is not a meeting to start a discussion about lowering prices, nor is it to become too peaceful.. The ECB would prefer to wait for wage data at the end of April.

/ However, there are several voices. (including Lagarde) They’re talking about summer/June, a possible first cut, and it’s time to explain. In any case, both dovish and hawkish forecasts, like the Fed, are still very far from market prices.

/ Bank of Japan unchanged at this meeting after being ‘forbearance’ in December. During 2024, with a 4% increase in wages, the possibility of eliminating negative rates may open up. We expect only moderate rate increases given that bankruptcies continue to rise. As for the outlook, we see a possible decline in core inflation and GDP following the contraction that occurred in the third quarter.

In addition, in the macro program of the week we will see surveys in Europe (PMI, IFO) with a predictable stabilization, and not with a large expected drop; In addition, new links to real estate in the United States, as well as industry indicators and prices.