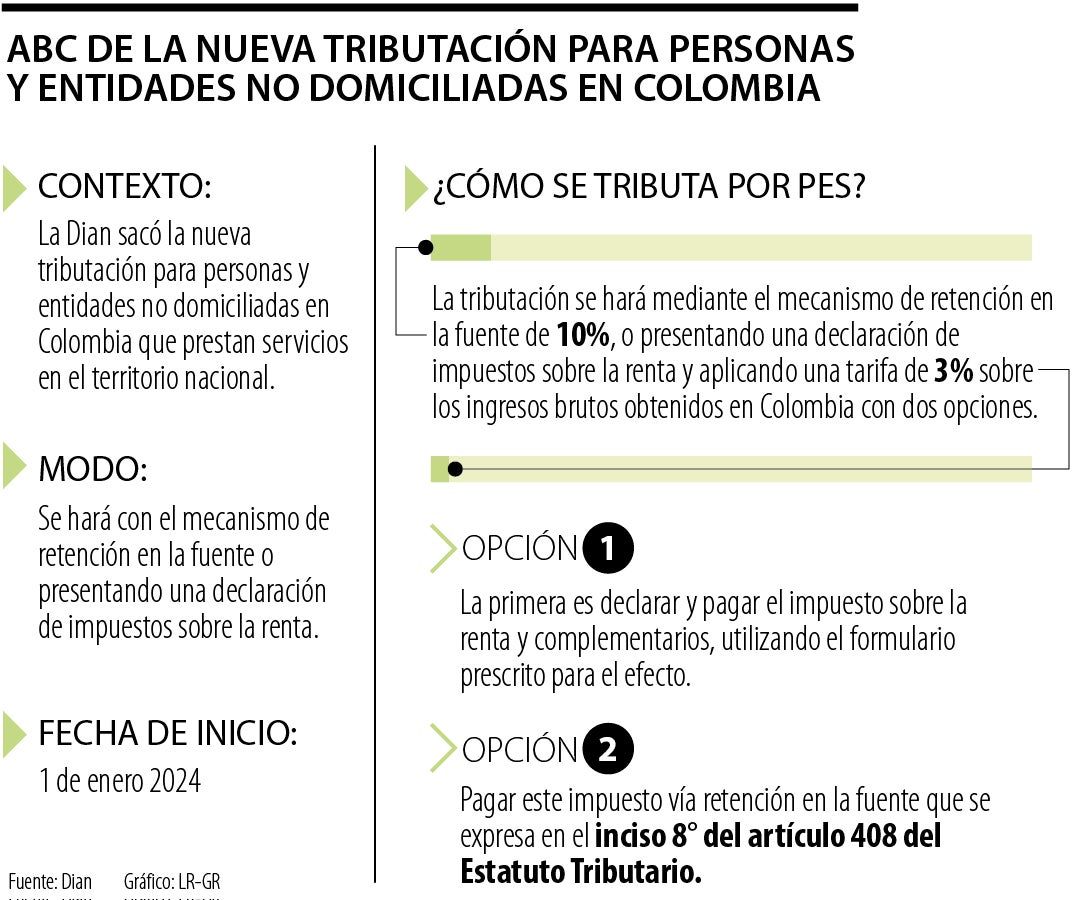

This will be the new payment to persons and entities without domicile in Colombia.

diane Introduced new taxation for individuals and entities resident in Colombia that provide services in the national territory. The entity explained that this will be done with the withholding at source mechanism or by submitting income tax returns and from January 1, PES, the taxation regime for significant economic presence, started.

It should be noted that effective taxation for Significant Economic Presence (PES) falls in accordance with the tax statute established by the National Tax and Customs Directorate, DIAN.On non-resident persons and entities, not resident in Colombia, who generate income from the sale of goods and/or the provision of services to customers and/or users located in the national territory.

How is PES taxed?

Depending on the entity, this taxation will be done through the 10% withholding mechanism at source, or by submitting income tax returns and Applying a 3% rate on gross income derived in Colombia with the two options.

The first is to declare and pay income and supplementary taxes, using the form prescribed for the purpose, in occasions specified by the national government. In this case, the taxpayer must choose between not applying withholding at source (subsection 8 of Article 408 of the Tax Law) or applying it. The second is to pay this tax through withholding at source, which is expressed in paragraph 8 of Article 408 of the Tax Law.

How to register or update a RUT with responsibility for PES taxation?

People subject to PES taxation can request registration or update the RUT, Providing the documents required in Section 11 of Article 1.6.1.2.11. According to Decree 1625 of 2016, through the following channels such as the ‘PQSR and Complaints’ service on the Dion website or virtual appointment scheduling at this link.

What documents need to be submitted?

It is divided into two parts, in case of natural persons you must have a copy of the identity document. But in the case of companies and entities, there must be a copy of the documents that prove existence and legal representation (in Spanish) duly induced or validated. If these documents do not contain information about the country of tax residence, Tax identification number, main address, postal code, telephone number, website and email, these data must be certified by the legal representative or lawyer through a document in Spanish or translated by an official translator and a copy of the legal representative There should be. Identity document.

(TagstoTranslate)Manufacturing(T)Commerce(T)Treasury(T)Energy and Mines(T)Environment(T)Education(T)Health(T)Labor(T)Agriculture(T)Industry(T)Automotive(T)Tourism (T)Transportation(T)Communication(T)Technology(T)Bags(T)Banks(T)Insurance(T)Fashion(T)Gastronomy(T)Shows(T)Culture(T)Entertainment(T)Sports(T) ) ) )Judicial(T)Legislation-Trademark