What do Spaniards invest their money in?

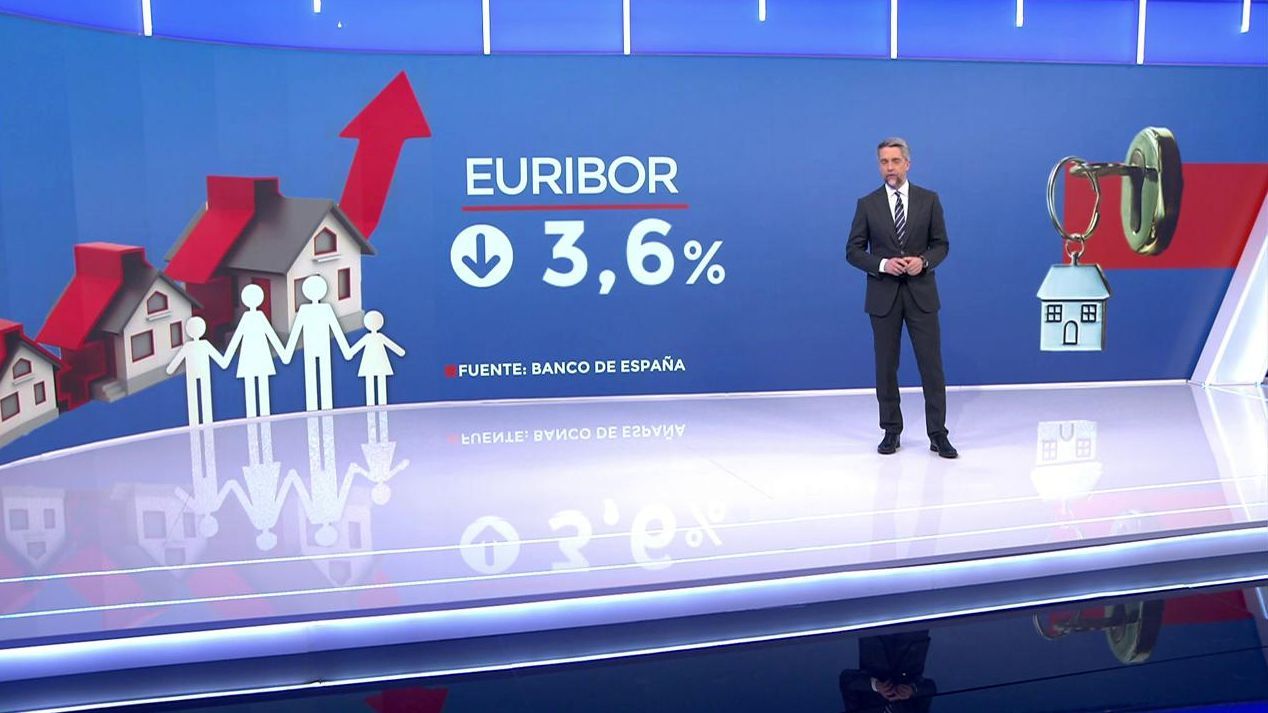

Euribor closed in January at 3.609% and has been falling for three months.

Families with variable mortgages breathed a little easier after the third drop in the Euribor rate. Those who review their credit every six months will pay less, even if For mortgages with an annual review, fees will increase. In the absence of confirmation from Bank of Spain, The monthly rate was lower than the 3.679% recorded in December and the summer high of 4.1% in January. However, it is still 25 basis points above the January 2023 Euribor, when the month closed at 3.337%.

This means that for Adjustable rate mortgageHe the fee increase will be about 24 euros per month. This calculation, prepared by Europa Press, assumes an outstanding capital of €150,000 and a remaining term of 30 years with a differential of 0.99% plus the Euribor rate.

