The Fed and the Bank of England replaced the ECB and the Bank of Japan. What can we expect from this new central banking week?

What do we expect from Powell and the Fed?

o Macro assessment, which takes into account the reliability of data (GDP for the fourth quarter as the latest and clear indicator), as well as control over inflation. Regarding the latter, we could find a favorable vision of controlling inflation expectations, cooling with rental rates, downward evolution of the underlying asset… in line with what was observed at the ECB. With a mixed macroeconomic situation (some studies are less optimistic than the data), but with a level of activity that in itself does not put pressure on rate cuts, and is better protected by lower inflation. A soft landing, which continues to be considered the central scenario.

o No rate cuts are expected yet, but more information is expected on the debate surrounding this issue. And the Fed, unlike the ECB, has openly admitted that it commented on this in December. How and by how much it will be cut remains in question, with central banks unlikely to rule out options. Also, keep an eye out for any additional hints about your balance decreasing.

Bank of England, no news yetWith…

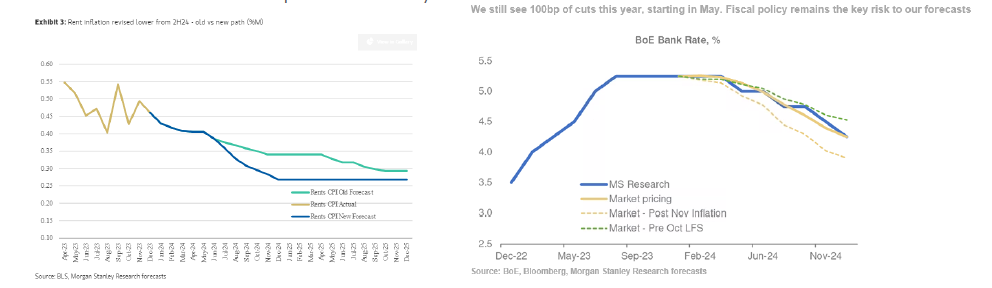

… But yes adjustments in forecasts. Inflation, which provides respite and whose medium-term estimates we hope will be lowered. Without changing its cautious tone, the Bank of England would mark the end of the monetary tightening cycle and, through votes, would already hint at votes in favor of starting cuts. A market that discounts the first drop until mid-year and remains very attentive to fiscal risks in a likely election year.