Tax evasion | 26 Spanish multinationals paid an average of 2.9% of their global profits in 2021 – El Salto

The Tax Agency is once again publishing country-by-country statistics (CBC) this year. On this occasion, the amounts of payments of large Spanish companies in 2021 have been published. The numbers are not very different from those observed in previous years, but this does not prevent them from surprising.

This document is mandatory for those Spanish multinational corporations whose turnover exceeds 750 million euros. With the submission of the said report, these companies must inform the Tax Authority about the number of their subsidiaries, the turnover, the profit they made before taxes and the amount they pay in each of the territories. This data is collected statistically and published every year.

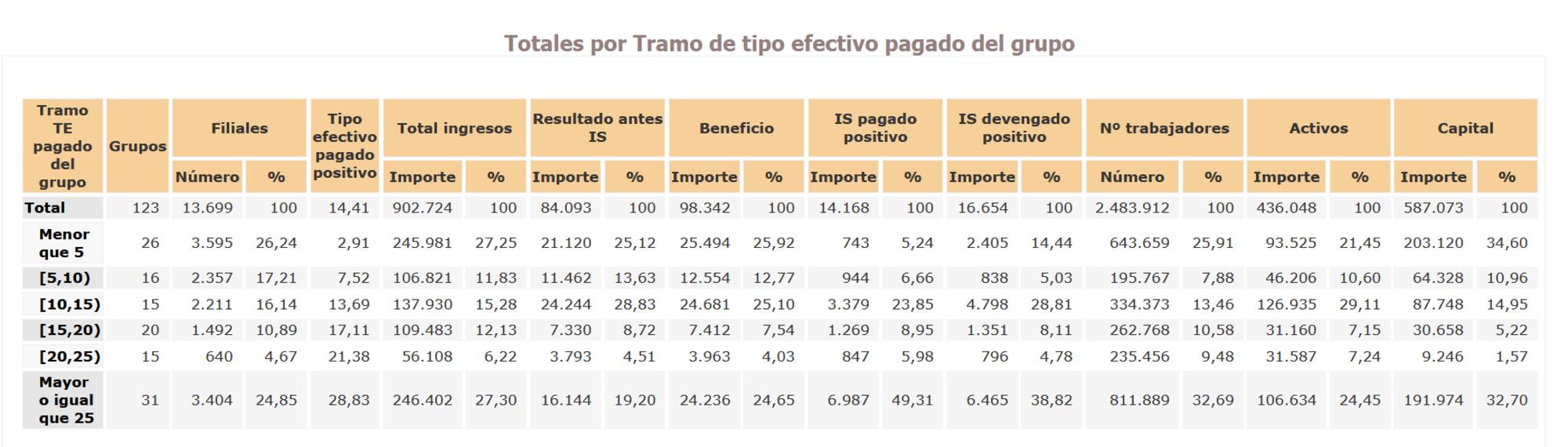

The 123 multinationals with turnover exceeding €750 million in 2021 paid an effective rate of 14.41% on their global profits.

According to published data, the 123 multinationals that had to surrender their accounts because their turnover exceeded €750 million in 2021 paid an effective rate of 14.41% of their global profits, already much less than that , which any SME can pay. and this is below the OECD agreement that companies never pay out less than 15% of their profits.

Table taken from Tax Agency Country Report 2021.

The numbers are much more dramatic if we look at those who pay the least for their benefits. According to the report, there are 26 Spanish business groups that pay out an average of 2.91% of their global profits. These companies accumulated a pre-tax result of €21,120 million (last year they accumulated a loss of €2,502 million and concentrate 25.9% of global profits across 123 companies, paying only 5.2% of tax paid). .

The figure is slightly lower than last year, as these companies’ profits fell during the pandemic year and many of them compensated for losses. In 2020, the year of the pandemic, 31 companies paid just 1.75% effective tax rate on their profits worldwide.

Next up from the bottom are the 17 groups based in Spain, which pay 7.52% of their profits worldwide, half the minimum 15% they would have to pay if the OECD agreements to which Spain had joined were introduced into action and effective. Last year, this second step saw 15 Spanish companies pay an average of 8.64% effective rate in 2020.

Workers in tax havens are three times more profitable

In this report, which large companies submit, they must also indicate the number of subsidiaries, the locations where their tax headquarters are located, and the number of employees who work in each of them. Based on this data, the Tax Agency calculates the profitability statistics obtained by each of these employees in each territory.

Large companies achieve higher productivity per worker: Malta, Luxembourg, the Netherlands and Ireland.

As in 2020, in this new report, the areas where large companies achieve higher productivity per worker are Malta, Luxembourg, the Netherlands and Ireland. In these countries, employee productivity and profitability are three times higher than in other territories. In other words, the four internal tax havens of the European Union are where multinational corporations concentrate three times more profits per worker than the rest of the world, thanks to the tax engineering techniques they use to transfer profits to those countries that those countries will pay less there and erode the tax base in other countries, reducing tax bills to the maximum.

Statistics but no names

Again, these numbers are known and may shock anyone who pays taxes and notices how large companies use tax engineering to pay less than any small and medium-sized business. But, I repeat, the data is purely statistical, but without names. We have no way of knowing which large companies are paying such ridiculous sums of their global profits. Just nameless data. What is stopping the Tax Agency from releasing this data so that citizens can know which companies are contributing more and which are contributing less than any small company or self-employed person?