I knowReal mortgage prices would be lower since in this example the entire capital of the mortgage is taken into account with the entire term still to be fulfilled. Thanks to the amortization system used in Spain, more interest is paid in the first years of the installment plan, so more mature mortgages will see smaller premium increases. “Euribor will remain at the current level until the first rate cut occurs. It is clear that the ECB will cut rates this year; “The big difference is the speed of subsequent contractions,” XTB analysts point out.

On your side, iAhorro forecasts ‘very positive year’ for mortgage sectoror due to the fall of Euribor already registered at the end of 2023 and the stabilization of ECB rates. “We think 2024 will be a very interesting year because, despite everything that has happened in recent months, the mortgage market is buoyant and the banking outlook for the rest of the year is very positive,” says the mortgage director. iAhorro, Simone Colombelli.

In fact, the expert believes that when the ECB starts cutting rates, the Euribor will fall faster than it is now, just as it rose significantly when the hike began.

“He geopolitical scenario is still unclear and the ECB must be careful: if rates are cut sharply, inflation could rise,” explained HelpMyCash co-founder and economist Olivia Feldman. “The next European Central Bank meeting is in March and then we will know something more definitive.” about what the direction of interest rates will be,” he added.

{{ #cards }}

{{#section.link.href}} {{section.link.title}} {{/section.link.href}}

{{title.data}}

{{ /maps }}

The value of corporate and household debt will begin to fall in 2024, according to the Bank of Spain.

He Bank of Spain considers the transmission of monetary policy and interest rates to the real economy complete, so he estimates that the cost of debt for companies and households, including mortgages, will begin to fall in 2024. “The transmission of the largest benchmark interest rates of variable rate loans will be almost complete,” the Bank of Spain indicates in its report on the financial position of households and companies for the second half of 2023, published this Wednesday.

In particular, the watchdog’s analysis shows that quarterly contracts due for review in January 2024, whether mortgages or loans to companies, will face a problem rate hike by five basis pointsand those who have to face The annual review will result in a 65 basis point increase in rates.

“Given current market expectations regarding interest rates, the amendments will become downward in March 2024. For contracts with annual review, linked to the 12-month Euribor rate, cuts that will exceed 150 basis points for those renewals that will take place in the last period of 2024,” added the Bank of Spain.

In this sense, from December 2023 to March 2024The organization estimates that the value of 7% of outstanding variable rate mortgages (almost 70% of all mortgages in Spain) will increase by 100 basis points or more, while 10% of mortgages will fall by at least 50 basis points. basis points.

In case of companiesThe Bank of Spain indicates that over this four-month period, 2% of the outstanding balance of fixed-rate loans to companies will undergo an increase of 100 basis points, while 25% of floating-rate loans will fall into the category of 50 basis points or more.

Interest payments on variable rate loans will “gradually decline” through 2024, stabilizing in 2025 at levels above those in effect before the rate tightening cycle, according to the banking regulator.

In the case of fixed rate loans to companies, there is a “defined growth trajectory” waiting to be amortized as they are expected to be fully renewed and most of these contracts were signed before the current rate hike cycle.

And what do the Spaniards do with money: bonds, safe assets and the stock market

As noted Manuel Parejo, professor of economics at Pablo Olavide University: “With interest rates so high to fight inflation, many have decided repay loans and mortgages”.

It didHousehold debt fell to 76.6% Last year was the lowest figure in 22 years.

In this difficult economic situation household economy has improvedThis is reported by the Bank of Spain. The houses have got rid of debts. They are also asked less loans due to increased financing costs. And they are fleeing traditional bank deposits in search of higher returns. Now people prefer, as he notes, Leticia Poole, Professor of Economics at the European University of Valencia“take money out of the bank, invest in government bonds, invest in the stock market or in safe assets that give higher returns than in the bank.”

Household welfare increased by el stimulating employment and increasing wages. But the number of vulnerable households finding it harder to pay their debts is also increasing. It will rise from 10.5% before the pandemic to 11.2% in 2023.

Subscribe to the Informativos Telecinco newsletter and we will send you news to your email.

Follow us on our WhatsApp channel and stay updated with all the news so far.